Solar Lease vs. PPA in 2026: Find Your Best Path to Savings

As of January 1, 2026, the residential solar industry has entered a new era. With the official expiration of the homeowner-claimed tax credit under the “One Big Beautiful Bill” (OBBB), the financial math for going solar has fundamentally shifted.

For many homeowners, the most viable path to immediate solar savings is now Third-Party Ownership (TPO). While you can no longer claim the 30% credit as an individual owner, TPO solar companies can still utilize a business-claimed tax credit to lower your costs.

But which should you choose: a Solar Lease or a Solar Power Purchase Agreement (PPA)? This 2026 guide breaks down the differences, risks, and rewards.

Jump ahead:

- Quick Comparison: Solar Lease vs. PPA

- What is a Solar Lease?

- What is a Solar PPA?

- The Game Changer: Prepaid Solar Leases

- Key Considerations for Homeowners in 2026

- Frequently Asked Questions

- Is Solar Still Worth It in 2026?

Quick Comparison: Solar Lease vs. PPA

| Feature | Solar Lease | Solar PPA |

| Payment Basis | Fixed monthly “rent” | Per kilowatt-hour (kWh) produced |

| 2026 Tax Credit | Section 48E (claimed by provider) | Section 48E (claimed by provider) |

| Predictability | High (Same payment every month) | Variable (Higher payment in the summer) |

| Maintenance | Included by provider | Included by provider |

| Best for | Strict monthly budgeters | Performanced-focused homeowners |

Another key difference between leases and PPAs is where they are allowed. In general, most states allow residential solar leases, and around 30 states allow PPAs, including Washington D.C.

Fifteen or so states have unclear guidance on whether PPAs are allowed. In these areas, check with local installers or authorities to see if this option is available.

What is a Solar Lease?

A solar lease is often compared to “renting” your solar equipment. You pay a fixed monthly fee to the solar provider in exchange for using the energy the panels produce.

Why it’s popular in 2026: Because the provider owns the system, they can claim the 30% federal tax credit plus additional Domestic Content Bonus Credits (available for systems meeting U.S. manufacturing thresholds). These savings are passed to you in the form of a lower monthly payment than you would get by purchasing solar with a loan.

- Pros: Highly predictable bills, immediate “Day 1” savings, zero maintenance costs.

- Cons: You pay the same monthly fee even during low-sunlight winter months.

What is a Solar PPA?

A Solar Power Purchase Agreement (PPA) is slightly different. Instead of renting the equipment, you agree to buy the power the system generates at a set price per kilowatt-hour (kWh). This rate is typically significantly lower than your local utility’s electricity rate.

The PPA Edge: In 2026, PPAs are the dominant choice for homeowners who want their costs strictly tied to performance. If the system underperforms, you simply pay less that month.

- Pros: You only pay for the energy actually produced, immediate “Day 1” savings, zero maintenance costs.

- Cons: Seasonal bill volatility; monthly costs will be higher during peak summer production.

The Game Changer: Prepaid Solar Leases and PPAs

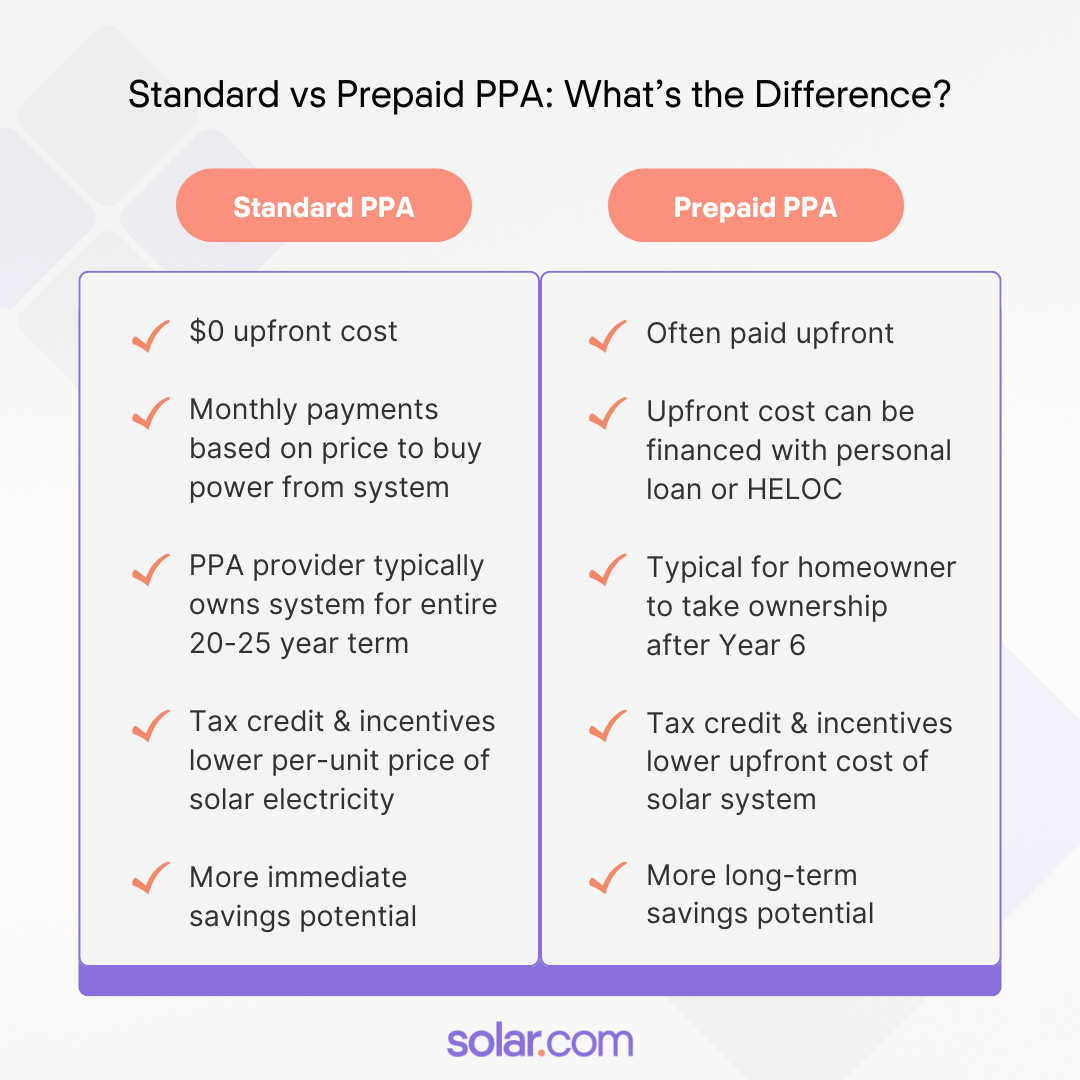

A rising trend in 2026 is Prepaid Solar Leases and PPAs. This “hybrid” model allows you to pay for 20-25 years of solar energy upfront at around 70% of the cost of a direct purchase.

Why consider this? Since the provider owns the system during the first six years, they can claim the Section 48E credit and pass through its value as discount to the upfront balance (which can be financed in many cases). This allows you to go solar for 20-30% less than a cash purchase and includes an option to take ownership after the six-year tax recapture period.

*

*

Key Considerations for Homeowners in 2026

1. Equipment Selection

Expect limited options for the solar modules, inverters, and battery storage allowed in a lease, PPA, or Prepaid proposal. In order to be eligible for the 48E federal tax credit (and the domestic content bonus), TPO providers typically only offer equipment that adheres to manufacturing regulations.

This is worth extra consideration for homeowners interested in a Prepaid arrangement and exercising the option to take ownership of the system after a handful of years.

2. Lease and PPA Escalators

Many 2026 contracts include an annual escalator—a yearly increase in your payment (typically 0.99%, 1.99%, or 2.99%). Having an escalator normally allows you to start with a lower initial lease payment or PPA rate, and thus unlocks more short-term savings. However, over the long term, no-escalator leases and PPAs generally return greater overall cost savings.

3. Grid Resilience and Battery Storage

With grid facing more stress and unreliability, many 2026 leases now bundle battery storage. Because batteries also qualify for the Section 48E credit under third-party ownership, adding storage to a lease is often more affordable than buying it outright.

Leases and PPA payments typically factor in the cost of replacing the energy storage system after 12-15 years, whereas homeowners who purchase solar outright are responsible for this cost when the need for replacement arises.

Frequently Asked Questions

Can I still get a 30% tax credit if I buy solar in 2026?

No. The Section 25D credit for homeowners expired on December 31, 2025. To benefit from federal incentives now, you must use a Third-Party Ownership (TPO) model like a lease or PPA, where the provider claims the credit and can include the value in your financing agreement.

Does a solar lease make it harder to sell my home?

In 2026, most lease and PPA contracts are designed for easy transferability. As long as the homebuyer qualifies for the agreement (as many do), the process is streamlined. However, a Prepaid Lease or PPA is often the most attractive to homebuyers as there are no remaining monthly payments.

Which is better: Lease or PPA?

Choose a solar lease if you want consistent monthly payments for an extended period of time (20-25 years). Choose a solar PPA if you want to ensure you are only paying for the exact amount of solar electricity your roof produces.

Is Solar Still Worth It in 2026?

Even without the direct consumer tax credit, solar remains the best hedge against rising utility costs. By leveraging Solar Leases and PPAs, homeowners can still access federal incentives indirectly, achieving lower energy bills with $0 upfront investment.

Team up with a solar.com Energy Advisor to review custom solutions for your home.