See how much solar panels cost in your area

Please enter a valid zip code.

Zero Upfront Cost

Best Price Guaranteed

![]()

![]()

Solar Learning Center > Solar Financing

Solar Financing

Choosing how to finance your home solar system is a very exciting moment in the solar process. I mean, how often do you get to set your own price for electricity and choose when your solar savings kick in?

The way you choose to finance a solar system has a direct impact on the return on investment you see from your system. So, in this article we will explore the three main solar financing options, and how each one affects your energy cost savings.

- Cash purchase

- Solar loans

- Solar leases and PPAs

- Ownership vs lease

Let’s dive in with a quick review of the available solar financing options.

See how much you could save by going solar. Start here.

Solar financing options

Solar financing options are divided into two camps.

- Direct Ownership (you own the system)

- Third Party Ownership (someone else owns the system)

Direct ownership of a solar system can be financed with a cash purchase or a solar loan. With the cost of solar panels plummeting and a 30% federal tax credit, ownership has become the preferred option for homeowners in the last decade.

Third party ownership can be financed through a solar lease or power purchase agreement (PPA). Leases and PPAs were more common in previous decades, but are now viewed as a last resort or going solar (for reasons we’ll cover later in this article).

| Cash purchase | Loan | Lease/PPA | |

| You own the system | X | X | |

| Greatest lifetime savings | X | ||

| Immediate savings | X | X |

Now that we have an understanding of the options, let’s take a closer look at each one.

Related reading: Solar Leases vs. Solar Loans vs. Solar PPAs

Buying solar panels with cash

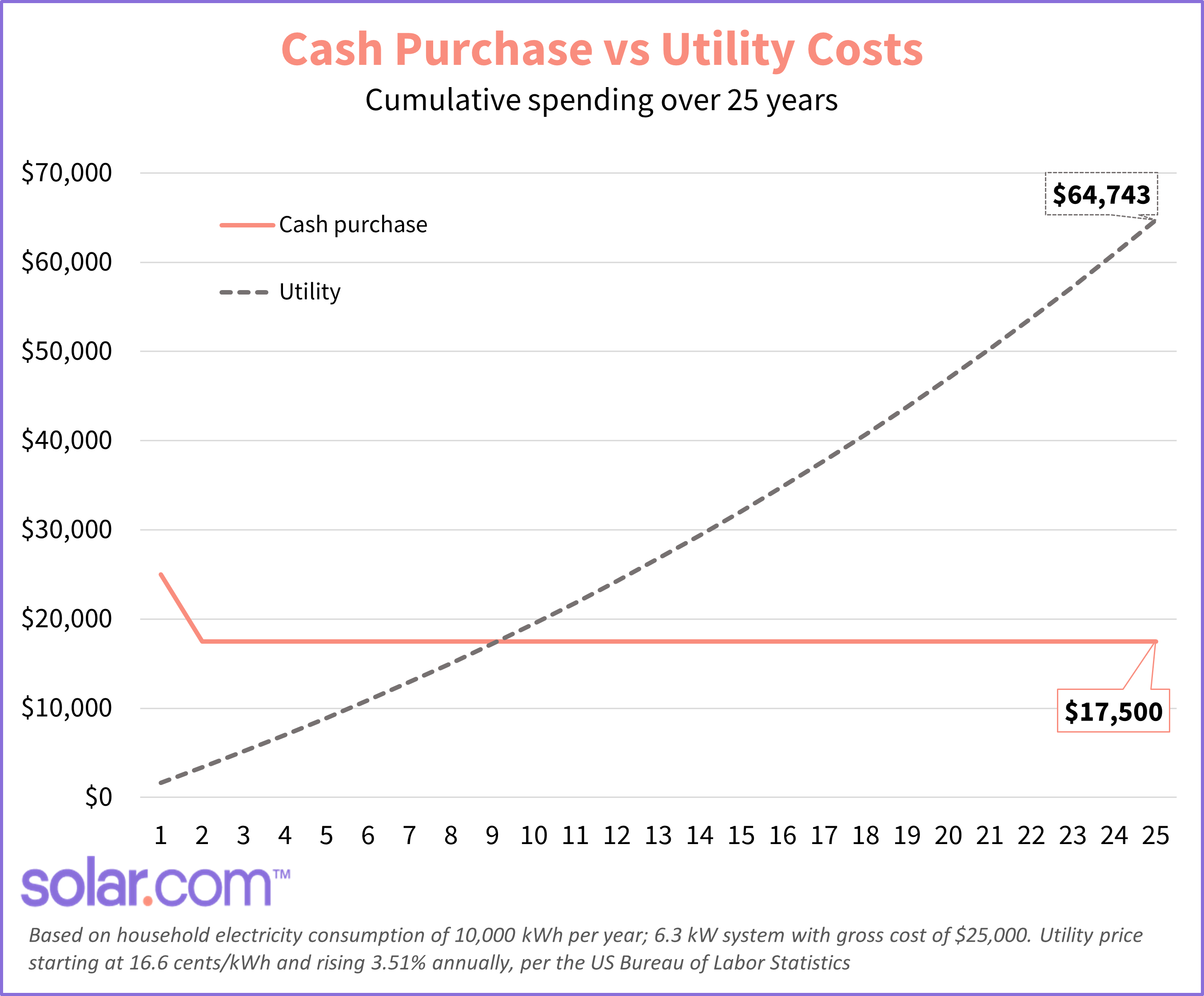

In terms of accruing the greatest lifetime savings, cash is king.

If you have enough saved up, buying solar panels outright with cash payments will provide the greatest savings for the simple fact that you avoid interest payments that come with solar loans.

One way to look financing a solar system with cash is that you’re paying for 25 years of electricity in bulk. And if we’ve learned anything from Costco, everything is cheaper in bulk.

Get multiple solar quotes from vetted local installers.

How buying solar with cash works

Buying a solar power system with cash is relatively straightforward as there are no third party solar financiers to deal with.

At Solar.com, there are 4 progress payments for a cash purchase:

- “Down Payment/Deposit” – $1,000 is typically due by the time your site visit is completed

- “Due Upon Approval of Site Designs” – $2,000 is due when you approve your ‘final site designs’ from the installer

- “Due Upon Delivery of Materials” – 60% of the remaining balance is due either when the equipment is delivered to you, or on the first day of installation

- “Due Upon Final Building Inspection – the rest of remaining balance is due once your project passes city building inspection.

One thing to consider with a cash purchase is your payback period. Although you’ll enjoy the greatest lifetime savings, it takes time — typically 6-10 years — to recoup your initial investment.

If you’d rather spread out your payments and front-load your solar savings, it’s worth considering a solar loan to finance your system.

Related reading: 6 Reasons You Should Buy Solar Panels

Financing with a solar loan

If you do not have the cash up front to pay for your system, you can take out a solar loan.

If nothing else, solar loans are flexibleand designed to accomodate the solar tax credit.

There is typically no down payment required for a solar loan and loan terms range from 8-20 years. So, by choosing a combination of down payment and loan term, solar borrowers are essentially able to dictate when and how they’re savings kick in.

As a rule of thumb:

- Shorter loan terms mean

- Higher monthly payments

- Greater lifetime savings

- Less money spent on interest

- Longer loan terms mean

- Lower monthly payments

- Less lifetime savings

- More money spent on interest

Here’s an example based on a $20,000 system for a homeowner with an average utility bill of $138 per month before going solar.

| TERM | 8-YEAR | 12-YEAR | 15-YEAR | 20-YEAR |

| Initial monthly payment | $183 | $129 | $133 | $125 |

| Lifetime interest paid | $3,662 | $4,645 | $10,082 | $16,230 |

| Lifetime savings | $43,260 | $42,252 | $36,888 | $30,828 |

As you can see, the 8-year loan provides the greatest overall savings, but the 20-year option provides the greatest immediate bill savings.

Around 60% of solar borrowers go with a 12-year loan because it provides a balance of immediate bill reduction and long-term savings.

Explore your solar loan options with an Energy Advisor.

Solar loan rates and qualifications

Your loan payments and energy cost savings are also affected by interest rates and lending fees.

Interest rates are largely determined by market forces and Federal Reserve policy — fun stuff like that. Like mortgage rates, they fell sharply during the pandemic and have been rising since mid-2022.

There are really only two things you can do to lower the rate on your solar loan:

- Raise your FICO credit score. Generally, you need a 650 or higher FICO credit score to qualify for a solar loan. However, lenders usually offer lower interest rates for borrowers with credit scores between 680-719, and the best rates for borrowers with scores 720 and above.

- Move quickly. Rates are expected to continue rising in 2023. So, the sooner you get approved for a solar loan and lock in a rate, the lower it will be.

Although loan qualifications vary by lender, you typically need:

- A FICO credit score of 650 or higher

- A debt to income ratio (DTI) below 50%

- The name of the primary borrower needs to be on the title of the home getting the solar system.

If some cases, adding a co-borrower with a solid credit score and DTI can strengthen your application and increase your chances of getting loan approval.

Combo vs reamortizing solar loans

The other thing to consider is what kind of solar loan with which to finance your system. There are two types of solar-specific loans to know about: Combo and reamortizing loans.

Combo solar loans

As the name suggests, a combo loan is actually two loans. There’s a primary loan is for the net cost of the solar system after the 30% federal tax credit is applied, and a bridge loan for the value of the tax credit.

So, if the contract price of your solar system is $25,000, then the primary loan balance would be $17,500 and the bridge loan balance would be $7,500.

Borrowers typically have 12-18 months to claim their solar tax credit and use it to pay off the bridge loan (although the funds can come from anywhere). If they bridge loan isn’t paid off in time, it’s rolled into the primary loan, which raises the monthly payments.

Here’s how that looks for a $25,000 system in a 20-year combo loan

| Borrower A | Borrower B | |

| Payment for months 1-18 | $110 | $110 |

| Month 18 | Bridge loan paid off | Bridge loan not paid off |

| Payment for months 19-240 | $110 | $160 |

The advantage of a combo solar loan is that your initial monthly payments are based on the lower net cost of the system. In other words, the solar tax credit is built into the loan before you even claim it.

Combo loans are the preferred choice for borrowers that are confident they have the tax liability to claim the solar tax credit in one year. However, if you are retired, or unsure you have enough tax liability for any reason, it’s worth considering a reamortizing solar loan.

Consult a licensed tax professional with questions regarding your tax liability.

Reamortizing solar loans

The second common type of solar loan is a reamortizing loan.

Reamortize is a bit of a mouthful, but it refers to making a lump sum payment on your loan in order to reduce your monthly payments. Like, for example, if you were expecting a tax credit worth 30% of the cost of your solar system…

Since most solar loan borrowers are expecting to claim the tax credit, a reamortizing loan allows them to make a free, one-time lump sum payment to restructure their loan. Elsewhere in the lending world, there are servicing fees associated with reamortizing a loan.

Unlike a combo loan, the initial loan balance is based on the contract price of the system (ie what you paid for it). Let’s see how that looks for a $25,000 system in a 20-year reamortizing loan.

| Borrower A | Borrower B | |

| Payment for months 1-18 | $158 | $158 |

| Reamortization payment | $7,500 | $0 |

| Payments for months 19-240 | $108 | $158 |

The advantage of a reamortizing loan is that your monthly payments won’t go up if you are unable to claim the tax credit and apply it to your loan balance.

Related reading: Solar Loans: Good Debt or Bad Debt?

Property Assessed Clean Energy

One alternative solar loan option is the Property Assessed Clean Energy (PACE) program through the US Department of Energy.

Residential PACE pgrams are offered in California, Florida, and Missouri, and can be used to finance solar systems. In a PACE loan, the “debt is tied to the property as opposed to the property owner(s).”

From our blog: All You Need To Know About Solar Home PACE Financing

Solar financing options for third party ownership

Now that we’ve covered the financing options for owning solar panels, let’s explore how to go solar without actually owning the system.

There are two ways to finance a solar system that someone else ones:

- Solar leases

- Power purchase agreements (PPAs)

Let’s start with the solar lease.

Solar Leases

A solar lease is similar to a solar loan in the sense that both are forms of residential solar financing with zero down solar financing options. But the similarity pretty much stops there.

Ads for “free solar panels” are typically for solar leases and, yes, they are too good to be true. There’s no such thing as free solar panels.

With a solar lease, you are renting your system from a third party owner. You pay the owner a fixed monthly payment for the full term of the lease, which is typically 15-20 years, instead of paying your utility company for electricity.

Solar leases generally include an escalator, which raises your monthly payment by 2-5% every year. So, if you had 20-year lease with an initial payment of $125 per month and a 3.5% escalator, your monthly payment would eventually reach $240 by year 20.

| Year | Monthly payment |

| 1 | $125 |

| 5 | $143 |

| 10 | $170 |

| 15 | $202 |

| 20 | $240 |

While leases typically offer immediate bill savings, you run the risk of the escalator outpacing the rate of energy inflation.

It’s worth noting that since you don’t own the system:

- The installer collects the 30% tax credit, not you

- The system adds no value to your home

- Leased solar systems can slow and complicate home sales, since transferring them involves a third party

Solar leases were more common in previous decades when the cost of solar was prohibitive to many homeowners. However, between the plummeting cost of solar equipment and the federal tax credit, ownership is now much more attainable and lucrative.

Solar Power Purchase Agreements (PPAs)

Power Purchase Agreements are very similar to solar leases. The major difference is that instead of a flat monthly rate, you pay a monthly fee based on how much the system produces.

The idea is that this rate is lower than what you pay a utility for electricity. However, PPAs typically include escalators, which increases the payment each year, and there is no gaurantee that the PPA rate will stay below the utility rate.

Like a solar lease, you do not own the system in a PPA.

Should I buy or lease a solar system?

If your main goal is locking in a steady electricity and accumulating long-term energy cost savings, then buying a solar system is the way to go.

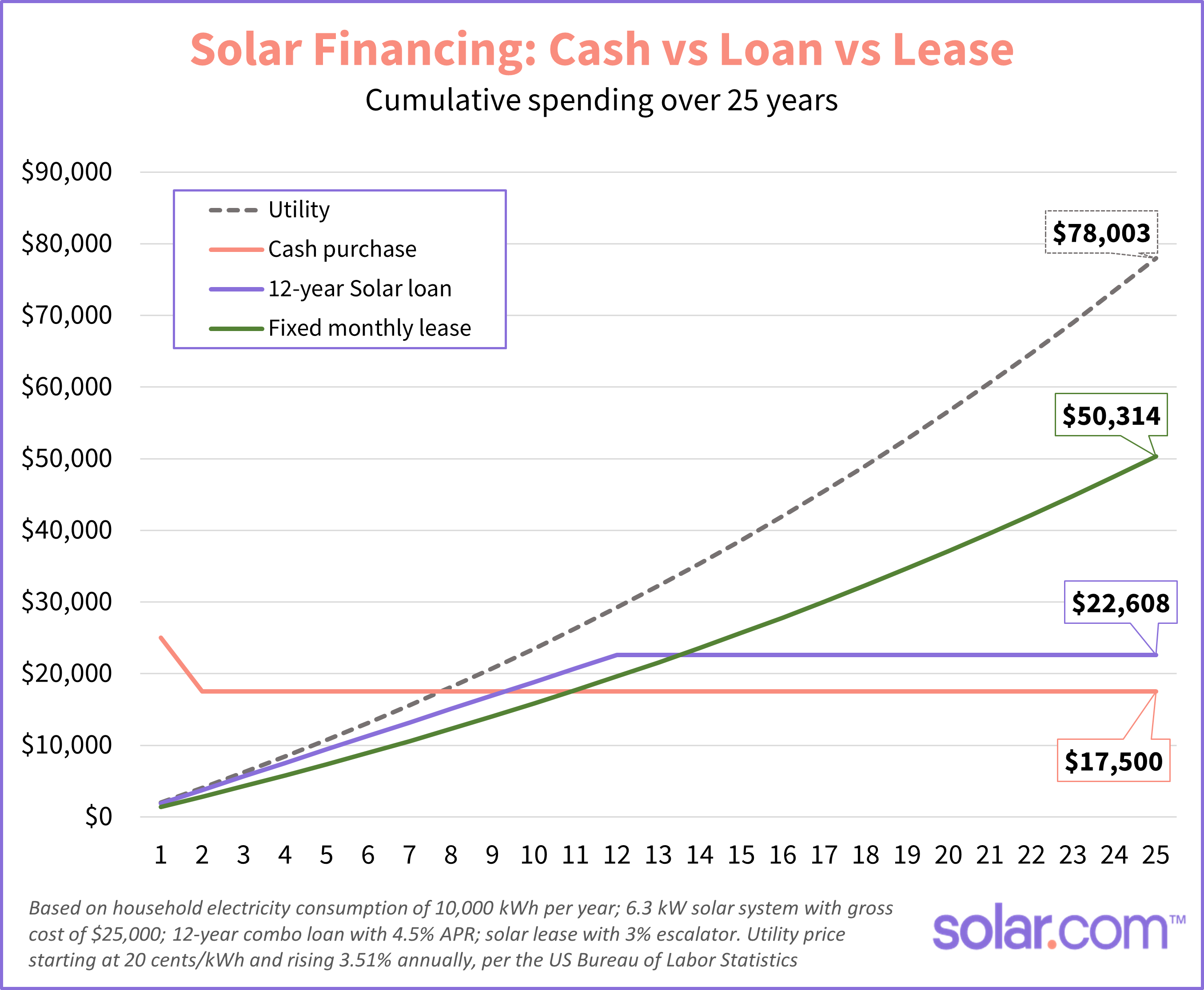

That graph below shows four ways of paying for 10,000 kWh of electricity per year. While a lease provides more immediate savings, buying a solar system — with cash or a loan — provides far greater lifetime savings.

Of course, there are other things to consider in addition to energy cost savings.

| Ownership advantages | Leasing advantages |

| Greater lifetime savings | Greater short-term savings |

| Increased home value | No maintenance |

| Claim the solar tax credit for yourself | |

| Easier to transfer in home sale | |

| Payments don’t escalate |

Lease and PPAs had their time in the spotlight when the cost-barrier to solar ownership was much higher. But today ownership is more affordable and adventageous, and leases are considered a last resort option for going solar.

Related reading: Solar Borrowing 101: Lease vs Purchase

The bottom line

While you may hear of the “high upfront cost” of going solar, financing a solar system is flexible and can be designed to meet your energy cost savings goals.

While buying a system with cash presents the greatest opportunity for return on investment, you can also use a solar loan to spread your payments overtime and start saving money sooner.

Connect with an Energy Advisor to discuss your solar financing options today.

Solar financing FAQs

Can you finance solar panels?

Yes, there two types of loans specifically designed to finance solar panels: combo loans and reamortizing loans. In most cases, in order to qualify for a solar loan you need a minimum FICO credit score of 650, a debt-to-income ratio lower than 50%, and primary borrower’s name needs to on the title of the home.

How does solar financing work?

There are two types of solar loans: combo and reamortizing. In a combo loan, there is a primary loan for the net cost of the system and a bridge loan for the value of the 30% federal solar tax credit. This essentially allows solar borrowers to use the tax credit as a delayed downpayment on their loan.

In a reamortizing loan, the loan balance is the contract price of the system. This loan allows for a free, one-time lump sum payment to reduce monthly payments. Borrowers typically reamortize within 12-18 months, after they have received their solar tax credit.

Is financing solar panels worth it?

There are several benefits to financing a solar system. First, it allows homeowners to go solar — and start accumulating energy cost savings — even if they don’t have enough cash to purchase a system outright.

Second, financing solar panels allows you to front-load your energy cost savings with a zero-down loan. Typically, the payments on a solar loan are lower than the average monthly utility payment.

Related Articles

How To Wrap The Cost of Solar Panels Into Your Mortgage

Most first-time homebuyers would love to find a home with solar panels already installed. They would switch them on to save themselves energy costs while...

Is It Better to Lease Or Buy Solar Panels?

Home solar is a means to long-term energy savings for a vast majority of US homeowners, but exactly how much you save depends on whether...

Mass Solar Loans are Making Solar Even More Affordable for the Commonwealth

The Mass Solar Loan Program was created by the Massachusetts Clean Energy Center and the Department of Energy Resources to make going solar even more...

Solar Loans - Good Debt or Bad Debt?

So you’re thinking about adding solar to your home. Awesome! One of the key questions that solar shoppers soon run into is how to finance...

Buying Solar Panels vs. Leasing Solar Panels

Buying solar panels is your best bet in today’s energy market. We will discuss the pros and cons in this article, but first, we must...

The Pros and Cons of PACE Solar Financing

You may have heard both good and bad things about PACE financing. Solar financing can be a good fit for some people, but not everyone....

5 Common Ways to Finance Solar and Storage Systems

Acquiring solar panels and a solar storage system for your home, and transferring to solar power can be expensive – it can add up to...

UCC Lien Filing's Effect on Solar Leasing

Although the price of a solar panel system is going down consistently year after year, it can still cost a homeowner well over $10,000 to...

All You Need To Know About Solar Home PACE Financing

As the cost of solar goes down year by year, more people are finding that a home solar panel system may be the right decision...

Is Bitcoin Mining Sucking the Energy Market Dry?

Bitcoin has crossed a threshold. The value of a single bitcoin peaked at $20,000 in December 2017, putting dollar signs in tech-savvy eyes around...

SolarCoin, an Energy Cyptocoin with a Bright Future

Everyone can admit that 2017 was a wild year for cryptocurrencies. Sure, Bitcoin popularity skyrocketed, but so did many altcoins as well, such as Litecoin,...

Two Key Updates to California Property Assessed Clean Energy (PACE) Programs

In today’s post, we’ll go over two new pieces of solar legislation that were recently signed into law by Governor Jerry Brown. The two new...

Mass Solar Connect Extended to November 30th

Mass Solar Connect, a program with the objective of helping South Coast residents use renewable solar energy to power their households, has extended its deadline...

What to Expect from a Solar Contract

You’ve decided to go solar. Now it’s time to start thinking about how you’re going to pay the solar bill. Like buying a car, you...

Affordable Solar Loan Providers

The first homes to install modern photovoltaics were in the 1960s. These early adopters were pioneers in alternative home energy. They took a risk of...

The Future of Solar Energy Under The Trump Administration

The recent election of President Trump has affected every sector of the economy, from agriculture to energy. While some would argue that most of the...

Solar Leases vs. Solar Loans vs. Solar PPAs

So, you’ve decided to go solar – fantastic! The easy part is done. But do you know how you’re going to pay for it? Here’s...

SolarCity Loan Review: Small Step in the Right Direction

For the past two months, SolarCity news coverage has focused on Tesla’s acquisition bid, drawing attention away from SolarCity’s reintroduction of a loan financing offer...

Two Reasons Why SolarCity’s Stock is Down

SolarCity lost focus while trying to become a vertically integrated nationwide construction company, a business model that is extremely difficult to execute. This has left...

SolarCity Pulls Plug on MyPower

Several weeks ago, SolarCity announced that they would be abandoning their flagship solar loan product, MyPower. Considering the product was a pretty poor deal for their...

SolarCity MyPower Review Part 2

In Part 2 we will peel back some more layers of the MyPower package by focusing on the financing. Make sure you have read about...

SolarCity MyPower Review Part 1

Being one of the most popular loan packages in the solar market today, it’s remarkable that SolarCity’s MyPower option has not yet received a...

See how much solar panels cost in your area.

Please enter a valid zip code.

Please enter a valid zip code.

Zero Upfront Cost. Best Price Guaranteed.