Mass Solar Loans are Making Solar Even More Affordable for the Commonwealth

The Mass Solar Loan Program was created by the Massachusetts Clean Energy Center and the Department of Energy Resources to make going solar even more affordable for Commonwealth residents. The program was started in 2015 with $30 million in public funds to provide homeowners with low interest, fixed-term loans to go solar.

More than 2,700 projects have been financed with Mass Solar Loans, bringing the state closer to reaching its goal of 1,600 megawatts of solar by 2020. If you’re looking to finance a project under $60,000 that’s not already installed or interconnected to the grid, the state is currently offering amazing incentives!

However, these incentives are already around 80% full and the state is looking to replace them with a program that would only provide assitance to low and moderate income families. If you’re currently earning 120% or more of the state’s median income, you will no longer qualify for Mass Solar Loans so act quickly to finance your project now!

Eligible applicants can take advantage of the Mass Solar Loan Program’s 1.5% Interest Rate Buy Down. An interest rate buys down simply means that the program utilizes some of its funds to pay off part of your interest up front, and in return, you receive a lower interest rate for the lifespan of your loan.

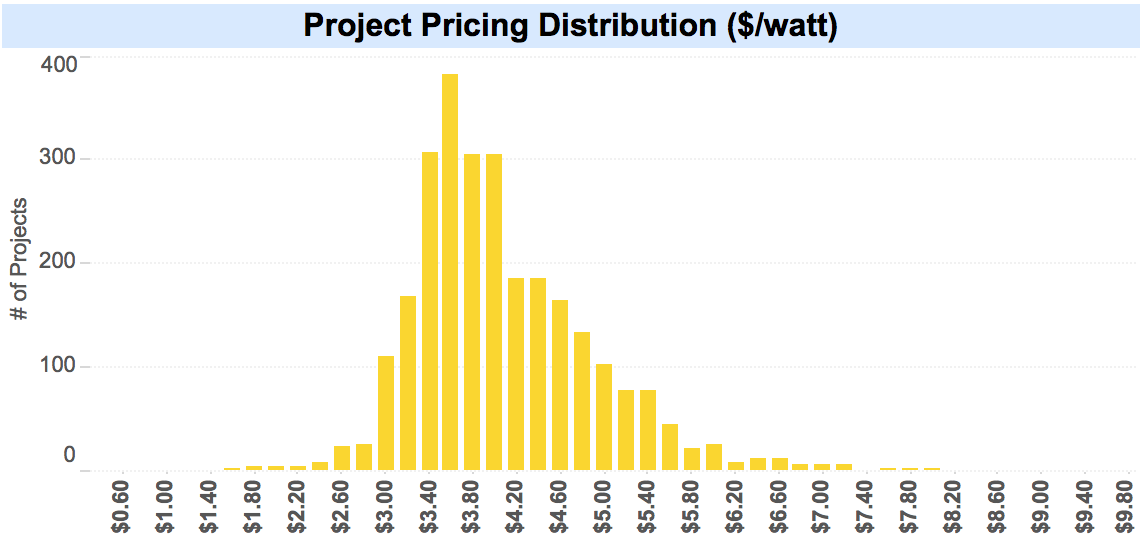

The median solar loan interest rate under the program is just 3.24%, which is significantly less than many interest rates offered by third-party financiers. Here’s a snapshot of the number of projects within different price per watt ranges for Mass Solar Loan (visit the Mass Solar Loan Program page for the most recent data).

Here is a snapshot of the median solar loan project that is funded through Mass Solar Loan. While the average cost per Watt in the Mass Solar Loan Program is $4.00, homeowners who participate in Mass Solar Connect are paying $3.30 per Watt on average.

Here is a snapshot of the median solar loan project that is funded through Mass Solar Loan. While the average cost per Watt in the Mass Solar Loan Program is $4.00, homeowners who participate in Mass Solar Connect are paying $3.30 per Watt on average.

Massachusetts residents without excellent credit scores may qualify for the Loan Loss Reserve incentive. Banks maintain loan loss reserves as protection against loans that go bad. A larger reserve may allow a bank to take on a greater amount of riskier loans. Through the program’s Loan Loss Reserve incentive, “lenders may be eligible for additional incentives to help their customers go solar.”

The Mass Solar Loan Program is also offering incentives targeted at increasing solar system ownership among lower-income families. Households that meet minimum income levels may be eligible for Income-Based Loan Support, under which the Mass Solar Loan Program will pay part of the principal interest amount.

Mass Solar Loan Providers

Here’s a list of the participating banks and the rates they offer for the Mass Solar Loan Program. Please note that your specific rate will vary depending on the parameters of your project.

Bank |

HQ Location |

Interest Rate

|

Interest Rate

|

Interest Rate

|

Offers solar loans for

|

| Equitable Bank (formerly Weymouth Bank) | East Weymouth | 1.25% | 1.25% | 1.25% | Yes, up to $50,000. |

| UMassFive College Federal Credit Union |

Hadley | 3.25% | 3.25% | N/A | Yes, but not through the Mass Solar Loan program. |

| Avidia Bank/BlueWave | Hudson | 1.89% | 1.89% | N/A | No |

| Bank Five | Fall River | 2.99% | 2.99% | N/A | Yes, up to $60,000. Interest rates vary based on term. |

| Clinton Savings Bank | Clinton | 3.00% | 3.00% | N/A | Unknown. |

| Naveo Credit Union | Somerville | 1.00% | 1.75% | 2.75% | Yes, but not through the Mass Solar Loan program. |

| Stoughton Co-Operative Bank | Stoughton | 2.49% | 2.99% | 3.25% | Yes, but not through the Mass Solar Loan program. |

| Sharon Credit Union | Sharon | 2.75% | 2.75% | N/A | Yes, up to $60,000 at the same interest rate. |

Solar Loan or Solar Lease?

We’ve written many articles about why using a loan or cash to buy a system is often a better choice than PPAs or third-party leasing. A loan can make you eligible for the Federal Investment Tax Credit, which amounts to 30% off your gross system cost. It also allows you to capture more of your system’s lifetime savings. When it comes to the Commonwealth, loans are also better for the state. Whereas many third-party solar financiers are based out of state, participating banks in the Mass Solar Loan Program are local to the state.

Want more information about the amazing incentives available to Massachusetts residents looking to go solar? Check out the other articles in our Mass Solar Connect Series.