5 Common Ways to Finance Solar and Storage Systems

Acquiring solar panels and a solar storage system for your home, and transferring to solar power can be expensive – it can add up to tens of thousands of dollars. Going solar is a good investment and it does pay off in the long run, but the first purchase of a solar system can be quite costly.

Many people are not able to make that purchase upfront and in cash, which can deter them from buying it in the first place.

To help you make that first, serious step towards going solar, making a great investment for your future, and increasing the value of your home, we have researched some of the best financing options for your solar and storage systems purchase.

The 5 traditional ways to finance solar can be broken up into two categories: Loans (you own it) and Leases (third-party ownership).

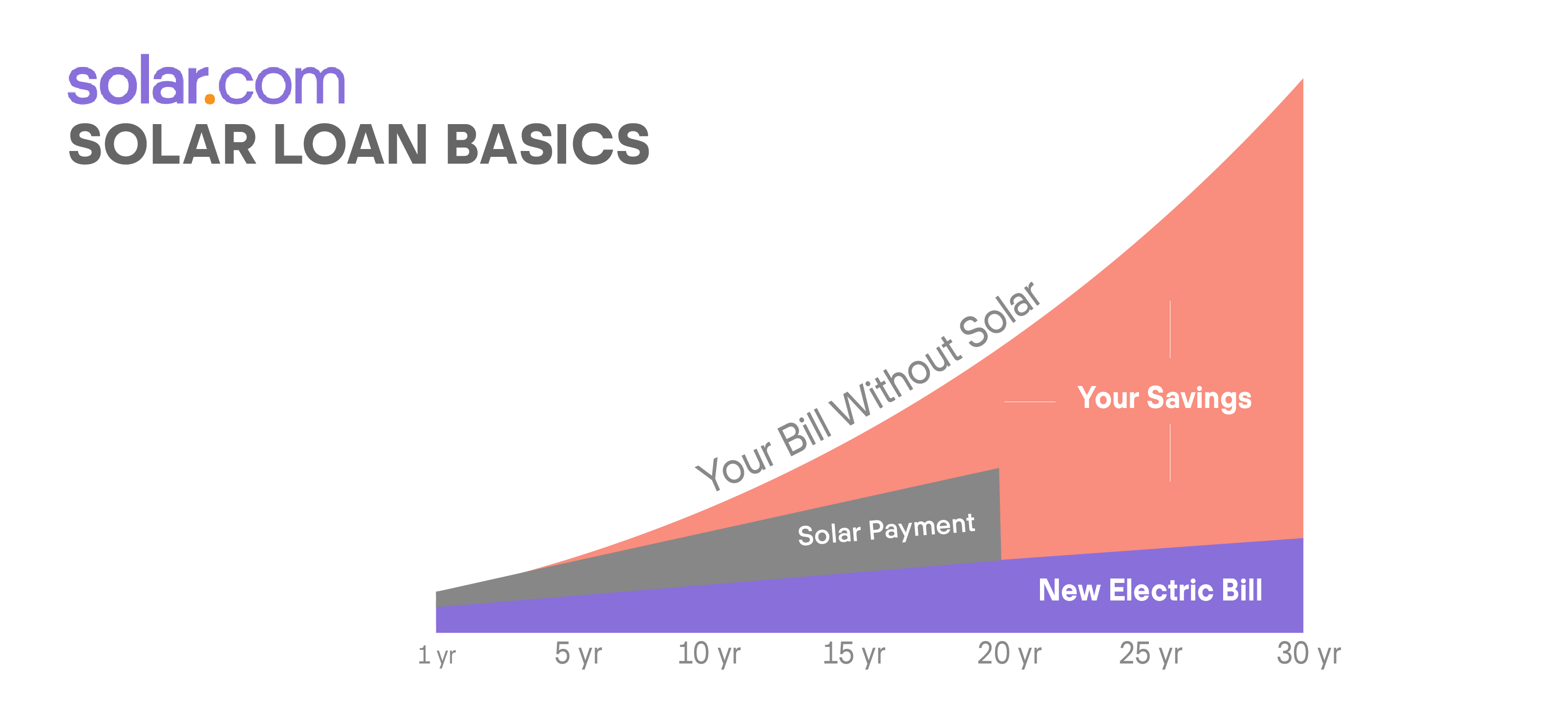

If you prefer not to spend the upfront money to install your solar panel system, solar loans are an excellent option for you. They allow you to finance the entire cost of your system.

Better yet, with a loan, you’ll own your system and you’ll be entitled to all the rebates, tax credits and, other incentives. These benefits allow you to maximize the return on your investment in solar.

There are two types of solar loans: secured and unsecured. With both types, there are zero down options, so you won’t have to put any money down. Regardless of which type you use, your monthly loan payments are likely to be less than your current electric bill so you’ll start saving money right away, without incurring any upfront costs, and, over time, as electricity prices continue to rise, your savings will continue to grow.

1. Home Equity Loan

1. Home Equity Loan

Home equity loans or home equity lines of credit are the most common form of secured loans. With this type of loan, you borrow against the equity in your home. Your home serves as collateral. These loans have favorable terms and the lowest interest rates, from 3.5-5.5 percent. Additionally, the interest on the loan is tax-deductible.

But – if for some reason you were to default on a loan, the bank has the option to foreclose on your home.

2. FHA, Title 1 Loan

FHA, Title 1 loans are a very similar type of secured loan, guaranteed by the government, where your home also serves as collateral. Similarly to the home equity loan, the terms are also favorable, with low-interest rates ranging from 5 to 7.5 percent. If you default on the loan in this case, the lender will have a lien against your home, so that the loan will be paid when or if you sell your house.

3. Unsecured Loans

These loans do not require any collateral, which makes them riskier for the lender and that risk is reflected in the higher interest rate. Unsecured loans are similar to other personal loans. Interests on these loans are not tax deductible, and if you were to default on an unsecured loan, your credit score would be impacted.

4. & 5. “They Own It” – Solar Leases or PPAs

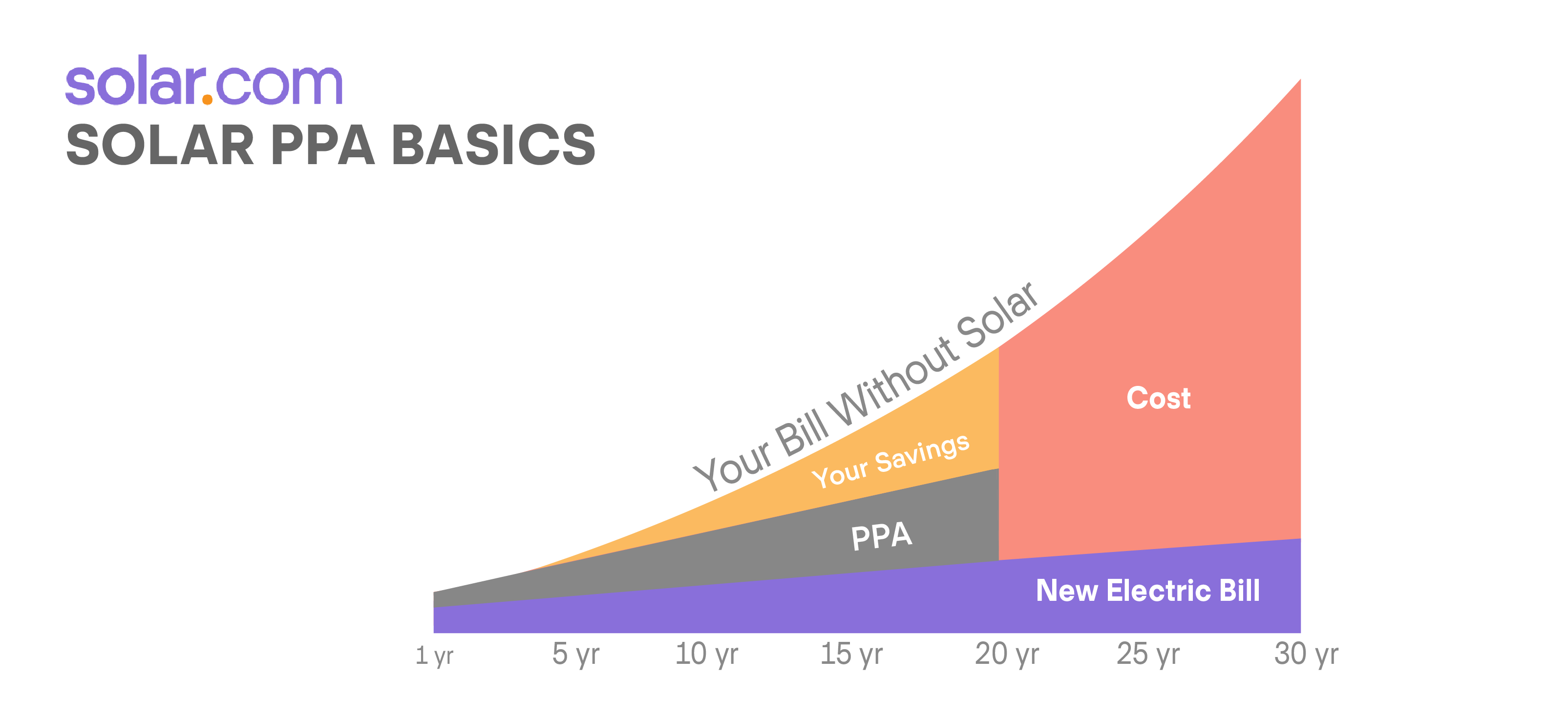

Solar leases and power purchase agreements, also known as PPAs, allow you to take advantage of the financial and environmental benefits of solar without owning your solar panel system. Both options are similar to renting. You can think of it as a car lease.

With a solar lease, you pay a monthly fee for the system and get to use all the electricity the solar panels produce – for free. With a PPA you agree to purchase the electricity the system generates at prices that are lower than what you would pay your utility.

Most leases and PPAs have zero-down options so you won’t pay anything upfront. Your monthly payments for a lease or a PPA are usually less than your current electric bill, so you begin saving right away. A solar lease or a PPA will help you to save 10 to 50 percent over your utilities and electricity bills without making any upfront investment.

Most leases and PPAs have zero-down options so you won’t pay anything upfront. Your monthly payments for a lease or a PPA are usually less than your current electric bill, so you begin saving right away. A solar lease or a PPA will help you to save 10 to 50 percent over your utilities and electricity bills without making any upfront investment.

Although solar panel systems require little to no maintenance, if something were to happen, the lease or the PPA company would be responsible for any repairs, since it is the owner of the system.

Securing a lease takes less time and effort than securing a loan. Generally, you sign a 20-year contract with the leasing company, and they will install the panels at your home. You usually will need to have a credit score of more than 700 to qualify for a solar lease or a PPA.

What Is the Best Option for You?

Since the leasing company owns the solar panel system, many of its financial benefits, things like rebates, tax credits and incentives would go to them. So if you’re looking to maximize your investment in solar, the better choice would be a solar loan.

Leases and PPAs, on the other hand, are a great option if you’re looking for a simple solution. They are also a good option if your taxes are less than the tax credit you would receive.

In the end, once you understand your financing options, you need to choose the one that’s best for you, and that best fits your needs and goals.