Is It Better to Lease Or Buy Solar Panels?

Home solar is a means to long-term energy savings for a vast majority of US homeowners, but exactly how much you save depends on whether you lease or buy solar panels.

We’ll be the first to admit that solar financing isn’t exactly the sexiest topic in the world and it can feel a bit overwhelming at first. However, the way you finance your solar panels can make the difference of tens of thousands in energy savings over the life of the system.

So we’ve created this guide to help you explore the basics of leasing vs buying solar panels. In this article, we’ll cover:

- Leasing vs buying solar panels

- Ways to buy solar panels

- Ways to lease solar panels

- Is it better to buy or lease solar panels?

- Frequently asked questions

Let’s dive in with the difference between buying and leasing solar panels.

Lease or buy solar panels: What’s the difference?

There are three major differences between buying and leasing solar panels:

- Who owns the system

- Who collects the solar incentives

- What happens when you sell your home

If you purchase a solar system, either with cash or a loan, you own the system and receive 100% of the benefits that come with it. That includes the 30% federal solar tax credit and any other state, local, or installer incentives.

When you sell your home, the solar system is treated as an attached appliance like a furnace or air conditioner — it’s sold as part of the home. In fact, multiple studies have shown that homes with solar systems sell faster and for more money.

If you lease a solar system, the company you lease from owns the system. You are essentially renting the system from a solar company, similar to leasing a car or renting an apartment. Since you don’t own the system, you don’t benefit from any of the incentives. The company that owns the system does.

And things can get sticky if you decide to move during your lease. The system adds no value since it’s technically not part of the home, and you’re left paying off the remainder of the lease yourself or finding a homebuyer that agrees to take it on.

Is it possible to sell a home with a leased solar system? Absolutely! However, it can complicate and drag-out the selling process.

| Cash Purchase | Purchase w/ Loan | Lease | |

| No Cash Out of Pocket | X | X | |

| Receive Tax Credit | X | X | |

| First Year Savings | X | X | |

| Greatest Lifetime Savings | X | ||

| Own Your Equipment | X | X | |

| Added Home Value | X | X |

Let’s take a quick look at how each financing method works.

Two ways to buy solar panels

Much like a house or car, home solar systems can be purchased with cash or a loan. Here are the basics of buying a solar panel system.

Buying with cash

Paying cash is the simplest way to buy a solar system and presents the greatest opportunity for energy savings. That’s because you are avoiding the interest payments on a loan and the escalating payments on a lease. And, some installers offer a discount for paying in cash, which increases your overall savings.

Buying a solar system with cash typically consists of four payments. The exact benchmarks and payment amounts will vary from installer to installer.

Here’s what a cash payment schedule may look like:

- Down payment or deposit – $1,000 due upon completion of site visit

- Design approval – $2,000 due upon approve of your final system design

- Materials deposit – 60% of the remaining balance is used to purchase materials for your installation

- Building inspection – The remaining balance is due after the installed solar system passes city building inspection

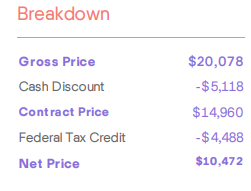

It’s important to note that the 30% federal solar tax credit kicks in after you’ve paid for the system. That means you pay the full contract price in cash and end up with the lower net cost after you claim your tax credit.

Buying with solar loans

Many homeowners use loans to purchase solar panels because it requires less cash upfront and still provides substantial long-term energy savings.

Solar loans typically have the following qualifications:

- The borrower is the owner of the home getting solar panels

- The home getting solar is a primary residence

- A minimum credit score of 650

- A debt-to-income (DTI) ratio that does not exceed 50%

With zero-down payment options and loan terms as long as 20 years, solar loans can be quite flexible. However, most solar loans operate within two basic frameworks: Combo loans and re-amortizing loans.

Combo loans

Combo loans are the most common loan for homeowners that are confident they have the tax liability to claim the full 30% solar tax credit in the first year after installation. Consult a licensed tax professional with questions regarding your tax liability.

As the name suggests, a combo loan is technically two loans:

- A primary loan for the net cost of the solar system, and

- A bridge loan for the value of the tax credit

The advantage of a combo loan is that the 30% tax credit is essentially built into the original loan balance. So instead of taking out a loan for the gross system cost $25,000, you’d take out a loan for the net cost of $17,500. This makes for lower monthly payments right off the bat.

In most cases, the borrower has 18 months to pay off the bridge loan, which is typically more than enough time to claim and collect the solar tax credit. If the bridge loan isn’t paid off in time, it’s rolled into the primary loan and raises the monthly payments.

Here’s an example of a 20-year combo loan with a contract price of $25,000 and a net price of $17,500 after the 30% solar tax credit.

| Borrower A | Borrower B | |

| Down payment | $0 | $0 |

| Monthly payment for first 18 months | $95 | $95 |

| Month 18 | Bridge loan paid off | Bridge loan not paid off |

| Monthly payment for months 19-240 | $95 | $140 |

Figures for example use only. This is not an offer to lend.

As you can see, it’s important to pay off your bridge loan to keep your loan balance and monthly payments low.

Re-amortizing loans

Re-amortizing loans work similarly to a home loan with a free one-time refinance. This loan structure is commonly used by homeowners that don’t expect to have the tax liability to quickly collect the 30% solar tax credit. Consult a licensed tax professional with questions regarding your tax liability.

In a re-amortizing loan, the loan balance is based on the contract price of the system. This makes for higher payments upfront than a combo loan. However, as the name suggests, borrowers can re-amortize by making a lump sum payment to lower the monthly loan payments.

One way to think of it is delaying a down payment until you receive your solar tax credit. However, the re-amortization payment can come from anywhere – inheritance, holiday bonus, selling baseball cards on eBay.

Here’s an example of a 20-year re-amortizing loan with a contract price of $25,000 and a re-amortization with the value of the 30% tax credit after year two.

| Age of loan | Monthly payment |

| 1-24 months | $135 |

| Re-amortization | $7,500 lump payment |

| 25-240 months | $93 |

It’s important to note that the lender has nothing to do with claiming the solar tax credit. That’s between you, the IRS, and a licensed tax professional.

Two ways to lease solar panels

Solar panels can also be leased, similar to renting an apartment or leasing a car. There are two basic types of solar lease agreements: Fixed monthly leases and Power Purchase Agreements (PPAs).

Fixed monthly solar lease

Fixed monthly solar leases are pretty straightforward. The solar company installs a system on your roof, and instead of paying your utility bill, you make a lower monthly lease payment on the solar system.

For example, if your utility bill is $140 a month, your monthly solar lease payments might be $99 for the first year. That saves you $41 a month and $492 in the first year.

Solar leases usually last 20 or 25 years and include an annual escalator. The escalator raises the monthly payment over time, typically by around 3% per year. So if the payments are $99 a month in the first year, they would be ~$102 per month in the second year, ~$105 in the third year, and so on.

While that may not seem like much, escalating payments pick up steam over time.

| Lease Year | Monthly Lease Payment | Annual Cost |

| 1 | $99 | $1,188 |

| 5 | $111.43 | $1,337.10 |

| 10 | $129.17 | $1,550.07 |

| 15 | $149.75 | $1,796.96 |

| 20 | $173.60 | $2,083.17 |

20-year solar lease with a 3% annual escalator.

Solar leases offer immediate energy savings. However, due to the escalator, they end up being more expensive in the long run than purchasing a solar system with cash or a loan. We’ll expand on that later in the article.

Power purchase agreement (PPA)

The difference between a PPA and a fixed monthly solar lease is that in a PPA the homeowner pays for the power generated from the solar system instead of a flat monthly rate for the equipment.

The idea is to pay a lower rate for solar electricity than for grid electricity. So a PPA provider may offer you a rate of 12 cents per kilowatt hour whereas your utility charges 16.6 cents per kilowatt hour.

However, like the fixed monthly solar lease, PPAs typically include escalators that increase the price each year. While you save money upfront, the long term savings is less than purchasing a solar system. You also run the risk of having the PPA escalator outpace the rise in utility electricity prices.

Is it better to buy or lease solar panels?

In previous decades, when solar technology was younger and more expensive, solar leases were the way to go. But today, buying solar panels typically provides more energy savings than leasing.

That’s because in just the last 12 years, the cost of an average home solar system (before incentives) has dropped from $40,000 to around $20,000, according to the Solar Energy Industries Association (SEIA).

The fast-falling cost of solar equipment coupled with the 30% federal solar tax credit have made potential energy savings of purchasing solar panels – either with cash or loan – much greater than a solar lease.

Buying vs leasing solar panels: Lifetime savings

Other than who owns the equipment, the biggest difference between buying and leasing solar panels is the total energy savings over 25 years.

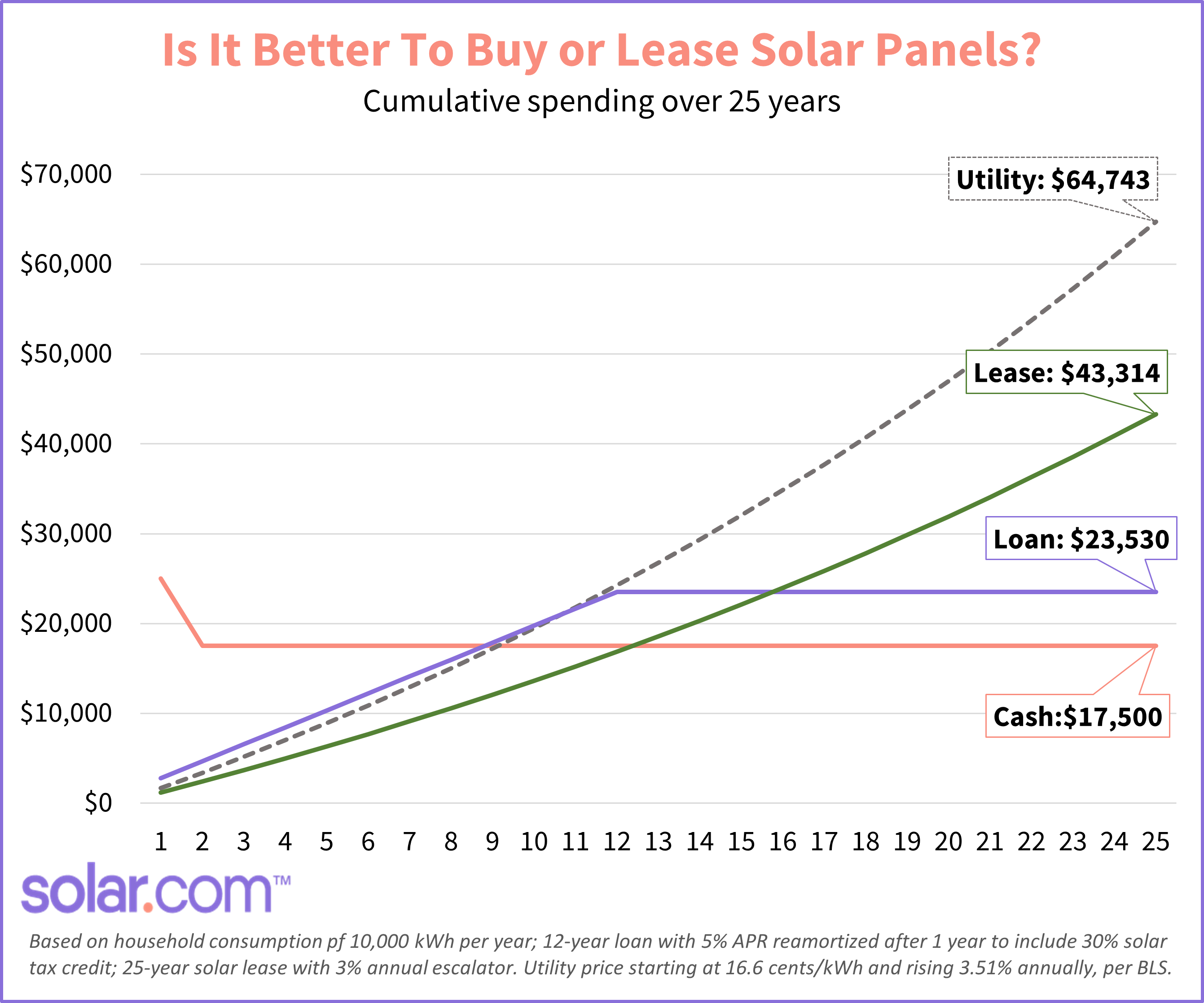

The graph below shows the cumulative cost of going solar through three financing methods:

- Buying with cash and claiming the 30% tax credit

- A 12-year solar loan with zero down, re-amortized with the 30% tax credit in Year 2

- A 25-year fixed monthly solar lease with a 3% escalator

The dotted line shows the cost of paying the national average price for grid electricity through a utility.

Three first takeaways from this comparison:

- Going solar, regardless of how you finance it, is far more affordable than sticking with a utility for 25 years

- Buying costs more upfront, but leads to greater savings than leasing

- A cash purchase offers the greatest lifetime savings

Solar financing methods ranked

| Rank | Financing method | Lifetime savings |

| 1 | Cash | $47,243 |

| 2 | Solar loan | $41,213 |

| 3 | Solar lease | $21,429 |

While the solar lease provides immediate energy savings, it is the most expensive solar financing option in the long term. That’s because the escalator increases your annual electricity costs exponentially throughout the life of the lease.

Lease or buy solar panels: Playing the long game

In many ways, paying for electricity is like paying for housing. Both are essential costs that will follow you for your entire life, and there are two basic options: Renting or buying.

Solar leases and relying solely on grid electricity is like renting an apartment. It’s cheaper in the short term, but regular price increases accumulate to make it the more expensive option in the long run.

Buying a solar system – either with cash or a loan – is similar to buying a house. By making the upfront investment, you can fix your essential costs at a lower rate and blaze a trail for long-term savings once you recoup your initial investment.

Picture yourself 20 years from now. Which would you rather have?

- A monthly utility bill for ~$266

- A monthly solar lease payment for ~$175

- A paid-off solar system with 5 years left on its warranty

- No electricity

If you like the sound of Option 3, connect with an Energy Advisor to discuss your energy goals and generate multiple solar quotes.

FAQs

Is it better to buy or lease solar panels?

In most cases, it is better financially to buy solar panels instead of lease them. Between the falling cost of solar and the 30% federal tax credit, buying panels with a cash or a solar loan provides much greater potential for energy savings than leasing over the life of the system.

What is the downside of leasing solar panels?

There are a few downsides to leasing solar panels. First, the energy savings potential is lower than buying solar panels. Second, you do not own the panels, and therefore cannot claim any incentives for going solar. Third, solar leases can be difficult to transfer during a home sale, whereas owned panels typically increase home value.

Is it better to finance or pay cash for solar panels?

In terms of long-term savings, paying cash for solar panels provides a greater potential return on investment. However, solar loans are quite common and there is still plenty of energy savings to be had for homeowners that finance their solar system.