At a glance:

- Suniva, a U.S. based solar panel manufacturer, filed a product dumping complaint with the International Trade Commission in April 2017.

- Suniva has requested tariffs in addition to what has been in place since 2014.

- Suniva has expressed interest in backing out of the complaint if China buys $52 million worth of their old factory equipment.

- Current tariffs have only resulted in a 3% increase in consumer costs.

- The global regulatory bodies are highly resistant to tariffs of this sort.

There has been considerable buzz surrounding the possibility of a solar trade war with China. Yet, the question most relevant to potential PV system owners regards the future of solar prices in the U.S. The trend of cheap solar came into question in April when Suniva, a U.S.-based module manufacturer, filed an anti-dumping complaint with the International Trade Commission.

The basis of Suniva’s complaint regards a supply surge of Chinese crystalline silicon photovoltaic (CSPV) cells, which provide a critical element to the manufacturing process.

If Chinese companies “dump” a massive supply of these cells into the U.S. market, domestic producers such as Suniva, unable to compete with such low costs, are effectively blocked from the market. Soon after the complaint was filed, Solar World, another PV manufacturer, joined Suniva as a co-petitioner.

While some leaders in the U.S. solar industry claim that tariffs on below-market value PV products from overseas will help revitalize national solar system production and innovation, other leaders believe that such measures accomplish little beyond increasing the variable costs for domestic producers, which consequently raises prices for consumers.

It should come as no surprise that China responded to U.S. tariffs with one of their own. In many ways, the political effects of a tariff can be understood in light of Newton’s third law – that every action creates an equal and opposite reaction.

In 2014, the Federal Department of Commerce announced anti-dumping duties of 26.7% to 78.42% on imports of most solar panels made in China, and rates of 11.45% to 27.55% on imports of solar cells made in Taiwan. In addition, the department announced anti-subsidy duties of 27.64% to 49.79% for Chinese modules.

In retaliation, China levied tariffs against REC Silicon

A producer of silicon materials for photovoltaics applications and multi-crystalline wafers. REC’s market was almost completely based in China. The tariffs against REC crippled their business, which ultimately led to decreased US production and the closing of factories in Washington and Montana.

The solar industry, nevertheless, is highly adaptable and resilient to unfavorable market conditions. As labor costs continue to rise in China and thus make manufacturing more expensive, alternative manufacturing hubs will emerge.

Perhaps the most important quality of the solar industry is the competitive attitude of innovation and production – a strong force in driving costs down. While recent tariffs certainly hinder competitive forces, the consumer, for now, has little to worry about.

Traditionally, solar system components come from China and other countries in Asia. Asian countries offer the lowest cost of production for components such as module frames, junction boxes, inverters, connectors, and more.

While a tariff would indeed make Chinese products less attractive (and give US manufacturers a slight competitive edge in the short run), the U.S. still lacks the infrastructure and raw material supply to begin manufacturing on a large scale.

These materials are currently in high demand, and at present, it is unlikely that the U.S. manufacturing sector will be able to meet long term supply needs. At the end of the day, the market will favor the nation with the most attractive production costs.

Homeowners have not yet experienced significant cost increases

Despite this aggressive competition, recent data analysis shows that homeowners should not be losing sleep over the trade conflict with China. According to Greentech Media’s Research, Solar Market Insight Q4 2016 report, the average cost of a residential PV system in Q3 2016 was $2.98 per watt. Since solar modules represent only a piece of the total cost of a system, a 25% tariff on solar modules would reflect a modest 3% increase in the total installation cost. However, the possibility of tariffs on other components like inverters or mounting brackets may raise costs should the political friction continue.

The International Trade Commission (ITC) will decide by September 22 whether China’s actions constitute an actionable injury. If just cause is found, temporary tariffs or other trade barriers would apply to all solar imports– not just components from China.

Suniva, along with co-petitioner SolarWorld, is calling for initial duties on solar cells of $0.40 per watt and an initial minimum price of $0.78 per solar module (phased out over four years). If the requested tariffs are implemented, the duties would possibly double the price of solar modules in the US (according to this Covington study) – and the US would consequently become the most expensive place in the world to go Solar.

It is important to remember, however, that modules only represent a small piece of the total system cost. If the tariff is implemented, then homeowners can expect to see an increase of several percentage points in total system cost.

The motivation behind Suniva’s complaint is dubious

Since the dawn of residential solar, the industry has relied on competition, especially from overseas, to drive down the price and encourage innovation. The problem with Suniva’s complaint is that it only represents a small portion of the US solar industry – manufacturers.

While US-based manufacturers would certainly benefit from the tariff, the rest of the solar industry and even the nation at large would suffer as a result. As panels become more expensive, less will be utilized which consequently impacts installers. The loss to the economy would be greater than the potential savings from tariffs, and that doesn’t even include the social cost of Suniva’s tariff recommendation.

The tariffs requested by Suniva and SolarWorld are apparently politically motivated in nature – Suniva has expressed interest in dropping the case if China agrees to buy $52 million worth of old Suniva factory equipment. Extortion tactics aside, the ITC is known to be hesitant when imposing trade barriers based on complaints from limited interests.

In 2003, George W. Bush attempted to levy tariffs against Chinese steel but the move was precluded by the World Trade Organization (WTO) and European Union, causing the US to withdraw the tariffs in 2004. If we can learn one thing from history, it’s that it seems very unlikely for the WTO and the global community to stand by tariffs imposed on behalf of limited interests.

So long as Suniva’s petition is shot down, which seems likely based on recent tariff history, the global solar industry will remain healthy. Nevertheless, one can never be 100% sure of anything so if you’ve been considering going solar, now is the safest time to save big.

If you’re interested in finding out how much solar costs today, you can explore pricing for your home by searching your area here.

Massachusetts introduced its SREC II Program in April 2014 to continue the success of the

Massachusetts introduced its SREC II Program in April 2014 to continue the success of the

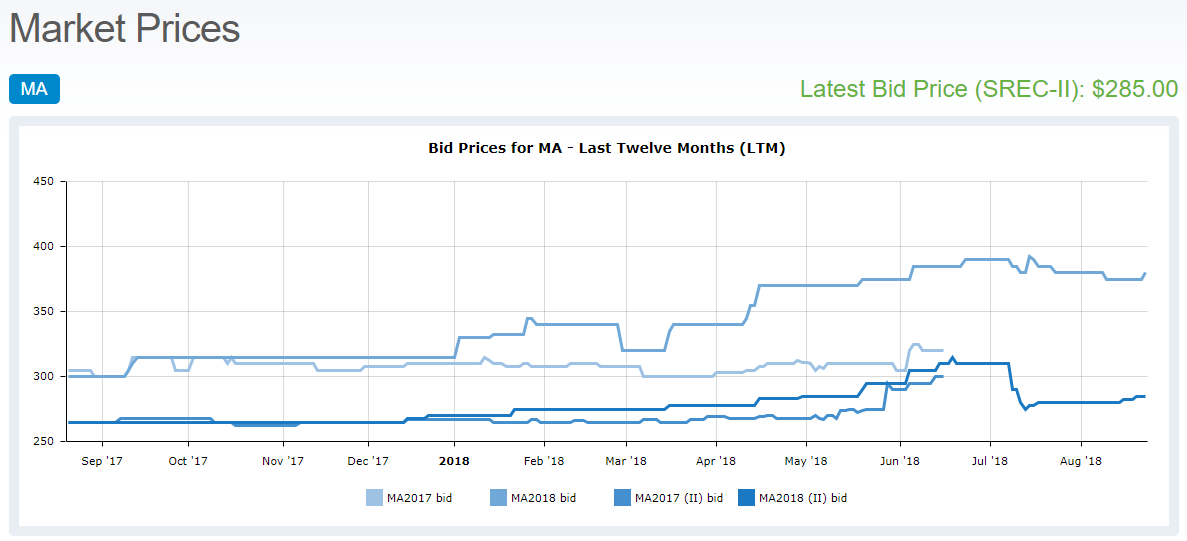

Before the extensions, given a floor price per SREC is $170 per MW, if your 7kW system generated 8.5MWh utilities would pay you a minimum of $1,445 before fees. SRECs are awarded for 10 years, and though the actualized price of SRECs may vary from year to year, you can expect to earn much more over the period than what you would receive solely through NEM.

Before the extensions, given a floor price per SREC is $170 per MW, if your 7kW system generated 8.5MWh utilities would pay you a minimum of $1,445 before fees. SRECs are awarded for 10 years, and though the actualized price of SRECs may vary from year to year, you can expect to earn much more over the period than what you would receive solely through NEM.