See how much solar panels cost in your area

Please enter a valid zip code.

Zero Upfront Cost

Best Price Guaranteed

![]()

![]()

Solar Learning Center > Solar Financing > Solar PPA: The Simple Guide to Power Purchase Agreements in 2026

Solar PPA: The Simple Guide to Power Purchase Agreements in 2026

A solar Power Purchase Agreement (PPA) is an arrangement in which a solar provider installs and owns the solar system on your property at little or no upfront cost, and you agree to buy the electricity it produces at a set price per unit, typically lower than your utility rate.

Solar PPAs (and their cousin, solar leases) are rising in popularity because they are eligible for a federal tax credit through the end of 2027, whereas the federal tax credit for purchasing panels terminates at the end of 2025.

This guide will explain how PPA solar agreements work, how much you can save, and whether it’s the right choice for your home.

Jump ahead:

- What is a Solar PPA?

- How a Solar PPA Works

- Solar PPA Rates in 2026

- Solar PPA Pros & Cons

- Is a Solar PPA Right for You?

- See Your Savings Potential

- Commonly Asked Questions about PPAs

*

*

What Is a Solar PPA?

A solar PPA is a deal where a company puts solar panels on your roof for little to no upfront cost, and you pay them only for the electricity the panels make.

The idea is to buy electricity at a lower and more predictable price than they can get from your utility (typically 10-30% less), without making a large upfront payment or taking on the responsibilities of owning and maintaining solar equipment.

For instance, if your utility charges you 20 cents/kWh for electricity, you can reduce your electricity costs by entering a solar PPA that offers solar electricity for 15 cents/kWh. At this rate, your $200 utility bill is replaced by $150 PPA payment—a monthly savings of $50.

Solar PPA Example

| Electricity Provider | Price per kWh | Bill for 1,000 kWh |

| Utility | 20 cents | $200 |

| Solar PPA | 15 cents | $150 |

Those monthly savings increase over time as the gap between your utility rate and PPA rate increases.

Solar PPA Key Features

- The third-party PPA provider owns the system and is responsible for monitoring, maintaining, and insuring it.

- The third-party owner claims tax credits and rebates for the project, and uses these incentives to offer lower rates.

- PPA payments are based on an agreed-upon rate for each kilowatt-hour (kWh) of electricity produced by the system.

- Some PPAs feature fixed rates, while others feature “escalating” rates that increase by 1-3% each year.

- PPAs are typically 20 to 25-year agreements, with options to pre-pay or buy out the system after 6 years.

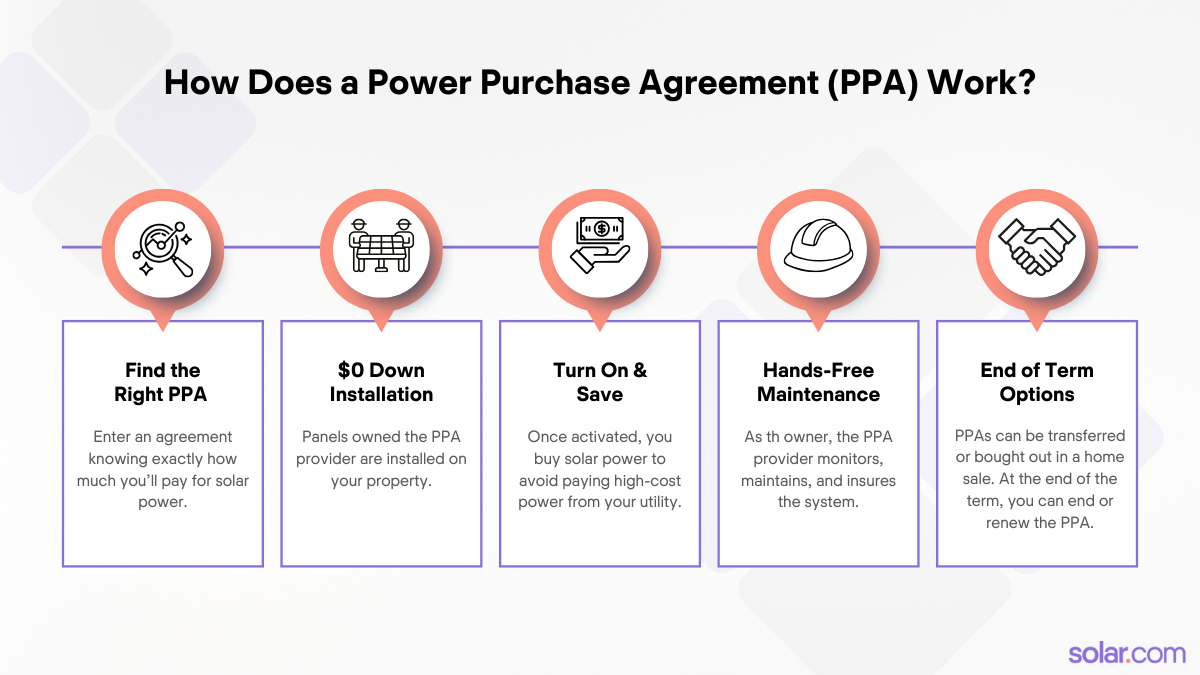

How a Solar PPA Works

At its core, a solar PPA is more like switching utilities than purchasing a solar system with cash or a loan. Sure, the solar panels on your roof, but they are owned, monitored, and maintained by a third-party owner, and your only obligation in a PPA is to buy the electricity they generate at a low, predictable rate.

Related reading: Solar PPA Rates: What’s a Good Rate for Your Home?

Step 1: Find the right PPA for you

Power Purchase Agreements terms vary from deal to deal. Some key differences are fixed vs escalating rates, pre-payment options, and buyout options. We’ll elaborate on each of these features below.

Step 2: Installation with no money down

The system is installed on your property at little to no upfront cost to you (depending on the PPA). The installation itself typically takes 1-2 days, depending on the scope of the project.

Step 3: Turn on the system and save

The system is activated after successful inspections and approval from your utility. Once turned on, you buy power from the solar system to avoid paying higher rates to your utility. In a PPA, your payments will vary from month to month based on the system’s production and any leftover utility charges that the system doesn’t offset.

Step 4: The PPA provider is responsible for monitoring and maintenance

As the system owner, the PPA provider is contractually obligated to monitor, maintain, insure, and repair the system. Many solar PPAs have production and performance guarantees to ensure the system delivers the savings you signed up for.

Step 5: End of term options

Power Purchase Agreements can end in a few ways. If you sell your home, the PPA can be transferred to the new homeowner, or the system can be bought out by you or the new homeowner. PPA providers have entire departments to facilitate these options.

If you reach the end of the 20-25 year PPA term, there are typically options to:

- Continue the PPA on a year-by-year basis

- Enter a new PPA with new equipment

- Exit the PPA and have the system removed at no cost

- Exit the PPA by taking ownership of the system

*

*

Solar PPA Rates in 2026

Rather than an upfront payment, solar PPA costs are measured in the price per kilowatt-hour of electricity produced by the solar system.

PPA rates typically range from $0.15 to $0.30 per kWh based on project-specific factors like location, PPA type, and incentives, and are usually 10-30% lower than your current utility rate.

Here are a few things to consider.

Upfront costs

Most PPAs feature zero upfront costs, which means you can go solar for $0 down and enjoy savings in the first month the system is operational. However, there are also prepaid PPAs in some parts of the country, in which the full balance of the PPA is paid upfront at a significantly discounted rate.

Your utility rates & policies

Your utility bill is perhaps the greatest indicator of your PPA rate. Most PPA providers are trying to hit a sweet spot of 10-30% reduction in your utility rate.

For instance, the solar PPA price per kWh in California is typically between 20-27 cents since utility rates are often above 30 cents per kWh.

For the average US utility rate of around 19 cents, a typical solar PPA price per kWh is in the 14-18 cent range.

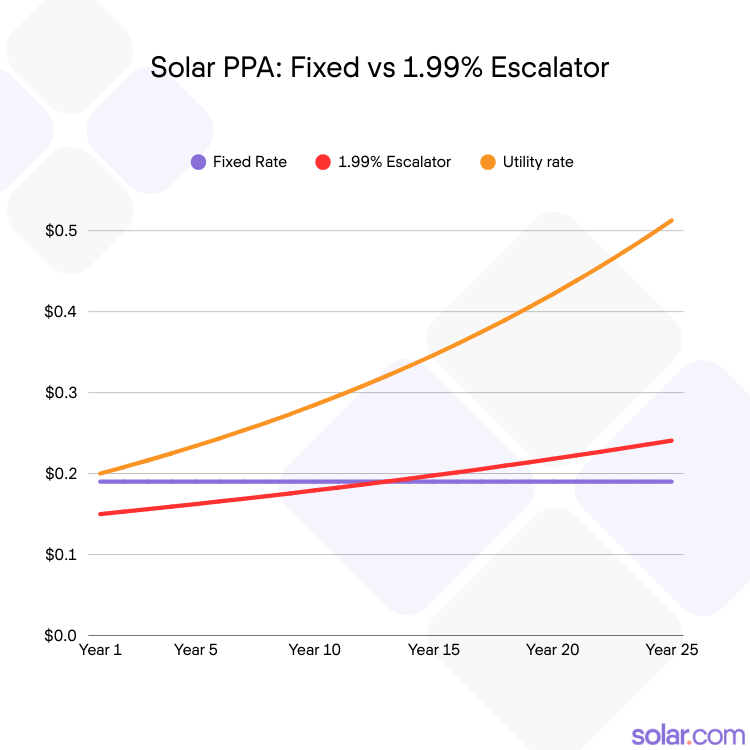

Fixed vs Escalating PPA rates

A key factor in a solar PPA electricity price is whether the rate is fixed for the full term or has an escalator that increases it each year. Common escalators are 0.99%, 1.99% and 2.99%.

For reference, utility rates historically increase 3-4% per year, on average—but recent years have been anything but average. With AI data centers, extreme weather, and electric vehicles straining the aging electrical grid, the average residential electricity rate increased by 7.4% in 2025 alone!

While fixed PPAs typically deliver greater long-term savings in exchange for a slightly higher initial rate, escalating PPAs allow for lower initial rates and greater immediate savings, as shown below.

Fixed vs Escalating PPA example

| Electricity source | Initial Rate | Rate after 10 years | Rate after 25 years |

| Fixed PPA | 19 cents | 19 cents | 19 cents |

| 1.99% PPA | 15 cents | 18 cents | 24 cents |

| Utility rate (4% avg. increase) | 20 cents | 28 cents | 51 cents |

Solar PPA Pros & Cons

There are pros and cons to solar PPAs. The key question is, “Is entering a solar PPA better than buying all of my electricity from my utility?”

Pros

- $0 or low upfront cost

- PPA provider pays for repairs and monitoring

- Lower energy cost than utility

- Easy approval for most homeowners

- Predictable power price

- Good for people who don’t want to own panels

Cons

- You don’t get the federal tax credit

- Restricted equipment choice

- Contract lasts many years

- Can take longer to sell your home if the buyer won’t take the PPA

- Escalators can raise your price over time

Is a Solar PPA Right for You?

Homeowners going solar in 2026 should start with a simple question: “Are my energy goals better served by purchasing solar without a federal tax credit, or entering a third-party lease or PPA that still has access to one?”

Here’s a quick decision framework that can help point you in the right direction.

| Question | If yes | If no |

| Is immediate savings my top priority? | Lease or PPA | Ownership |

| Is total savings over the long term my top priority? | Ownership | Lease or PPA |

| Do I want to handle monitoring & maintenance? | Ownership | Lease or PPA |

| Do I plan on moving within the next 5 years? | Ownership | Lease or PPA |

| Do I need final say in the specific products installed in my home? | Ownership | Lease or PPA |

Here are some other considerations that can help you decide the best energy solution for your home.

State & local incentives

If your area has valuable local incentives, consider whether you would rather claim them yourself (ownership) or have a third-party claim them and pass down the savings (lease or PPA).

Backup battery storage

Owning battery storage gives you total control over its size, configuration, and usage. However, battery storage installed after 2025 no longer qualifies for a federal tax credit.

In many cases, backup battery storage can be included in a solar PPA. However, the third party owns and operates the battery, and there may be restrictions on the size, model, and configuration.

Every situation is unique. The right energy solution is the one that helps you achieve your goals.

If a lease or PPA sounds like the better fit for your home, here’s how to decide between these two options.

Solar PPA vs. Solar Lease

Solar PPAs and solar leases are cousins that both fall under the umbrella of “Third-Party Ownership” solar arrangements. The difference between them is quite simple: A PPA charges you for the power the panels make. A solar lease charges you a fixed monthly payment for the panels themselves.

| PPA Advantages | Lease Advantages |

| Only pay for the power you use | Predictable monthly costs |

| Easier to compare to utility rates | Easier for budgeting monthly costs |

There’s also a difference in where PPAs and leases are available. The states shaded pink below allow solar PPAs in varying capacities, while states shaded grey may disallow them or have unclear guidance.

See Your Savings Potential with a Solar PPA

In its simplest form, a solar PPA is like a coupon for your electricity costs. Instead of buying all your electricity at utility retail rates, you buy solar electricity at a lower and more predictable rate.

With no upfront payment or ownership responsibilities, PPAs are great for homeowners looking for a quick, hands-free path to energy cost savings.

Team up with a solar.com Energy Advisor to see your savings potential.

*

*

Common Questions About Solar PPAs

Do I get the tax credit with a PPA?

No. The company owns the system and is responsible for claiming the tax credit and other applicable incentives.

Is a solar PPA free?

No, and be skeptical of anyone promising your “free solar.” In a PPA, you often pay $0 upfront, but you make monthly payments for the power the panels make.

How long does a PPA last?

Usually 20–25 years, with options to extend the term or buy out the system early and take ownership.

What happens if I move?

You can transfer the PPA to the home’s buyer. There are also options for you or the new homebuyer to buy out the PPA early and take ownership of the system.

Is a PPA cheaper than a utility?

Often yes — Solar PPA rates usually start 10–30% below utility rates.

Related Articles

Is Prepaid Solar Better than the Original Tax Credit?

The solar.com team exists to provide choice, transparency, and trust to our homeowners and partners. This means we’re constantly evaluating the market for new technologies,...

Solar Lease vs. PPA in 2026: Find Your Best Path to Savings

As of January 1, 2026, the residential solar industry has entered a new era. With the official expiration of the homeowner-claimed tax credit under the...

Solar PPA Rates in 2026: What's a Good Rate for Your Home?

Solar Power Purchase Agreements (PPAs) are one of the most popular ways for homeowners to go solar without paying thousands of dollars upfront. But one...

What Is the Difference Between a Standard PPA and a Prepaid PPA?

What is the difference between a PPA and a prepaid PPA? A standard solar Power Purchase Agreement (PPA) charges homeowners monthly for the electricity their...

HDM Prepaid Solar PPA: How It Works and Why It's Compelling in...

What is an HDM Prepaid Solar PPA? An HDM Prepaid Solar Power Purchase Agreement (PPA) is a solar financing model that allows California homeowners to...

See how much solar panels cost in your area.

Please enter a valid zip code.

Please enter a valid zip code.

Zero Upfront Cost. Best Price Guaranteed.