What Is the Difference Between a Standard PPA and a Prepaid PPA?

What is the difference between a PPA and a prepaid PPA?

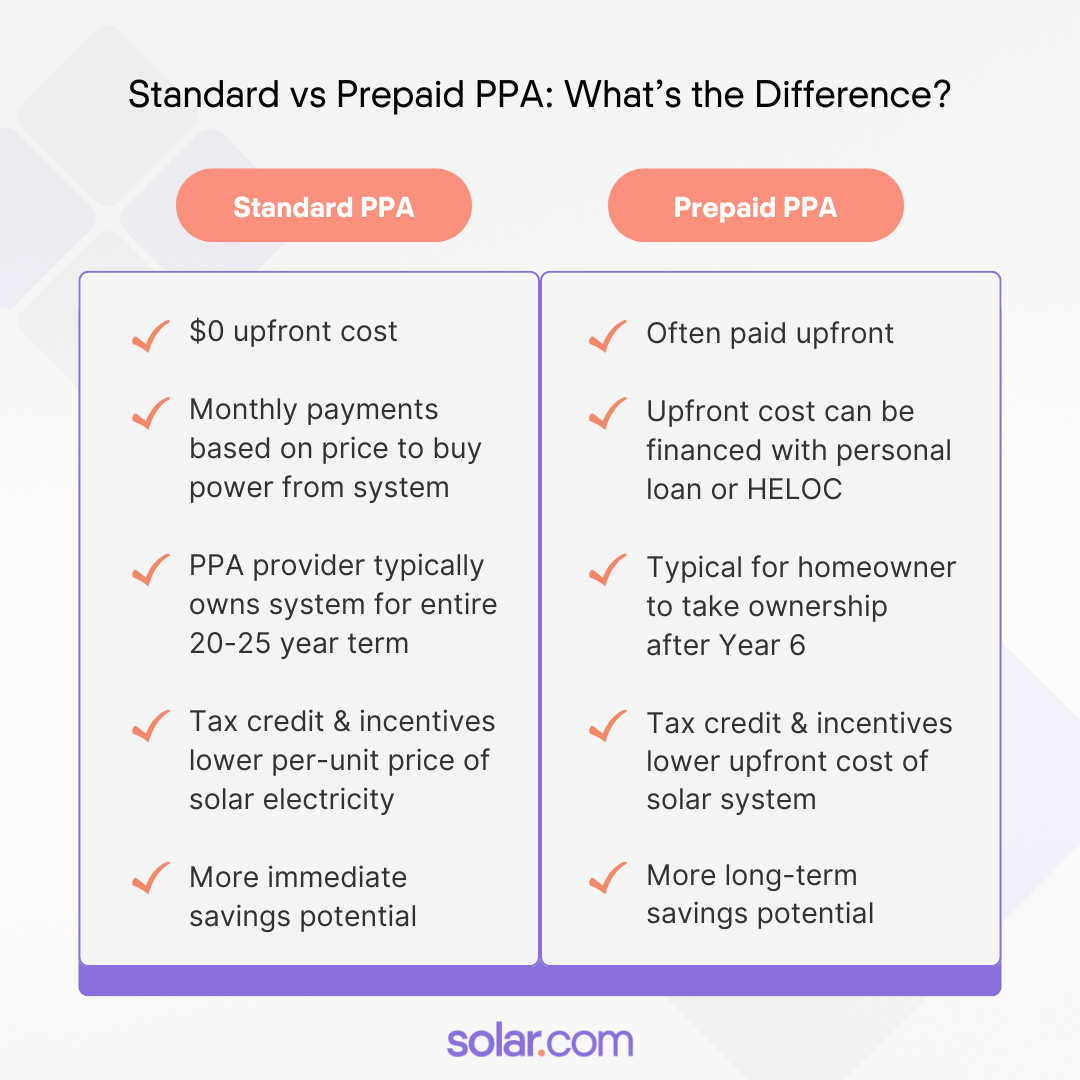

A standard solar Power Purchase Agreement (PPA) charges homeowners monthly for the electricity their system produces, while a prepaid PPA features an upfront payment (that can be financed) based on the post-tax credit value of the system. Both involve third-party ownership of the system, but a prepaid PPA typically results in lower total costs and no monthly solar payments.

In simple terms:

- A standard PPA spreads payments over time, typically over a 20-25 year term.

- A prepaid PPA lets homeowners pay once and avoid ongoing solar payments.

- Prepaid PPAs usually cost less overall and have a simple process to transfer ownership to the homeowner after 6 years.

What is a standard Power Purchase Agreement (PPA)?

A standard Power Purchase Agreement is a financing arrangement where a solar company owns the system and sells the electricity it produces to the homeowner at a set price per kilowatt-hour.

Here’s how a typical PPA works:

- The solar company installs the panels at little or no upfront cost.

- The PPA provider claims the 48E federal tax credit and local incentives and passes through their value as a reduced per kilowatt-hour rate.

- The solar company owns, monitors, and maintains the system.

- You pay a monthly bill based on a set price for the power the system produces, which may escalate each year.

- The solar rate is usually lower than your utility’s electricity rate.

PPAs are popular with homeowners who want to switch to solar without making a large upfront investment. They provide predictable savings, protect against rising utility rates, and remove the responsibility of system maintenance.

However, because payments are spread out over many years and PPA rates can escalate over time, a standard PPA often costs more over the long term than other solar options.

What Is a Prepaid Solar PPA?

A prepaid solar PPA is a variation of a standard PPA. Instead of paying monthly for solar electricity, the homeowner pays most of the cost upfront, effectively prepaying for years of solar power. Prepaid PPAs can be thought of as “lease-to-own” solar, as it’s typical for the homeowner to take ownership of the system after 6 years.

With a prepaid PPA:

- The solar company still owns the system initially.

- The PPA provider claims the 48E tax credit and local incentives and passes through their value as an upfront discount.

- The homeowner makes a single upfront payment (which can be financed).

- The solar company owns, monitors, and maintains the system for at least the first 6 years.

- After 6 years, the homeowner can take ownership of the system or leave it as a third-party ownership arrangement.

A helpful way to think about a prepaid PPA is that you’re buying years of solar electricity in advance at a discounted price. Because the solar company receives payment upfront and claims the 48E federal tax credit, they can offer a lower overall cost compared to a monthly PPA.

Standard PPA vs. Prepaid PPA: Key Differences

While both options are types of PPAs, there are important differences in how they work and how much they cost over time.

| Standard PPA | Prepaid PPA | |

| Payment Structure | $0 upfront, ongoing monthly payments for solar electricity that may escalate each year | One upfront payment (can be financed with a personal loan) based on discounted price for system |

| Total Cost | Higher total cost over lifetime of agreement | Lower overall cost due upfront payment |

| Cash flow | Greater immediate cash flow | Greater long-term cash flow |

| Maintenance | Handled by solar company, typically for entire 20-25 year term | Handled by solar company until ownership transferred (typically after Year 6) |

| Ownership options | Buyout option based on “Fair Market Value” | Typically includes cost-free transfer to homeowner after Year 6 |

How Do Tax Credits Work with PPAs and Prepaid PPAs?

With both standard PPAs and prepaid PPAs, the solar company—not the homeowner—claims the 48E federal solar tax credit (and other incentives), since the company owns the system. Notably, 2026 is the first year in which there is no federal tax credit for homeowners to claim directly. Both types of PPAs, however, can help homeowners benefit from the business-claimed tax credit that remains available through the end of 2027.

In many prepaid PPA structures, the value of the tax credit is reflected in a 30% reduction in the upfront cost. In a standard PPA, the tax credit value shows up as a reduction in the cost per kilowatt-hour rate to buy power from the system.

*

Is a PPA or Prepaid PPA Better for Homeowners?

The better option depends on your cash flow, financial goals, and whether taking ownership of the system is important to you.

A standard PPA may be a better fit if:

- You want minimal upfront cost

- You prefer predictable monthly payments

- You don’t want to worry about system ownership

A prepaid PPA may be a better fit if:

- You want to avoid monthly solar payments

- You want the lowest total cost over time

- You want a clear path to system ownership later

The Bottom Line

Standard and prepaid PPAs are both valuable ways for homeowners to lower their energy costs with solar and benefit from a business-claimed federal tax credit. While standard PPAs offer no upfront costs and greater short-term cash flow, prepaid PPAs offer greater long-term return on investment and a clear path to ownership.

Which option better suits your home and energy goals? Team up with a solar.com Energy Advisor to get custom proposals and review your options.