Lease or Buy Solar Panels in 2026? Find Your Best Path to Savings

In 2026, choosing between buying and leasing solar panels requires more consideration than it has in recent years. Ownership has traditionally been the preferred path, but without a federal tax credit for cash and loan purchases, leasing (and other “Third Party Ownership” options) have emerged as the better choice for many homes.

- The homeowner tax credit for purchasing solar and battery systems ended on December 31, 2025.

- Homeowners can benefit from the business claimed tax credit via Third-Party Ownership solar options through the end of 2027.

- The best option for your home now depends more on whether you prefer greater immediate savings or greater long-term savings

This article explores the new landscape in residential solar to help you find the best path to accomplishing your savings and energy goals.

Jump ahead:

- Why Buying vs Leasing Solar Is Different in 2026

- Lease vs Buy Solar Panels: Side-by-Side Comparison

- Key Factors to Consider

- Decision Tree: Should You Lease or Buy in 2026?

- Common Myths About Leasing vs Buying Solar

- Frequently Asked Questions

Why Buying vs Leasing Solar Is Different in 2026

In 2026, solar leases, PPAs, and Prepaid Solar are the only residential solar options eligible for a federal tax credit (specifically the 48E “Clean Electricity Investment Credit”). The 25D tax credit for purchasing solar ended on December 31, 2025, and can only be claimed by homeowners who had their project installed before that date.

Purchasing solar with cash or a loan now means paying full price, minus any incentives from your state, utility, or installer.

- Cash buyers will need a few more years to see a return on investment.

- Buying solar with a loan will require higher monthly payments or a longer loan term.

As a result, homeowners seeking greater immediate savings may find more value in Third-Party Owned (TPO) solar—the umbrella term for leases, PPAs, and Prepaid Solar options.

How Buying Solar Works in 2026

Buying solar in 2026 will work much the same as before. You can still purchase solar with cash or a loan, but come tax season, you won’t have the option to claim 30% of your costs on your federal tax return.

Buying still makes sense for:

- High income + strong cash position

- Has confirmed state/local incentives, including net metering

- Wants maximum long-term return on investment & added property value

- Comfortable with monitoring & maintenance responsibilities

- Control over equipment selection and configuration

How Third-Party Owned Solar Works in 2026

In 2026, Third-Party Owned solar often provides better immediate cash-flow savings than buying, even if total lifetime savings are lower.

As the name suggests, a third party owns the equipment and is responsible for monitoring, maintaining, and insuring the system. They also claim the federal tax credit and other incentives, and pass this value through to lower your monthly payments.

There are a few types of TPO solar arrangements.

| TPO Solar Type | Payment Description |

| Solar Lease | Consistent monthly payments for solar equipment on your roof |

| Solar PPA | Variable monthly payments based on the power produced by the solar system |

| Prepaid TPOs | Post-tax credit value of the system purchased with cash or financed with a loan; option to gain ownership of the system after 6 years |

Availability of these options can vary based on local regulations, and there are variations within each product. Team up with a solar.com Energy Advisor to review your options.

Buy or Lease Solar in 2026: Side-by-Side Comparisons

If you’re considering solar in 2026, start with a simple question: “Is my primary goal immediate savings or an investment with greater long-term savings?”

Solar loan vs Lease or PPA

If your goal is immediate energy cost savings, compare buying solar with a loan to a lease or PPA with monthly payments.

| Feature | Buy Solar with Loan | Solar Lease | Solar PPA |

| Upfront cost | $0 | $0 | $0 |

| Federal tax credit | None | 48E available through end of 2027 | 48E available through end of 2027 |

| Incentives | Claimed by homeowner | Claimed by lease provider, value passed through | Claimed by PPA provider, value passed through |

| Monthly cost | Fixed monthly payment for loan term | Consistent from month to month; can increase each year | Variable from month to month; can increase each year |

| Monitoring & Maintenance | Homeowner’s Responsibility | Lease Provider’s Responsibility | PPA Provider’s Responsibility |

| Best for | Long-term savings | Greater immediate savings | Greater immediate savings |

With access to a federal tax credit, leases and PPAs generally offer lower initial payments than solar loans in 2026. That means more savings in the short term. Keep in mind, some leases and PPAs have escalators that increase these payments each year—typically by 1-3%—whereas a loan payment stays fixed over time.

Buying solar with cash vs Prepaid TPOs

If your goal is maximum return on investment—even if it takes several years to accomplish—then it’s best to compare buying solar with cash versus Prepaid TPO options.

Consider the example below:

| Feature | Buy Solar with Cash | Prepaid TPO |

| Upfront cost | $30,000 | $21,000-$25,500 |

| Federal tax credit | None | 48E available through end of 2027 |

| Incentives | Claimed by homeowner, may apply upfront or retroactively | Claimed by TPO, factored into upfront cost |

| System ownership | Homeowner | Homeowner has option to take ownership after Year 6 |

| Monitoring & Maintenance | Homeowner’s responsibility | TPO’s responsibility until homeowner takes ownership |

| Best for | Long-term savings with sole ownership | Lower upfront cost, flexibility in ownership options |

Before 2026, Prepaid TPO’s were a relatively obscure option. Why have someone else claim the tax credit when you can do it yourself?

However, with the homeowner tax credit gone, Prepaid TPO’s offer a way to benefit from the 48E tax credit upfront and a path to system ownership. Plus, in many cases, homeowners can take out a loan post-tax credit value of the system.

Key Factors to Consider

Beyond tax credit eligibility, there are some key differences between purchasing solar and entering a TPO arrangement in 2026.

| Consideration | Ownership | Third-Party Ownership |

| Monitoring & Maintenance | Homeowner’s responsibility | TPO provider’s responsibility |

| Selling your home | System adds to property value & sold as part of home | Several options to transfer; requires additional escrow paperwork |

| Incentives | Claimed by homeowner at full value | Claimed by TPO, some or all of value passed through |

| Equipment selection | No restrictions other than availability | Limited selection based on provider and FEOC rules, TPO has final say |

| Battery storage | Full control over selection & usage | Limited selection, TPO controls usage |

Monitoring, Maintenance, and Repairs

This is one of the main differences between buying and leasing solar panels. When you own the system, you are responsible for:

- Adding the system to your home insurance policy

- Monitoring performance and flagging issues to your installer

- Cleaning the panels

- Coordinating insurance or warranty claims

- Out-of-pocket costs for maintenance and repairs

In a lease or PPA, the third-party owner is responsible for the system’s health and performance and bears the financial obligations for insuring, maintaining, and repairing the system.

What happens when I sell my home?

Selling a home with owned solar panels is typically easier than selling a home with a lease or PPA. Owned panels are considered a part of the home (like a furnace or water heater) and increase your property value.

Solar leases and PPAs don’t directly add to your sale price, but they can make your home more attractive to potential buyers (who doesn’t want a lower electricity rate?). Lease and PPA providers have entire divisions dedicated to transferring systems in a home sale, and you and the buyer will have options.

- Transfer the lease or PPA to the new homebuyer (most common)

- You can pre-pay the lease or PPA

- You or the new buyer can buy out the lease or PPA

- The new buyer can upgrade the system with newer technology

Local incentives

Several states—namely New York, New Jersey, and Illinois—have strong statewide solar incentives that can make ownership attractive, even without access to a federal tax credit. If these are available, consider how you want to access them.

- Buying solar means claiming incentives yourself (possibly with help for the installer) and receiving full value.

- Leasing solar means having the third-party owner claim these incentives and passing through some or all of the value via lower payments.

Equipment restrictions

When you purchase solar, you’re essentially free to buy any equipment available on the market. By contrast, your equipment options are often limited in a lease or PPA due to recently updated Foreign Entity of Concern (FEOC) rules.

These rules limit the amount of components from Chinese-owned or controlled companies in a solar system claiming the 48E federal tax credit. So, your lease or PPA provider will likely only offer FEOC-compliant solar modules, inverters, racking, and batteries. And as the system owner, they have the final say in what’s installed.

Battery storage

Adding battery storage to your solar system can improve your savings and provide backup power when the grid goes dark.

- If you own the battery, it’s yours to charge and discharge as you see fit.

- In a lease or PPA, a third party owns the battery and has control over which technology is installed, how it’s configured, and how it is charged and discharged.

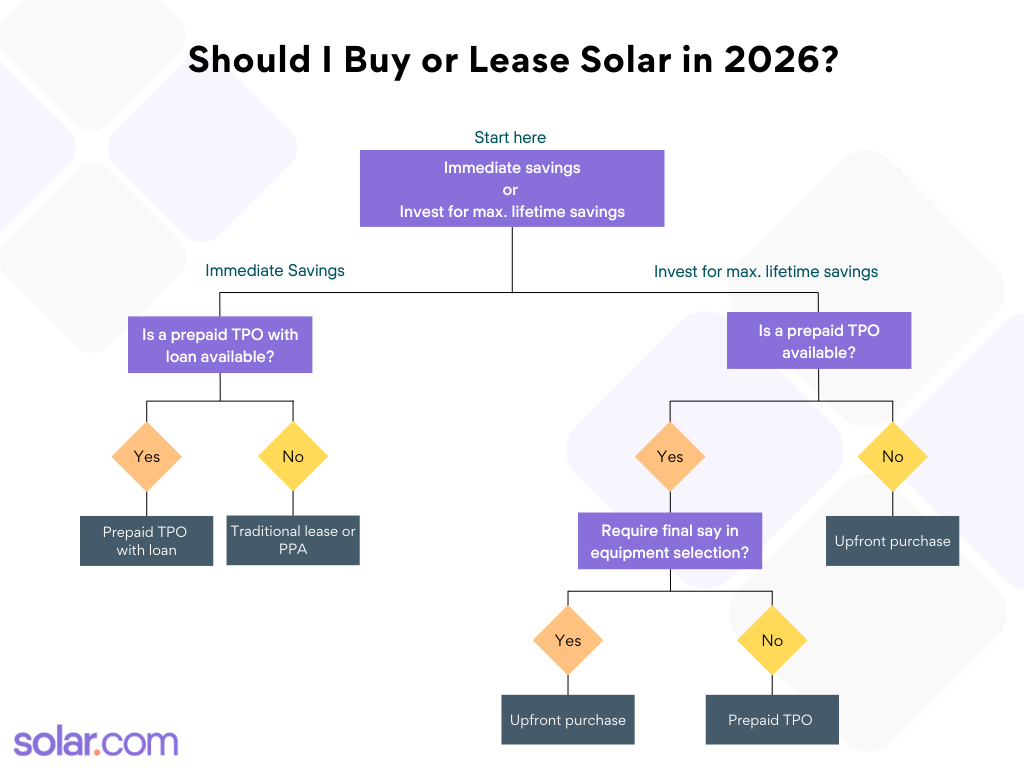

Decision Tree: Should I Lease or Buy Solar in 2026?

There are a few key questions that can help you decide whether buying solar (cash or loan) or Third-Party Owned (lease, PPA, prepaid) is the better option for your home.

Is my primary goal immediate savings or greater long-term savings?

- If immediate savings: Lease, PPA, or Prepaid TPO with a loan

- If long-term savings: Cash purchase or Prepaid TPO

Is full control over equipment selection a must-have?

- Yes: Purchase with cash or loan

- No: Third-party ownership

Do I want responsibility for monitoring, maintaining, and insuring the system?

- Yes: Purchase with cash or loan

- No: Third-party ownership

Common Myths About Buying vs Leasing Solar

Myth 1: “Buying is always better”

With direct access to a federal tax credit, buying solar typically offered greater overall value in the past. That equation has changed in 2026, with third-party ownership being the only path to accessing a federal tax credit.

Myth 2: “Leasing is throwing money away”

Solar leases and PPAs are an alternative way to purchase electricity that provides lower and more predictable energy costs. You are going to use electricity anyway – leases and PPAs provide choice over where it comes from and how much it costs.

Myth 3: “Leases kill home sales”

Poorly structured leases and PPAs have complicated home sales in the past, but well-structured ones transfer smoothly. TPO providers have departments dedicated to smooth transfers, and solar becoming more common, real estate professionals are becoming more adept at processing these sales.

The Bottom Line

With changes to the federal solar tax credits, most homeowners installing solar and/or battery in 2026 will find that Third-Party Owned solar provides similar or greater overall value than ownership. However, this largely depends on your cash position and your savings goals.

Where available, prepaid solar products can offer the best of both worlds:

- Upfront access to the 48E federal tax credit

- Options to pay upfront or finance over time

- Path to system ownership after 6 years

Explore your options with a solar.com Energy Advisor to see which path is best for your home and savings goals.

Frequently asked questions

Is it better to lease or purchase a solar system?

In 2026, this decision largely depends on your savings goals. Leases still have access to the 48E federal tax credit and can provide greater immediate savings than taking out a loan to purchase solar. In most cases, buying solar outright with cash still offers the greatest long-term return on investment, even without access to a homeowner-claimed federal tax credit.

Do you get a tax credit if you buy solar in 2026?

No. The federal tax credit for purchasing solar (25D) only applies to systems installed by December 31, 2025. The federal tax credit for third-party owned solar (48E) remains through the end of 2027, which homeowners can access through leases, PPAs, and prepaid solar programs.

Can you pay off a solar lease early?

Most solar leases have discounted pre-payment options and early buyout options.

Does a solar lease put a lien on your house?

No—the lease provider files a UCC-1 for the equipment in your solar system, not on your home.