Electricity is an essential good that we all pay for one way or another. In Southern California, unless you have solar panels, you’re likely buying electricity from Southern California Edison (SCE) and at the mercy of their ever-changing rates and plan structures.

Heading into 2026, SCE has three residential time-of-use (TOU) rate plans in which electricity prices range from 24 to 74 cents per kWh. With such a wide range, it’s important to understand SCE’s TOU rates in order to minimize your electricity bills.

In this article, we’ll explore:

SCE tiered rates vs TOU rate plans

Most residential SCE customers can choose between a tiered rate plan and three TOU rate plans. With TOU plans, electricity prices vary based on the time of day, encouraging usage during off-peak hours. Meanwhile, tiered rate plans charge a constant rate until usage exceeds a certain threshold, after which a higher rate applies.

While TOU plans can save money for those who shift their usage to off-peak hours, tiered plans may be more beneficial for households with consistent energy use throughout the day.

SCE tiered rate plan

SCE’s tiered rate plan is relatively simple. As of January 2026, electricity costs 31 cents per kWh until you reach your monthly baseline allocation limit, at which point the price jumps 42 cents per kWh for the remainder of the month. For context, the average utility rate in the US is around 19 cents per kWh.

SCE Tiered Rates 2026

| Tier 1 |

Tier 2 |

| 31 cents per kWh |

42 cents per kWh |

Your monthly baseline is how much electricity you can use before paying Tier 2 rates. Your baseline allocation depends on where you live and can easily be determined by multiplying the daily allocation limit for your region (found here) by the number of days in the month.

The name of the game with a tiered rate plan is simple: Keep your total electricity consumption as low as possible to avoid paying Tier 2 rates.

Related reading: Why Is My Electricity Bill So High?

SCE TOU rate schedules

In Time-Of-Use (TOU) plans, electricity prices vary based on the time of day. These plans are designed to reflect the changing costs of producing and delivering electricity as it fluctuates throughout the day.

SCE’s TOU rates can be a double-edged sword. If you are deliberate about your electricity usage, you have an opportunity to lower your electricity costs from a tiered rate scheme. However, this can easily backfire if you use too much electricity during expensive on-peak hours.

There are three TOU rate plans that SCE customers can choose:

- TOU-D-4-9PM

- TOU-D-5-8PM

- TOU-D-PRIME

Now, the names of these plans are a bit daunting, so let’s break them down a bit.

- TOU simply means time-of-use

- The “D” indicates that it’s a residential rate plan (rather than a commercial one)

- The numbers (4-9PM) indicate the on-peak pricing hours

- “PRIME” indicates a specific plan for customers with EVs, solar, batteries, heat pump HVAC systems, and other home electrification upgrades

Each plan has dedicated rates for summer versus winter months and weekdays versus weekends. So, SCE’s TOU rates change based on the time of day, the day of the week, and the season.

Let’s take a look at each TOU rate plan to get a better sense of how they work.

TOU-D-4-9PM rate plan

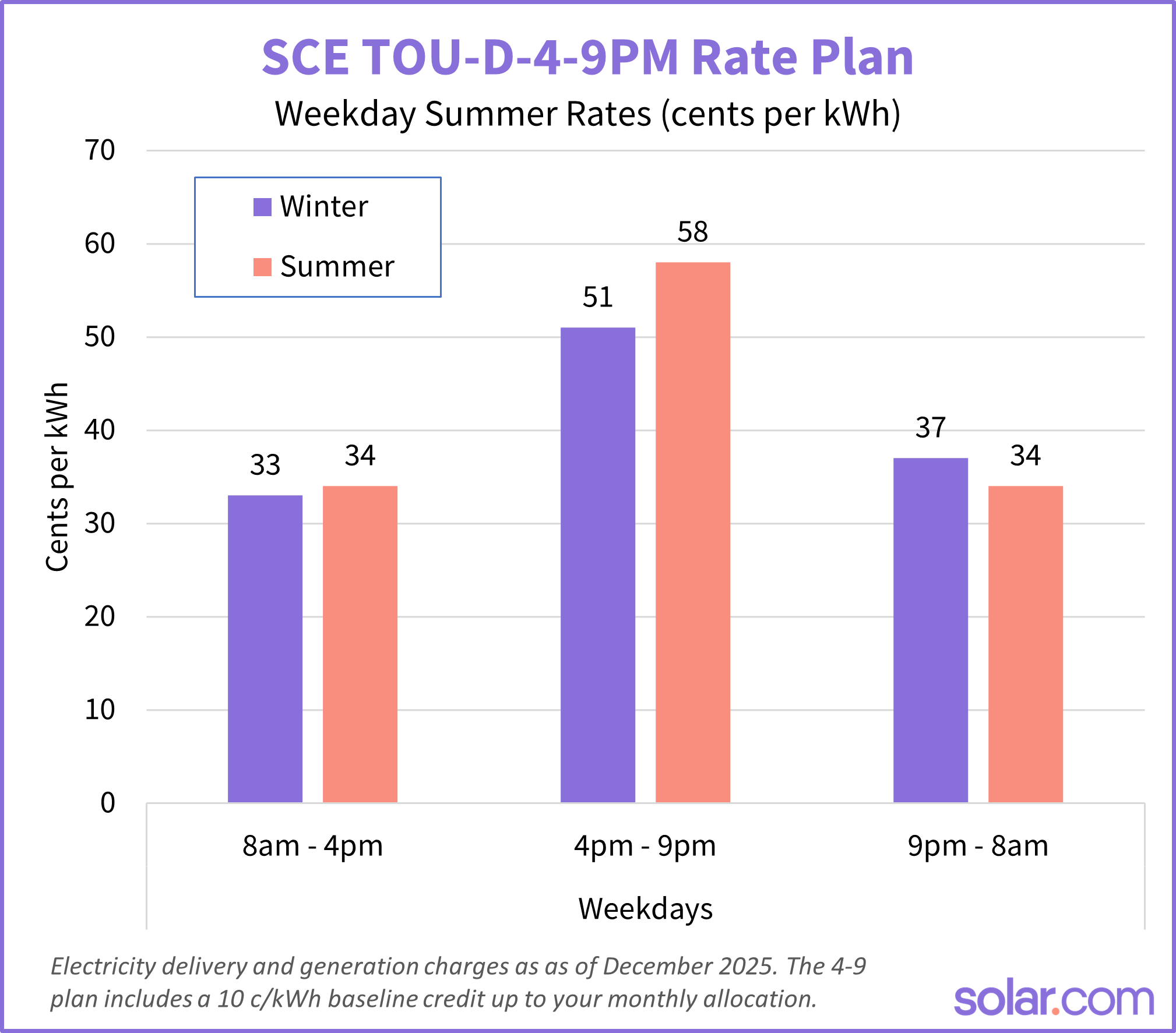

As the name suggests, SCE’s TOU-D-4-9PM rate plan has an on-peak window of 4 pm to 9 pm, in which electricity costs 58 cents per kWh.

This plan includes a baseline credit of 10 cents per kWh up to your monthly baseline allocation. That means you’ll be charged for the baseline rates shown above, but you’ll receive an on-bill credit for 10 cents per kWh in your baseline allocation. So, if your baseline allocation is 200 kWh, you’ll see a $20 credit on your bill.

SCE TOU-D-4-9PM weekday rates (as of January 2026)

| TOU Weekday rates |

Before baseline credit ($/kWh) |

After baseline credit |

| Summer on-peak |

$0.58 |

$0.58 |

| Summer off-peak |

$0.34 |

$0.24 |

| Winter mid-peak |

$0.51 |

$0.41 |

| Winter off-peak |

$0.37 |

$0.27 |

| Winter super off-peak |

$0.33 |

$0.23 |

Rates are accurate as of January 2026 and are subject to change.

The advantage of SCE’s TOU rate plans is that the off-peak rates are lower than rates in the tiered pricing plan, both before and after you reach your baseline allocation. So, if you are careful about avoiding on-peak hours, you can pay less for electricity under a TOU rate plan.

If you can’t substantially decrease your electricity usage between 4-9 pm, then the 5-8PM plan offers an alternative that may be better suited for your consumption habits.

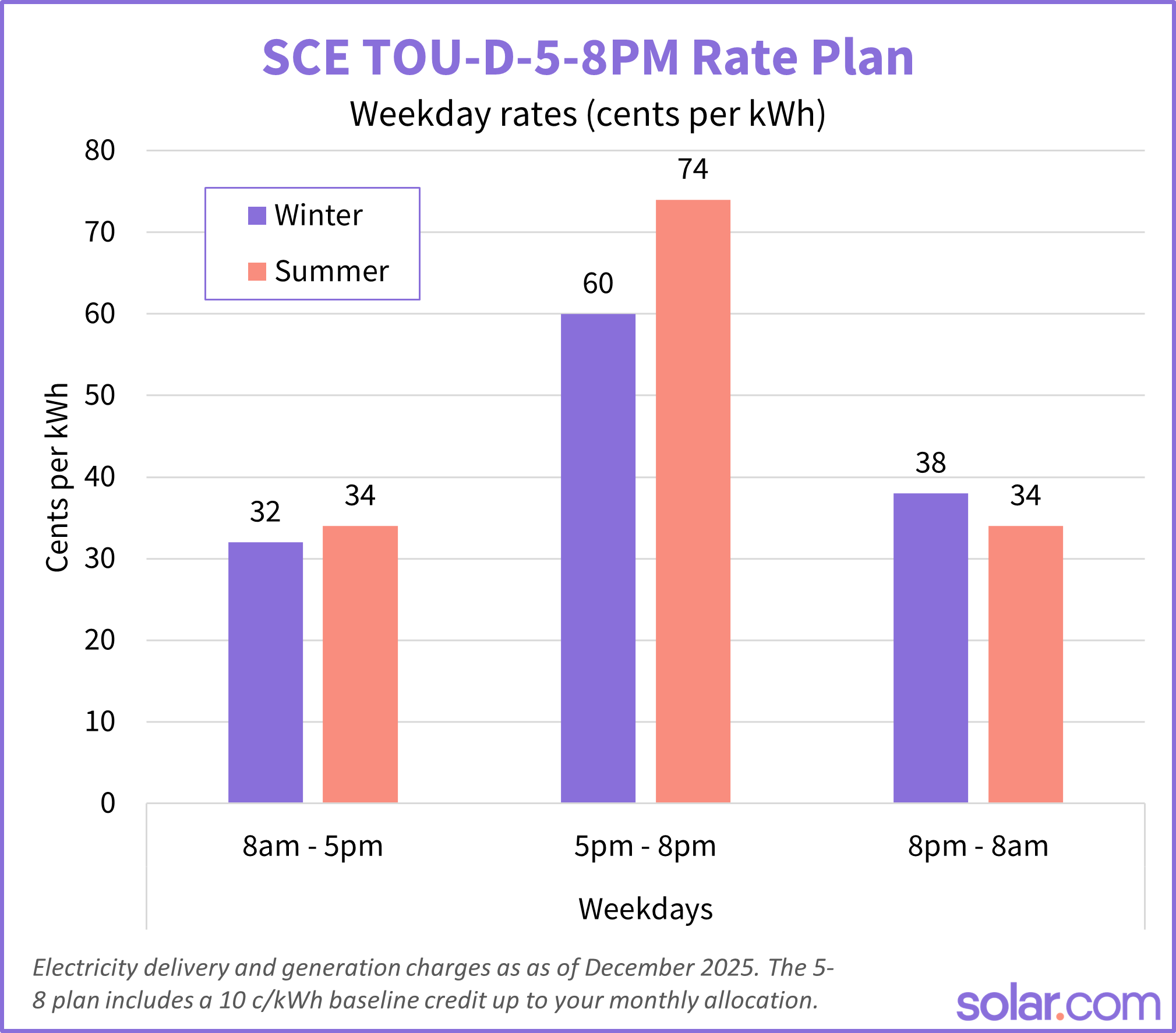

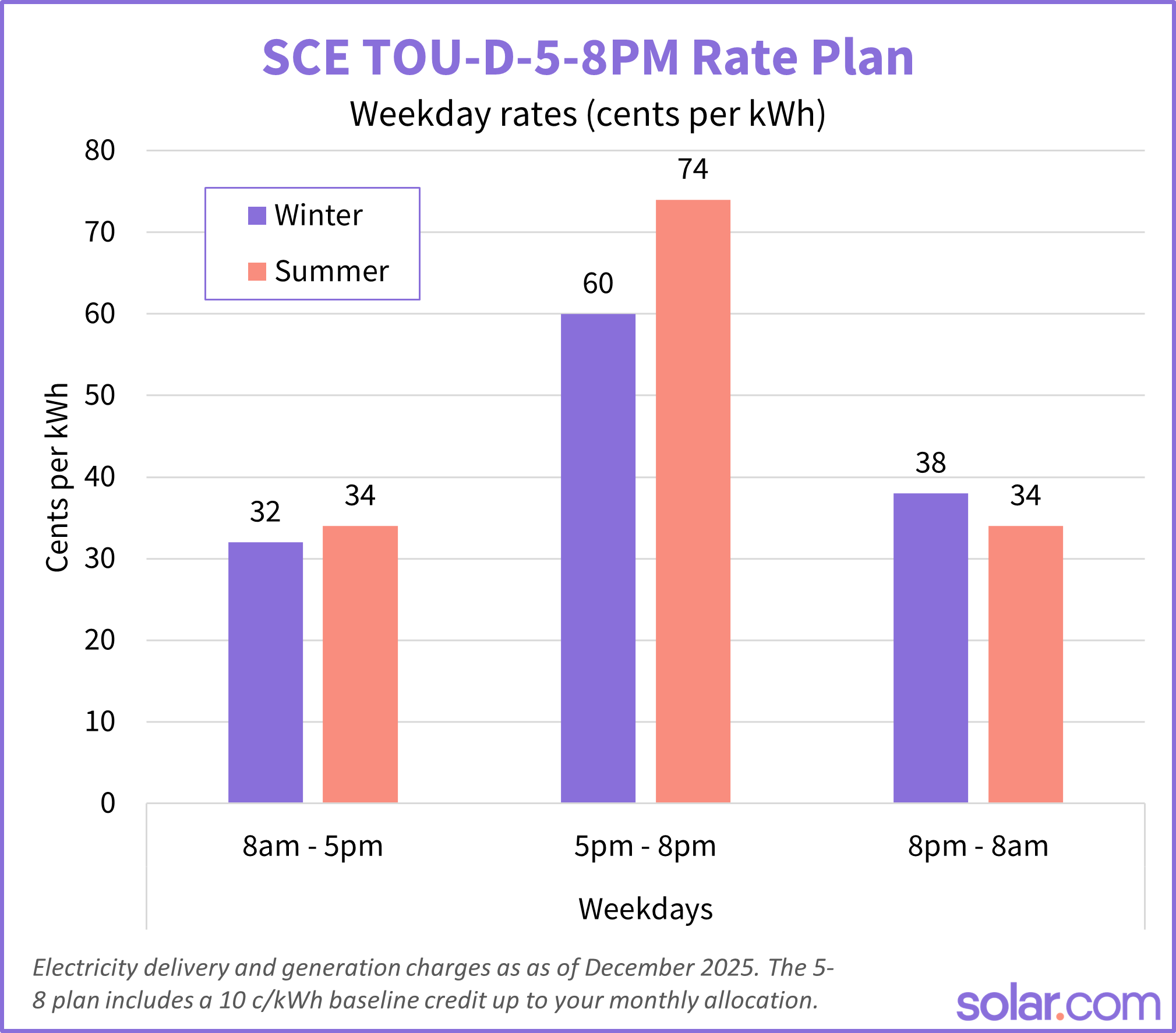

TOU-D-5-8PM rate plan

The 5-8 pm rate plan is similar in every way to the 4-9 pm rate plan described above, except for key differences in the on-peak and super off-peak rates. The idea is that this shorter window is easier to avoid, but much more costly if you end up using electricity between 5-8 pm. Specifically, the on-peak window is two hours shorter, but the summer weekday rate is 74 cents per kWh.

For context, the average utility rate in the US is around 19 cents per kWh.

This plan is best suited for customers who can completely avoid the on-peak window of 5-8 pm. For example, if you work second shift or are typically out of the house from 5-8 pm, then it can be worthwhile to select this TOU rate plan.

SCE TOU-D-5-8PM weekday rates (as of January 2026)

| TOU Weekday rates |

Before baseline credit ($/kWh) |

After baseline credit |

| Summer on-peak |

$0.74 |

$0.64 |

| Summer off-peak |

$0.34 |

$0.24 |

| Winter mid-peak |

$0.60 |

$0.50 |

| Winter off-peak |

$0.38 |

$0.28 |

| Winter super off-peak |

$0.32 |

$0.22 |

Rates are accurate as of January 2026 and are subject to change.

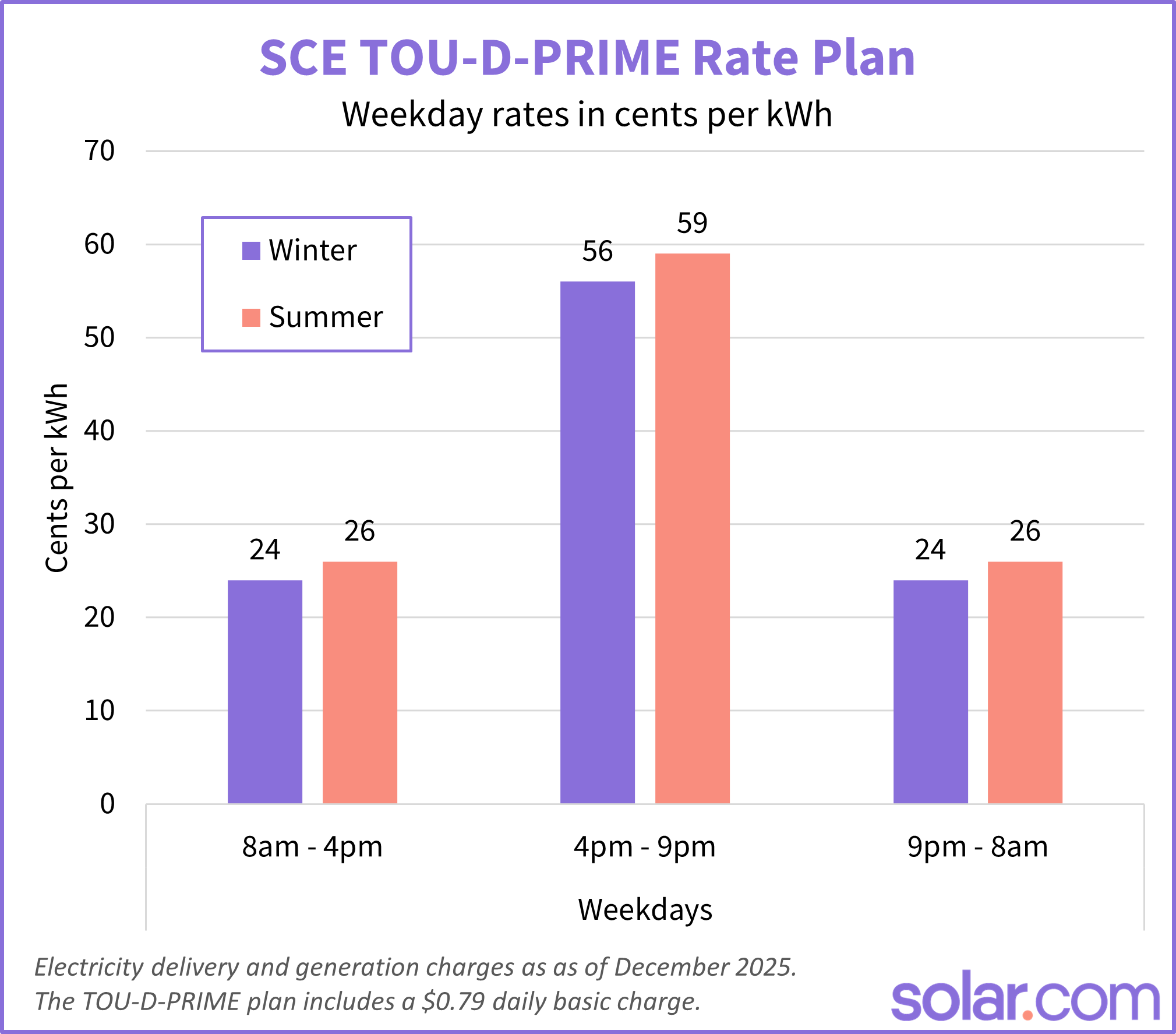

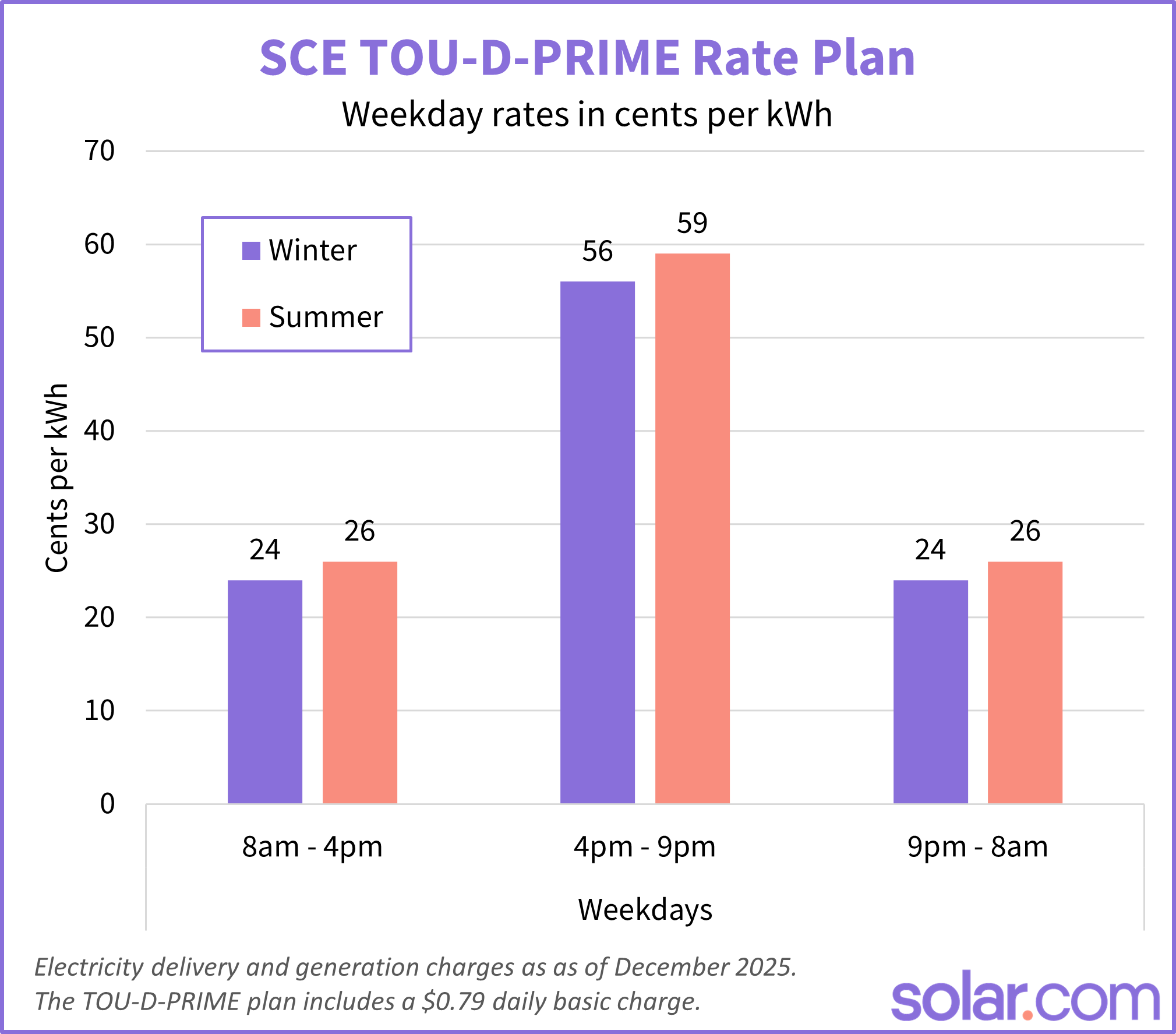

SCE solar and EV rates

The third SCE TOU rate plan, known as TOU-D-PRIME, is reserved specifically for customers with electrification upgrades like EV charging, solar panels, battery storage, and heat pump HVAC systems.

The main difference is that this plan comes with a 79-cent daily basic charge (~$24 in a 30-day month) and, in turn, has lower rates. TOU-PRIME does not have a baseline credit, so the charges are the same regardless of how much electricity is consumed throughout the month.

The theory behind this TOU plan is to lower the cost per kWh of electricity for households that have adopted clean energy upgrades. For example, if you’re using 300 kWh per month to charge an electric vehicle at home overnight, it would cost less to be on the TOU-D-PRIME plan.

SCE TOU rates for solar owners

Under the NEM 3.0 Solar Billing Plan adopted on April 15, 2023, new solar owners will be billed under TOU-D-PRIME rates.

Given the low export rates of NEM 3.0 solar billing, the PRIME schedule is the best SCE TOU plan for solar owners, as it provides the smallest difference between import and export rates. Even so, it’s substantially more economical to pair a NEM 3.0 solar system with battery storage in order to store and use your own electricity instead of selling it for minimal credit.

SCE rate increases in 2026

SCE is proposing electricity rate hikes for each year from 2025 to 2028. This began in October 2025 with a 12.9% increase to the average residential bill — an additional $22 per month.

| Year |

Bill Increase (%) |

Bill Increase ($) |

| 2025 |

12.9% |

$22.06 |

| 2026 |

2.7% |

$5.14 |

| 2027 |

2.6% |

$5.11 |

| 2028 |

2.7% |

$5.26 |

Rate hikes are nothing new for SCE customers. Since 2020 alone, SCE rates have increased 14 times and decreased just four times, according to rate change advisories from the California Public Utilities Commission. Over that span, a typical homeowner saw their monthly bill increase by $80 per month or $960 per year.

SCE rate increases since 2020

| Month/Year |

Change to Average Bill |

| January 2020 |

+3.1% |

| April 2020 |

+6.2% |

| October 2020 |

+3.8% |

| February 2021 |

+8.6% |

| October 2021 |

+8.8% |

| January 2022 |

+2.9% |

| March 2022 |

+7.7% |

| October 2022 |

+2.9% |

| January 2023 |

+7.2% |

| October 2023 |

+0.55% |

| Jan 2024 |

+2.0% |

| March 2024 |

+1.2% |

| June 2024 |

-1.6% |

| October 2024 |

-2.2% |

| January 2025 |

+1.4% |

| March 2025 |

-0.7% |

| June 2025 |

-2.06% |

| October 2025 |

+12.9% |

Data from the CPUC and SCE “Rate Change Advisories”.

Go solar to hedge against rising energy costs

Any way you slice it, electricity costs have increased dramatically in recent years for SCE customers, and are expected to continue rising at a substantial clip.

Solar and batteries allow homeowners to drastically reduce the amount of electricity they are importing and exporting from the grid, thereby replacing their utility bills with lower payments on their equipment.

Connect with an Energy Advisor to get binding solar and battery quotes from trusted local installers.

Frequently asked questions

What are the peak hours for SCE?

Peak hours for SCE customers with time-of-use (TOU) rate plans are either 4-9 p.m. or 5-8 p.m., depending on their specific plan. In 2026, On Peak rates are highest in the TOU-D-5-8PM plan, in which on-peak rates reach 74 cents per kWh during summer weekdays. The TOU-D-4-9PM plan features a longer on-peak window, but a slightly lower summer weekday rate of 58 cents per kWh.

What is the best SCE rate plan for solar?

Under NEM 3.0 solar billing, the only rate plan available for solar owners is the TOU-D-PRIME schedule, which features lower electricity rates in exchange for a monthly charge of around $24. Solar systems under NEM 2.0 and NEM 2.0 are best left under their current rate plan.

How much will SCE Rates be in 2026?

SCE’s average residential rate is 35.3 cents per kWh as of January 2026. However, this can vary based on your rate plan, with “On Peak” rates reaching as high as 74 cents per kWh in the summer.