Selling a Home With Leased Solar Panels: Transfer Steps, Buyout Options, and Resale Tips

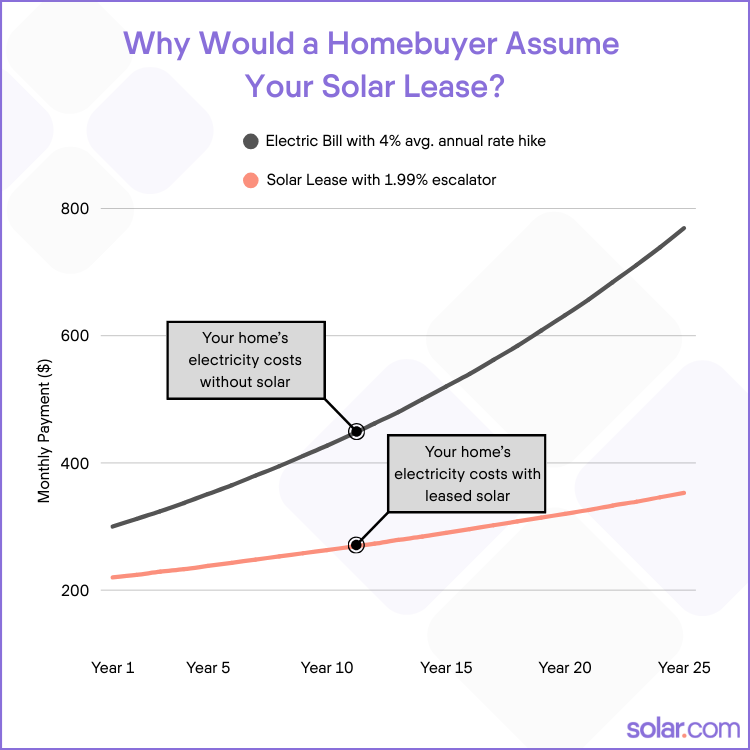

With access to a federal tax credit through the end of 2027, solar leases and Power Purchase Agreements (PPAs) are strong options for homeowners looking to immediately reduce their electricity costs and hedge against fast-rising utility rates. However, it’s important to consider how these solar arrangements can affect your ability to sell your house in the future.

While solar can add to your home value, selling a house with leased solar panels creates some extra considerations at the closing table.

The good news: with residential solar becoming more common, real estate agents and homebuyers are becoming more adept at handling transactions that include solar, so the process continues to get easier.

What Happens to a Solar Lease When You Sell Your Home?

In the vast majority of sales, the new buyer assumes the lease as part of the home sale. They love your home, and when they find out the solar panels on the roof provide electricity at a lower and more predictable cost than the local utility, they’re accepting of the responsibility to pick up the lease where you leave off. Every lease and PPA company has dedicated departments to handle these transfers and provide the documents, which are included at the closing table as part of the pile of escrow paperwork.

Why most homebuyers assume the solar lease:

- They’re already committed to buying the home and likely qualify for a mortgage.

- The solar system provides power at a lower cost than the local utility.

- Lease payments are usually fixed or predictable, whereas utility rates are volatile.

How your lease or PPA provider assists the transfer:

- Credit checks for the buyer

- Transfer documents

- Coordination with escrow and closing

What if the Solar Lease Transfer is Denied?

Occasionally, there are hurdles that can slow or stall the transfer of a solar lease. This can happen for one of two reasons:

- The homebuyer fails the credit requirements for the lease. This is rare because if a homebuyer is already qualified for a mortgage, they’re likely more than qualified to assume the solar lease.

- The new buyer declines to take on the lease. This can often be overcome by explaining to them how the solar works and how much money it will save them. Very rarely do people choose to not save money if all they have to do is sign a piece of paper.

Options If the Buyer Will Not Assume the Solar Lease

In most instances, transferring the lease in the home sale benefits both the buyer and seller. However, if this option falls off the table, there are still options at your disposal.

1. Pre-payment of the lease at “Net Present Value”

Most solar leases and PPAs allow you to pre-pay for the remainder of the power at a discounted rate, known as the “Net Present Value.” As the seller, you can use the proceeds from the home sale to pre-pay the lease. The buyer assumes the lease without any remaining payments and receives the benefits and savings of the system, which continues to be maintained, monitored, and supported by the lease or PPA company.

2. Buy out the lease at “Fair Market Value”

In this option, you or the homebuyer can choose to purchase the solar system from the lease or PPA company. The buyout amount is calculated using the “Fair Market Value” of the system (we’ll expand on this below). Homebuyers may consider buying out the solar array and rolling it into their mortgage.

It’s important to note that due to underlying tax rules, most systems can’t be fully bought out in the first 6 years in the life of the system. In these situations, a pre-payment is offered through the tax credit recapture period, and then the sale happens after.

3. Upgrading the lease

Some homebuyers are reluctant to assume a leased solar system with technology that’s a decade or more old, even if it works perfectly and is being monitored and maintained by somebody else. In this scenario, the new homebuyer can work with the lessor to analyze a system upgrade.

Understanding Lease Buy Out Values

Some homeowners are surprised to see that the cost to buy out their solar lease in the first few years might be higher than if they had purchased a solar system with cash. This is due to the accounting treatment of corporation-owned solar systems, in which the tax credit and depreciation of the array are done on the Fair Market Value (FMV) of the solar, which also includes the cost of the equipment and the anticipated future revenues from the array.

Similar to buying out a lease on a car, the payment made to the bank is generally to cover depreciation of the vehicle, with the underlying asset providing a securitized value. Solar works in a similar way, except you don’t have a massive first-day depreciation of the underlying asset like you do with cars. So, where buying out the lease on a car might make sense in some situations, buying out a solar lease obligation in the first few years is generally not something most homeowners will opt to do.

Should I lease solar if I’m going to sell my house?

If you plan on moving in the next few years, it might be best to let the new homeowner make the decision to go solar on their own terms. However, if you’re not sure about moving or think your horizon is 5+ years out, then the data says going solar generally increases the value of your house in the market. In most cases, the new buyers will gladly accept the low and predictable electricity costs provided by the lease.

Connect with a solar.com Energy Advisor to see if a solar lease or PPA aligns with your savings goals.

Frequently asked questions

Can I sell a home with leased solar panels?

Yes. Most homes with solar leases transfer smoothly to the buyer during closing. Leased solar systems can be an attractive feature to homebuyers looking for low, predictable electricity costs without the responsibility of monitoring, maintaining, and insuring the system.

Do solar leases hurt resale value?

Typically no—solar generally increases home value. In fact, having low and predictable electricity costs tied to your home can be an attractive feature to homebuyers. However, short-term homeowners with a solar lease may face more negotiation during the sale.

Can a buyer refuse to take over a solar lease?

Yes, but the seller can respond with options like pre-payment, buyout, or system upgrades.

How long before you can buy out a solar lease?

Usually not within the first 5–6 years due to tax equity rules. There is often an option to pre-pay through the end of this 5-6 year period, and complete the buy out sale afterwards.

Do mortgage lenders allow solar leases?

Yes. Solar leases are increasingly common, and lenders and real estate agents are familiar with them. Additionally, every solar lease and PPA company has a dedicated team to help transfer the system in a home sale.