See how much solar panels cost in your area

Please enter a valid zip code.

Zero Upfront Cost

Best Price Guaranteed

![]()

![]()

Solar Learning Center > Solar Financing > Leasing Solar Panels: The Complete Guide > Page 4

Leasing Solar Panels: The Complete Guide

In 2026, solar leasing remains one of the most popular ways to go solar—especially as the 30% tax credit for buying solar has expired and the tax credit for leasing is still available through the end of 2027.

A solar lease lets you enjoy clean, reliable power without the upfront cost or long-term maintenance of ownership. For many families, it’s the simplest path to immediate savings and predictable energy costs.

In this guide, we’ll break down everything you should know about leasing solar panels, including how it works, how it compares to ownership, and whether it’s the right fit for your home.

Jump to a section:

- What Is a Solar Lease?

- Why Solar Leasing Matters in 2026

- Lease vs Buy: Which Is Best for You?

- Solar Lease Economics Explained

- Tax Incentives and Credits for Solar Leasing

- Pros and Cons of Leasing Solar Panels

- Key Terms to Check in a Solar Lease Contract

- Step-by-Step: How to Get a Solar Lease

- FAQs About Leasing Solar Panels

.

What Is a Solar Lease?

A solar lease is an agreement where a third party installs and owns a solar system on your home, and you pay a fixed monthly fee to use the energy it produces.

In a typical solar lease, a third-party company (often called the lessor) installs and owns the panels on your property. You, the lessee, agree to pay a predictable monthly payment for the power generated.

This structure makes solar affordable for homeowners who want lower electricity bills without paying tens of thousands upfront or incurring interest on a loan. The lease company handles installation, monitoring, maintenance, and repairs throughout the term — usually 20 to 25 years.

How It Works

- System Ownership: The leasing company retains ownership and claims incentives, including the federal tax credit (currently 48E).

- Monthly Payments: You pay a fixed or slightly escalating amount each month, often 10-30% less than your current utility bill.

- Maintenance & Repairs: The provider covers equipment servicing, performance monitoring, and insurance.

- Performance Guarantee: Many leases promise a minimum energy output each year. If production drops below that threshold, you receive a credit or refund for the missing production.

- End-of-Term Options: After the lease ends, you can renew, remove, or purchase the system at fair market value.

Whereas owning solar panels is often seen as an investment, leasing solar panels is more like switching to a utility with lower rates. With none of the ownership responsibilities, your role is simply to save money by purchasing lower-cost electricity from the power plant on your roof.

Different Types of Solar Leases

While there may be slight variations in lease terms from company to company, the most important difference between leasing products is the escalator.

The escalator dictates how much your monthly payment will increase year-over-year. This figure can range from 0% (no change in payments) to 3%. There are pros and cons to having an escalating lease structure, and the “right” structure depends on your savings goals.

Compared to escalating leases, no-escalator leases typically have higher monthly payments up front. However, by accepting less immediate savings, you can gain greater long-term savings as that payment stays flat.

In contrast, high escalating leases (around 3%) start with the lowest monthly payments in exchange for less savings over the long term.

Why Solar Leasing Matters in 2026

In 2026, leasing solar panels has become one of the smartest ways to lower your essential electricity costs, thanks to shifting tax incentives and record-high electricity prices.

The economics of solar have evolved dramatically in the past year. With drastic changes in federal policy, homeowners are re-evaluating whether to buy, lease, or enter a power purchase agreement (PPA).

Leasing is a strong option for households looking for immediate savings and long-term cost stability. Here’s why.

Solar Leases Still Benefit from a Federal Solar Tax Credit in 2026

For nearly two decades, the Investment Tax Credit (ITC) helped homeowners recoup 30% of the cost of purchasing solar systems. The “One Big Beautiful Bill” signed in July 2025 eliminates this incentive for systems installed after December 31, 2025.

However, this bill left the 48E Clean Electricity Investment Tax Credit intact through the end of 2027, allowing businesses that own leased residential solar systems to claim a 30% tax credit.

Leasing providers pass this benefit to customers as lower monthly payments in the solar lease agreement.

| Incentive | Who Claims It | Availability | Benefit to Homeowner |

| Section 25D Credit | Homeowner | Through Dec. 31, 2025 | Reduction in tax liability for year system as installed |

| Section 48E Credit | Leasing company | Through Dec. 31, 2027 | Lower lease payments via credit passthrough |

Rising Electricity Rates Boost Solar Lease Value

Across the U.S., residential electricity rates are rising and expected to continue increasing with the extreme weather and data centers stressing the outdated power grid. From 2021 to 2025, the average U.S. electricity rate increased 34%, adding over $500 to the average household’s annual electricity costs.

Because lease payments are locked in for 20–25 years, they act as a hedge against future utility inflation.

For many homeowners, leasing delivers instant savings with long-term price stability, even if total lifetime savings are slightly lower than ownership.

Easier Access and Lower Credit Barriers

Unlike solar loans, leases typically require only soft credit checks and minimum FICO scores around 650, making them accessible to a wider range of homeowners.

Leasing also removes the need to manage system performance, warranty claims, or equipment replacements — all of which remain the lessor’s responsibility.

Key Takeaway: In 2026 and after, leasing solar panels makes sense because homeowners can still benefit from the federal 48E tax credit through 2027, even after the 30% ownership tax credit expires at the end of 2025. Combined with rising electricity prices, solar leases offer immediate savings and long-term cost stability to a wide range of homeowners.

Lease vs Buy: Which Is Best for You?

Choosing between leasing and buying solar depends on your financial goals, tax eligibility, and how long you plan to stay in your home.

Each financing method offers a unique mix of ownership benefits, tax advantages, and long-term value. For most homeowners, the decision comes down to whether they prefer a long-term investment with ownership or immediate savings through a lease.

The Big Picture: Comparing Solar Financing Options

| Feature | Buy (Cash / Loan) | Solar Lease |

| System Ownership | Homeowner | Lessor (Company) |

| Federal Incentive | 30% Credit (25D): Claimed by homeowner, expires Dec. 31, 2025. | 30% Credit (48E): Claimed by lessor, passed through to homeowner, expires Dec. 31, 2027 |

| Monthly Payment | Loan Payment → $0 after payoff | Predictable payment, fixed or escalating through end of lease term |

| Maintenance & Monitoring | Homeowner’s responsibility | Provider’s responsibility |

| System Performance Risk | Homeowner’s responsibility | Provider’s responsibility |

| Term Length | N/A | 20 – 25 years |

| Best For | Homeowners looking for maximum long-term savings | Homeowners looking for instant savings with no maintenance duties |

Which Option Is Right for You? — Quick Decision Framework

There are a few key questions that can help you decide whether leasing or purchasing solar is the better option for your home.

Am I looking for a long-term investment or immediate savings?

If you’re in a position to purchase a solar system outright and wait 7-10 years to see a return on investment, then ownership (even without a tax credit) may better suit your needs.

If immediate savings are your primary goal, leasing should be considered Option A.

How long do I plan to stay in my home?

If you plan on moving in the near future (next 5 years or so), then ownership may be more beneficial than a lease. Purchased systems directly add to the resale value of your home and are more easily transferred in a sale.

While leased solar systems can be an attractive feature (who doesn’t want lower electricity costs?), they do not directly add value to the home and can be trickier to transfer in a home sale. Solar leases are best suited for folks who plan to stay in their home for the foreseeable future.

Do I want to be responsible for monitoring and maintenance of the system?

When you purchase a solar system, you are responsible for monitoring its performance and paying for maintenance, upgrades, and repairs. That may include the cost of replacing a battery storage system at the end of its useful life (10-15 years).

In a solar lease arrangement, the lessor is financially and contractually obligated to keep the system performing as agreed upon, and the cost of replacing battery storage is baked into your predictable monthly payments.

Related Reading: Adding Battery Storage to a Solar Lease: What You Need to Know

.

.

Solar Lease Economics Explained

A well-structured lease can deliver instant savings, predictable long-term costs, and zero maintenance responsibilities. This section breaks down how those numbers work — including monthly payments, escalators, buyouts, and lifetime value compared to ownership.

How much is a solar lease per month?

Solar leases are designed to provide near-term savings from day one. Most homeowners see monthly payments that are:

- 10–30% lower than their current utility bill

- Fixed, or increasing at a predictable 1–3% annual escalator

Your new electricity costs become the lease payment plus any leftover utility bill that the solar system can’t offset.

For example, let’s say your average electricity bill without solar is $300 per month. Leasing solar can reduce your average monthly electricity costs to $250 or less. You’d have a $220 lease payment and perhaps $20-30 in leftover electricity bill from your utility per month.

| Primary electricity source | Solar Payment | Avg. Utility Bill | Monthly Electricity Cost |

| Utility | – | $300 | $300 |

| Leased solar system | $220 | $30 | $250 |

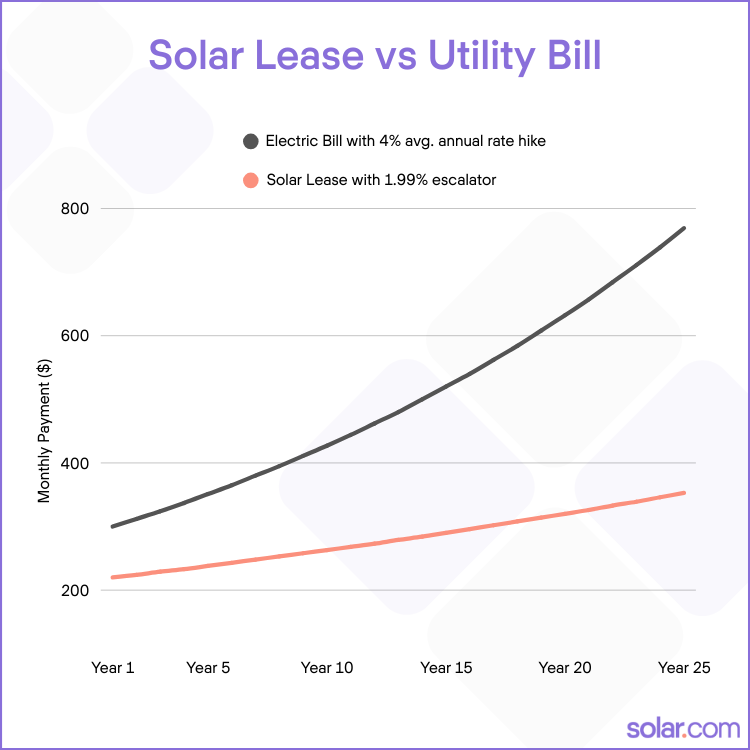

Even with an escalator, solar lease savings tend to grow year after year. As your utility rate grows unchecked, your lease payments are capped at a predictable rate.

How much does it cost to lease solar panels?

Solar lease payments are typically between $50-$300 per month, depending on the system size (based on your electricity usage), location, local incentives, and lease agreement terms. In many cases, there are zero upfront costs, and your monthly payments begin when the system is activated and producing power.

The beauty of a lease is that you can see exactly how much you’ll pay over the 20-25 year term.

Take our example above: a lease with a $220 initial monthly payment and 1.99% annual escalator. Over 25 years, the solar lease cost just under $85,000. Without solar, this household would have faced nearly $150,000 in total electricity costs from their utility, assuming 4% annual rate increases, on average.

| Primary electricity source | Year 1 payments | Year 25 payments | Total Cost |

| Utility | $300 avg. bill | $769 avg. bill | $150,000 |

| Leased solar system | $250 | $353 | $84,500 |

How Escalators Affect Long-Term Value

Most solar leases include an annual escalator, typically 1–3%, which increases your payment slightly each year.

While escalators reduce long-term savings compared with flat-payment leases, they remain highly competitive because:

- Utility rates have grown 5–9% annually since 2021, and are expected to continue rising quickly extreme weather, AI, and aging infrastructure stress the grid

- Lease escalators are predictable and capped

- 48E tax credits keep baseline lease prices lower through 2027

The key metric:

If your escalator is lower than your expected utility rate inflation, you save more money each year.

Buyout Options and End-of-Term Value

Many solar leases have buyout options. The exact terms of these options can vary from contract to contract, and they should not be glossed over by the salesperson. On Solar.com, your Energy Advisor will carefully explain your options so you can make the best savings plan for your home.

Below are the common buyout and end-of-term options for solar leases.

Most leases offer one or more buyout points:

- Early buyout (usually after Year 5–7)

- Mid-term buyout

- End-of-term purchase option at fair market value (FMV)

Buying out the system can significantly improve lifetime ROI if:

- You plan to stay long-term

- You want to eliminate the monthly payment

- You prefer to own the asset once the lease’s early years (and provider costs) are behind you

At the end of a 20-25-year lease, customers typically choose between:

- Extending the lease

- Upgrading to a new system

- Buying the system at FMV

- Having the provider remove it at their cost

This flexibility makes leases particularly appealing to homeowners uncertain about their long-term plans.

Tax Incentives and Credits for Solar Leasing

Just like owned systems, leased solar systems qualify for tax credits and incentives at the federal, state, and local levels. The difference is in who claims them and how the homeowner benefits from them.

For starters, leased systems still qualify for the 48E federal tax credit through the end of 2027, while the 25D for homeowner-owned systems expires at the end of 2025.

The 48E Tax Credit Supports Solar Leasing Through 2027

The 48E Clean Electricity Investment Tax Credit was created under the Inflation Reduction Act (IRA) and applies to companies that own and operate solar systems, including residential systems offered through:

- Solar leases

- Solar PPAs

- Community solar ownership models

Related reading: Solar Lease vs. PPA in 2026: Find Your Best Path to Savings

How does 48E benefit homeowners if the company claims it?

Although you cannot claim the credit as a lessee, the leasing or PPA provider receives a 30% tax credit and typically passes much of that value back to you through:

- Lower monthly lease payments

- Lower escalators

- Better performance guarantees

- Reduced down payments (often $0-down options)

48E Timeline

- Available for systems installed by December 31, 2027

- Value: Generally 30%, with potential adders for:

- Domestic manufacturing

- Low-income households

- Energy communities

- Brownfield redevelopment zones

These bonus credits allow some providers to reach 40–50% effective tax benefits, further reducing lease pricing in eligible areas.

Key takeaway:

From 2026–2027, leasing becomes the only solar option with a stable, federally backed incentive.

State and Utility Incentives for Leased Systems

Some state and utility incentives apply differently depending on system ownership.

Common applications:

- Performance-based incentives (PBIs) → usually apply regardless of ownership

- Upfront rebates → often tied to system owner (provider), not homeowner

- Net metering → applies to your home, whether you lease or own

- State tax credits → typically available only to system owners

Each state sets its own rules about how incentives are shared, so homeowners should consult a Solar.com Energy Advisor to navigate the best path forward for solar savings.

.

.

Pros and Cons of Leasing Solar Panels

Solar leasing offers low upfront costs and predictable savings, but should be weighed against the long-term ownership benefits. Understanding both sides is essential for making the right financial decision in 2026.

Pros vs. Cons Comparison Table

| Pros of Leasing Solar Panels | Cons of Leasing Solar Panels |

| $0–Low Upfront Cost — Most leases require little or no money down, making solar accessible without major upfront costs. | Lower Lifetime Savings — You may not receive the full value of a federal tax credit or the full lifetime ROI of ownership. |

| Predictable Monthly Payments — Fixed or low escalator payments help protect you from utility price hikes. | Escalators Can Reduce Value — 1–3% annual increases may cut into long-term savings depending on your utility rate growth. |

| Maintenance, Repairs & Monitoring Included — The provider covers inverter & battery replacement, panel repairs, labor, and insurance. | No Equipment Ownership — You have limited control over upgrades, customizations, or adding batteries later. |

| Performance Guarantees — Minimum energy output ensures consistent system performance or credits. | Home Sale Complications — Leases must be transferred or bought out, which can add friction to the resale process. |

| 48E Tax Credit Passed Through to You — Leasing companies claim the federal credit and lower your payments through 2027. | Buyout Options May Be Complex — Early or end-of-term buyouts depend on fair market value and contract terms. |

| Easier Qualification — Lower credit thresholds than loans; ideal for homeowners without tax liability. | Limited Incentive Eligibility — State or utility rebates that apply only to owners won’t flow to the homeowner. |

Key Terms to Check in a Solar Lease Contract

A solar lease is only as good as its contract. Homeowners should pay close attention to payment terms, escalators, performance guarantees, transfer rules, and buyout options before signing.

Contract Review Checklist

Use this checklist before signing any solar lease contract:

1. Monthly Payment Structure

- Is the payment fixed or escalating?

- If escalating, what is the annual rate (1–3% is typical)?

- Are there any seasonal adjustments or hidden fees?

- Does the payment change with production or stay flat?

2. Length of the Lease

- Standard terms run 20-25 years.

- Ask whether the term can be shortened, extended, or renewed.

- Confirm system removal responsibilities at the end of the term.

3. Performance Guarantee

- What annual kWh production is guaranteed?

- How are shortfalls compensated (credits, refunds, service visits)?

- Does the guarantee adjust as panels degrade?

4. Maintenance, Repairs, and Monitoring

Confirm that the provider covers:

- Inverter replacement

- Battery replacement (if battery is included in original system)

- Panel repairs

- Monitoring hardware/software

- Labor and roof penetrations

- Insurance and liability

Ensure these protections remain valid for the full duration of the lease.

5. Home Sale and Lease Transfer Rules

This is one of the most important parts of any solar lease:

- Can the lease be transferred to the buyer?

- Does the buyer need a minimum credit score?

- What if the buyer refuses to take over the lease?

High-impact clause: Some leases allow a prepaid buyout at fair market value to simplify resale — always ask if this is available.

6. Buyout Options

Ask these questions:

- When is the earliest buyout window? (Usually Year 5–7)

- How is the fair market value (FMV) calculated?

- Are there end-of-term buyout options?

- Will the company remove the system for free if you don’t buy it?

7. System Removal and Roof Work

Make sure the contract states:

- The provider removes the system at no cost

- Roof repairs after removal are included

Before signing a solar lease, check the payment terms, escalator rate, maintenance coverage, performance guarantee, transfer rules for selling your home, and buyout options. These factors determine your total cost, flexibility, and long-term value.

On Solar.com, walking you through your lease contract is a standard part of our process.

Step-by-Step: How to Get a Solar Lease

For too long, solar leases have been sold door-to-door by high-commission salespeople who don’t hesitate to stretch the truth or gloss over important details.

On Solar.com, we take a different approach. Whether it’s ownership, lease, or no solar at all, our mission is to empower you with the transparency, choice, and education to make the best decision for your home.

You can get your custom solar proposal in a few easy steps:

- Take a two-minute questionnaire

- Meet your Energy Advisor on a short introductory call

- Upload a utility bill

- Review your proposal on a web conference with your Energy Advisor

With a recent utility bill and basic information about your home and energy goals, we’ll develop a custom proposal for you to review with an unbiased Energy Advisor.

The Bottom Line

With access to a federal tax credit through 2027, leasing solar panels is gaining traction as an option for saving money with solar. All leases are not created equal, and it’s important to understand the details of your proposal so you can make the best decision for your home.

Explore your options on Solar.com today and see how much you can lower your electricity costs.

FAQs About Leasing Solar Panels

1. Do I get the federal tax credit if I lease solar panels?

No. If you lease solar panels, the leasing company (the system owner) claims the federal tax credit, not the homeowner. However, the company typically passes the 48E credit through as lower monthly payments, which reduces your cost indirectly.

2. What is the 48E tax credit for solar leasing?

The 48E Clean Electricity Investment Credit gives leasing companies a 30% federal tax credit for solar systems they own. This credit is valid for systems installed through the end of 2027, helping keep lease payments more affordable for homeowners.

3. Is it better to buy or lease solar panels in 2026?

Buy if you have strong state and/or local incentives, and you’re in a position to purchase the system outright with cash. Without a tax credit for ownership in 2026, taking out a loan to go solar is typically less beneficial than a lease.

Lease if you want $0 down, immediate savings, predictable payments, and no ownership responsibilities (monitoring, maintenance, insurance, etc.).

4. How much do solar leases cost per month?

Typically, solar lease payments are initially 10-30% less than your average electricity bill, depending on system size, location, and provider. Payments may be flat or increase with a 1–3% annual escalator.

Leases return greater monthly savings over time as utility rates outpace the predictable payment schedule for the lease.

5. Are solar lease escalators bad?

Not necessarily. Low escalators (0-1%) offer greater long-term savings by hedging against energy inflation over 20-25 years. Higher escalators (2-3%) allow for lower monthly payments upfront and a quicker path to cost savings.

Escalators only become a problem if your utility rates rise more slowly than your lease rate, which is uncommon because utility rates have increased 5–9% annually since 2021, and are expected to continue rising due to rising demand and extreme weather straining the aging power grid.

6. What happens at the end of a solar lease?

At the end of your 20-25-year lease, you can typically:

- Extend the lease (1 year at a time or for longer intervals)

- Purchase the system at fair market value

- Upgrade to a new system

- Have the provider remove it at no cost

7. Can I sell my home if I have a solar lease?

Yes. You can transfer the lease to the buyer if they meet the provider’s credit requirements, which most homebuyers easily qualify for. Alternatively, some providers allow buyout or prepayment options to simplify the sale.

8. Can I buy out my solar lease?

Usually yes. Most contracts allow buyouts after 5–7 years or at the end of the term. The buyout amount is based on the system’s fair market value (FMV) at the time of purchase.

9. Do leased solar panels increase home value?

Leased solar panels generally don’t increase home value the way owned panels do. However, they can still make a home more attractive if the lease offers clear savings, low payments, and flexible transfer terms.

10. Can I add a battery if I lease my solar panels?

Sometimes. Some leasing companies allow battery additions through a separate agreement, but batteries are not always included in performance guarantees. Check contract rules before planning an upgrade.

11. Are leased solar systems eligible for net metering?

Yes. Net metering applies to the home and meter, not the system owner. If net metering is available in your area, leased systems receive the same credit structure as owned systems.

12. What credit score do I need to lease solar panels?

Most providers require a credit score of 650 or higher, but some offer flexible underwriting or soft-pull approvals.

Related Articles

Is Prepaid Solar Better than the Original Tax Credit?

The solar.com team exists to provide choice, transparency, and trust to our homeowners and partners. This means we’re constantly evaluating the market for new technologies,...

Solar Lease vs. PPA in 2026: Find Your Best Path to Savings

As of January 1, 2026, the residential solar industry has entered a new era. With the official expiration of the homeowner-claimed tax credit under the...

Lease to Own Solar Panels: How Does It Work in 2026?

In 2026, many homeowners find themselves caught between two imperfect options for going solar. Most prefer to own the solar system powering their home, but...

Solar Pricing in 2026: Are Costs Going Up or Down?

With the start of 2026, there are a few substantial changes to the residential solar industry, mainly driven by the passage of Trump’s “One Big...

Lease or Buy Solar Panels in 2026? Find Your Best Path to...

In 2026, choosing between buying and leasing solar panels requires more consideration than it has in recent years. Ownership has traditionally been the preferred path,...

Adding Battery Storage to a Solar Lease: What You Need to Know

Many homeowners considering solar also want to know if their project is suitable for battery storage. After all, batteries are the Swiss Army Knife of...

Prepaid Solar Leases & PPAs: A New Path for Going Solar in...

A prepaid solar lease is a financing model where a homeowner pays most or all of a solar lease upfront—typically 70% of system cost—in exchange...

Selling a Home With Leased Solar Panels: Transfer Steps, Buyout Options, and...

With access to a federal tax credit through the end of 2027, solar leases and Power Purchase Agreements (PPAs) are strong options for homeowners looking...

What Is a Solar Lease Escalator? What Homeowners Need to Know

Homeowners evaluating solar proposals will likely be confronted with options that include an escalator. This article will help you unpack solar lease escalators and understand...

See how much solar panels cost in your area.

Please enter a valid zip code.

Please enter a valid zip code.

Zero Upfront Cost. Best Price Guaranteed.