The best time to own solar panels is when you receive an electricity bill for zero dollars. But when is the best time to buy solar panels?

The answer to this question depends on a few things like your location, net metering policy, and local incentives. In this article, we’ll cover some of the things to think about when you’re planning your solar project.

Team up with an Energy Advisor here to determine your best time to go solar.

When is the best time to buy solar panels?

For many US homeowners, fall is the best time to buy solar panels because it sets them up for a late winter/early spring installation, which has its advantages.

The process of going solar typically takes between three to five months from start to finish, so in order to have your solar system up and running by March, you’d need to get the process going in late fall/early winter.

There are two major advantages of shopping for solar panels in the fall:

- By shopping in fall or winter, you’re missing the late summer solar rush that can lead to longer project timelines

- By installing and activating your solar system in early spring, you can avoid overlap between your solar and utility payments

Avoid the summer solar rush

Like most industries, residential solar has its busy and slow seasons.

Summer is typically the busiest time of year because with the sun shining, air conditioners humming, and peak utility rates in effect, homeowners get their biggest electricity bills of the year and react by switching to solar. Fall and winter are slower for the opposite reasons – less sunlight, little to no A/C, and lower energy bills. But that’s exactly what makes it the best time to go solar, especially for proactive customers who want to set themselves up for peak summer bills.

Three reasons to start your solar project in the fall

- Greater scheduling flexibility for calls and appointments

- More face time to ask questions and address concerns

- Stronger personal connections with the people managing your solar project

Think of shopping for solar panels like going out for breakfast. If you go during the Sunday morning after Church rush there will be a line out the door, 10 other tables competing for your server’s attention, and the food will take longer to prepare and deliver – it’s just the nature of the beast.

But if you go out for breakfast on a Tuesday morning you’ll have an entirely different – and in many ways better – experience. The restaurant will be at most half full, the server will have time to chit-chat and customize your order, and the food will come out hot, fresh, and fast.

Now, solar panels aren’t a $13 plate of eggs benedict. They are a major investment in lowering your essential electricity costs. So having that extra time, care, and attention from your installer and Energy Associate is absolutely worth starting your project during the off-season.

Related Reading: How To Choose Solar Panels for Your Home

Avoid overlapping solar and utility payments

Another reason why fall is the best time to buy solar panels is can help you avoid overlap between your utility and solar payments.

After all, replacing your utility bill with a lower solar payment is a huge reason for going solar, and it would be a shame to pay for both at once. Here’s how shopping during the offseason can help you avoid this overlap.

In general, solar systems tend to produce more electricity than your home uses beginning in March.

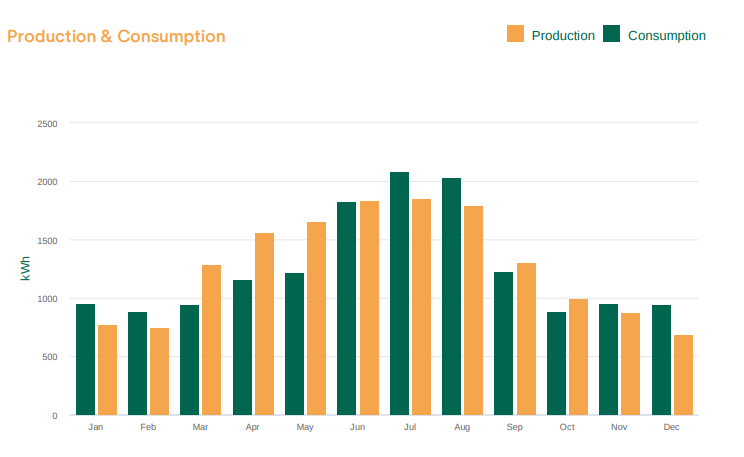

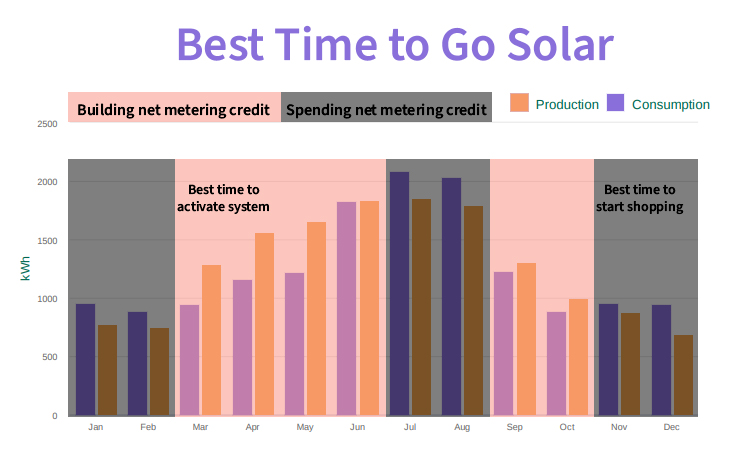

The best months for overproduction – and best chance to build up net metering credit – are often March, April, and May as shown by the charts below for a home near Los Angeles. Note: Production and consumption will vary by location, solar production, and electricity consumption.

By taking a proactive approach and planning ahead for a late winter/early spring installation date, you are setting yourself up to start overproducing and earning credit right off the bat — which will minimize, if not eliminate, your utility bill — by the time your solar loan payments kick in.

Now, if you take a reactive approach by starting your solar project when your summer bills hit, you’ll end up installing in late fall/early winter — right when solar production declines for the year. That means you’ll be making electricity bill and solar loan payments each month until at least March.

For example, if your system is installed and activated in late October, you could have four months of double payments.

Why it’s best to buy solar panels sooner rather than later

By shopping for solar panels in the fall you can improve your customer experience and minimize your first net metering bill. But there are a few other things to consider when choosing when to go solar.

To make sure you can use the solar tax credit

The best solar incentive available to most homeowners is the federal solar tax credit worth 30% of the installed cost of your solar project.

That means if you paid $20,000 for your solar system, you can claim a $6,000 credit on your federal tax return, effectively reducing the cost of the project to $14,000.

However, this non-refundable tax credit can only be used to reduce your tax liability – it’s not a “Thank You For Going Solar” Hallmark card with a $6,000 check inside.

Having sufficient tax liability generally isn’t an issue for homeowners who are still in the workforce, but it tends to become an issue for retirees who no longer have much taxable income.

Frankly, this can come as a frustrating surprise to retired homeowners and it’s worth keeping in mind as you plan your solar project. So if retirement is on the horizon, the best time to buy solar panels may be before you hang up your boots.

This article does not constitute tax advice. Consult a licensed tax professional with questions regarding tax liability and the federal solar tax credit.

To claim incentives and net metering policies before they change

Net metering and incentives have been monumental for increasing residential solar adoption and nurturing a growing industry. However, the cost of solar panels has decreased rapidly in the last decade and changed the landscape.

Solar incentives put in place a decade ago, like New York’s MW Block Incentive, are winding down and are unlikely to be renewed or extended because home solar costs so much less now.

Another thing to consider is changes to net metering policies. Just like solar incentives, many net metering policies were formed 10-20 years ago when solar was still an expensive, budding technology.

Now that solar is much cheaper, utilities – namely in California and New York – are proposing and making changes to net metering policies that would increase costs for solar owners.

So the best time to buy solar panels is before those changes happen so you can be grandfathered into a more favorable net metering policy.

The sooner you go solar, sooner you’ll save

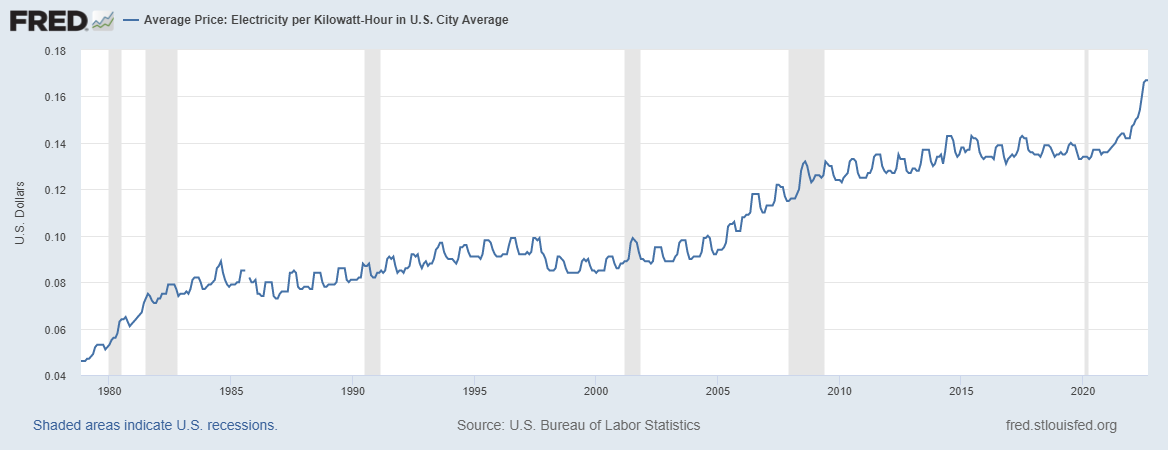

Perhaps the best reason not to wait to go solar is because you can’t start saving until you start generating.

Like real estate and your 401k, solar is a long-term investment, often with a substantial return. But, you can’t start saving until you make the investment. And the longer you wait, the longer you’re subject to grid electricity prices (shown below), which makes yesterday the best time to buy solar panels.

Best time to buy solar panels is when you’re ready

Just like buying a house, solar is a long-term investment and there’s more to be lost than gained by trying to time the market. The best time to buy solar panels is when you are ready to make an investment in your future.

However, if you are trying to choose a time of year to start your search, fall and winter provide some unique advantages. By starting the search in the offseason, you’ll have more hands-on service from installers and Energy Associates. You’ll also set yourself up to avoid overlap between your solar and utility payments.

Start your solar journey here with multiple quotes from vetted installers.