Is Solar a Good Investment?

With inflation eating away at cash and stirrings of an upcoming recession, people are looking for safe places to invest their money and ride out the post-pandemic economic storm.

Despite its outdated reputation as a luxury item, home solar is a good investment and a hedge against inflation for many homeowners. In addition to energy savings and increased home value, solar also offers one thing that few other investments can: a performance warranty.

In this article, we’ll explore whether solar is a good investment for your home and how it compares to other traditional investments.

Is home solar a good investment?

Solar is a good investment for many homeowners because it freezes your electricity rate in an era of rapidly rising energy costs.

In many ways it’s similar to buying a home. Homeownership fixes your housing payment and shields you from rising rent prices, and solar fixes your electricity costs at a low rate for 25 or more years.

And, just like buying a home, there are solar loan options for making little-to-no down payment. However, in both cases, the more money you put down the greater the return on investment.

As of September 2022, the national average grid electricity price was 16.7 cents per kilowatt-hour – up nearly 16% from the year before – while the average price of solar purchased on solar.com was around 7 cents per kilowatt-hour after applying the 30% federal solar tax credit.

Let’s see how the cost of grid versus solar energy compares for an average American household.

Solar vs grid for the average US household

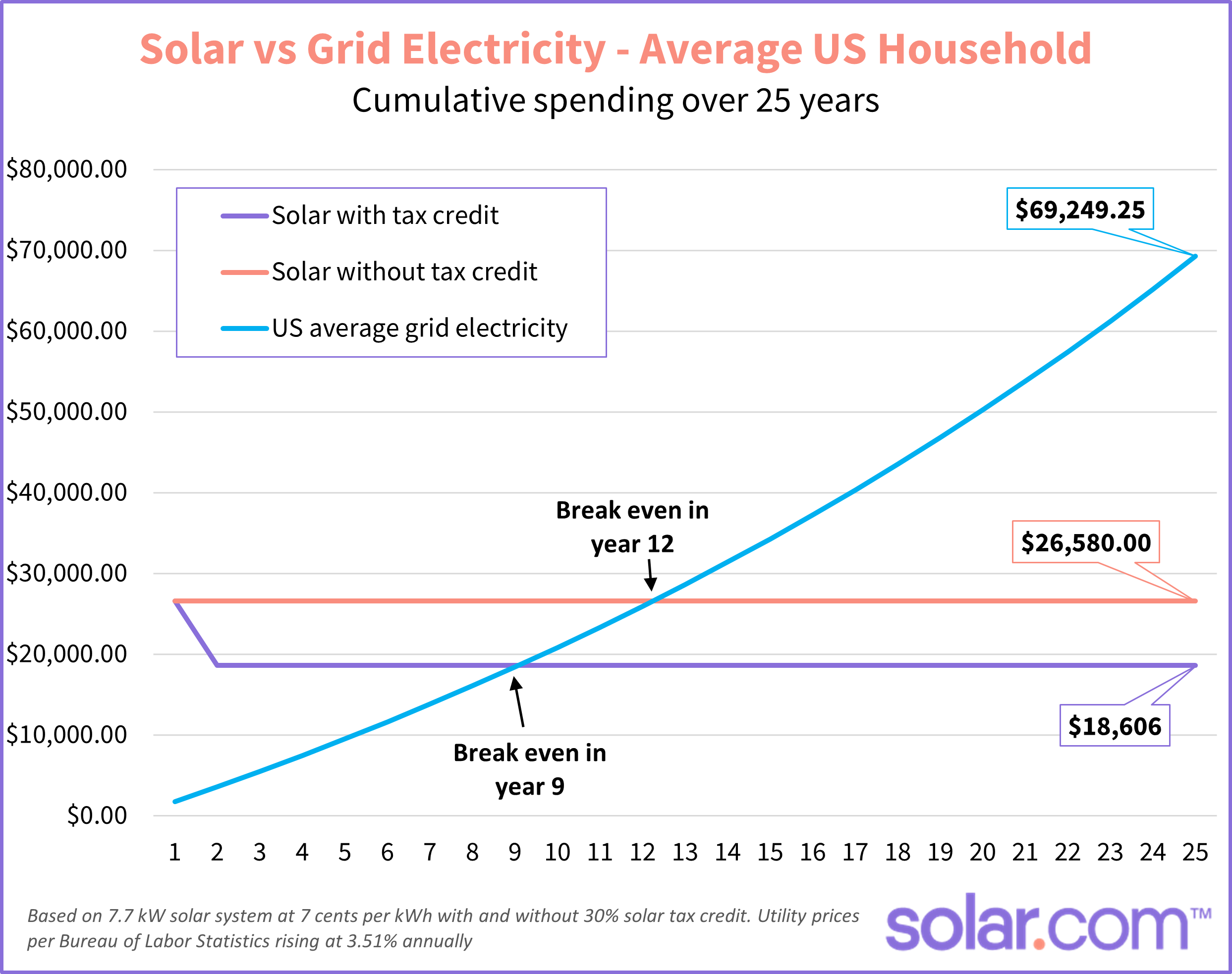

In 2021, the average residential utility customer used 10,632 kWh of electricity. Here’s how much it costs to run the average household on grid electricity versus home solar for one year.

| Electricity source | US average price | Cost per year for average household |

| Grid – US average | 16.7 cents per kWh | $1,775.54 |

| 7.7 kW solar system with 30% tax credit | 7 cents per kWh | $744.24 |

| 7.7 kW solar system without 30% tax credit | 10 cents per kWh | $1,063.20 |

An average household could save over $1,000 by going solar in the first year alone. But as we mentioned above, solar is a good investment because it freezes your electricity costs while utility rates keep climbing.

According to the Bureau of Labor Statistics, the national price of electricity increased by 3.51% on average per year from 2018-2022. If this trend continues, the cost of sticking with grid electricity over 25 years would be two and a half times greater than buying a 7.7 kW solar system without the 30% federal tax credit.

Over the 25-year warrantied life of a solar system, the average US household could save:

- Nearly $43,000 by going solar without the 30% tax credit

- Over $50,000 by claiming the tax credit

And that’s just in electricity savings, which is not the only way solar panels provide a return on investment.

Increased home value

Studies by Zillow and Berkeley Lab found that solar panels increase home value and lead to quicker home sales.

Zillow found that homes with solar panels sell for 4.1% more than comparable homes without them. That would add more than $18,000 to the typical home based on the latest national median sales price.

Berkeley Lab found that going solar adds on average $4 per Watt of solar panels installed. That amounts to $30,800 in value added by the 7.7 kW system we used above.

The exact figure is going to vary from home to home, but increased home value should not be overlooked when considering if solar is a good investment. Especially considering some states – including Florida, New York, and California – with property tax exemptions for value added by solar panels.

Solar compared to traditional investments

Between energy savings and added home value, solar is a good investment for most homeowners. But how does it compare to more traditional investments like 401(k) and real estate?

In just energy savings alone, solar performs on par with traditional investments. In the example above, the average US household would see a 272% return on investment (ROI) by going solar over 25 years, for an average annual rate of 5.4%.

Of course, the ROI of solar will vary from home to home. For example, in San Diego, where grid electricity costs over 40 cents per kWh and abundant sun makes for cheap solar, the ROI of solar can be upwards of 10%. And in places where electricity is cheaper and sunshine is more scarce, the ROI will be lower.

| Investment | Average annual rate of return |

| 401(k) | 3-10% |

| Home appreciation | 4.25%* |

| Solar over 25 years | 3-10% |

*Based on the national median home price from 1996 to 2021.

Here’s the big difference: Solar is a good investment because it comes with a 25-year performance warranty and relatively steady return.

Real estate and 401(k) portfolios are both considered safe long-term investments, but neither come with a literal guarantee that they will perform at a certain level in 25 years. They also tend to have dramatic swings like we saw in 2008 and 2020.

During stock and housing market crashes, people tend to panic-sell to try to cut their losses instead of riding it out. This realizes those losses and defeats the purpose of a long-term investment.

But panic-selling is nearly impossible with home solar — unless you sell your house along with the panels.

Why is solar a good investment?

We’ve established that solar is a good investment with a predictable return on investment backed by a 25-year performance guarantee.

But why? Why is powering your house with solar panels cheaper than continuing to buy grid energy?

The answer essentially boils down to scarcity. Solar power is fueled by a limitless supply of sunlight whereas utilities still generate most of their power from a depleting supply of fossil fuels.

When you go solar, you are buying equipment, not fuel. Once you’ve paid for that equipment, you’re done. You’ve locked in your cost for the life of the system – unless the sun decides to jack up the rate for its rays.

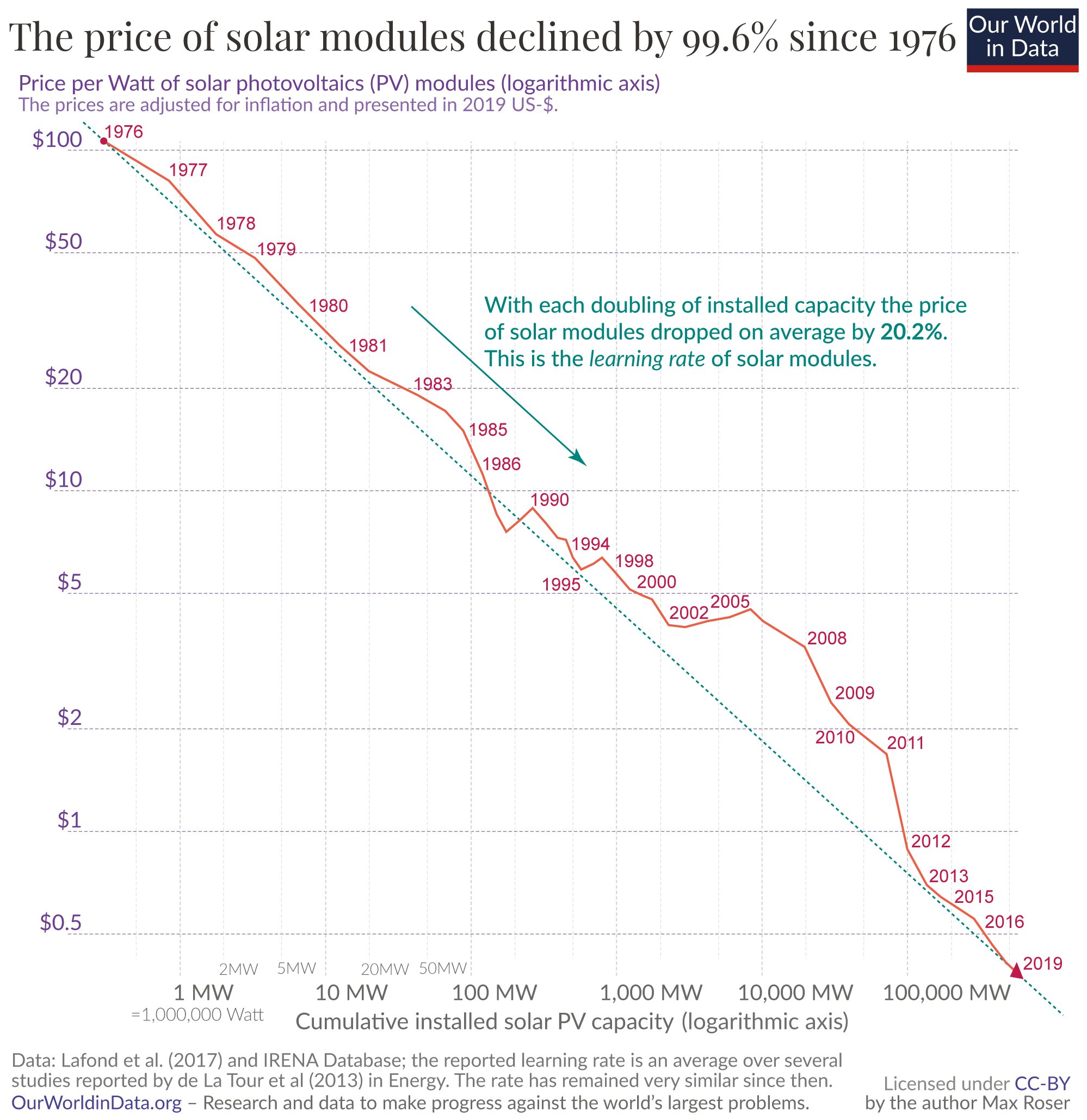

Because the fuel supply is unlimited and free, solar power is inherently deflationary. As technology improves the cost of solar equipment decreases, which looks like this:

Fossil fuels, on the other hand, are inherently inflationary because there is a limited supply of fuel controlled by a limited group of people that own it. And as the supply depletes it gets harder to extract, and we need new infrastructure to access and transport it. So we’re paying for the equipment and the fuel.

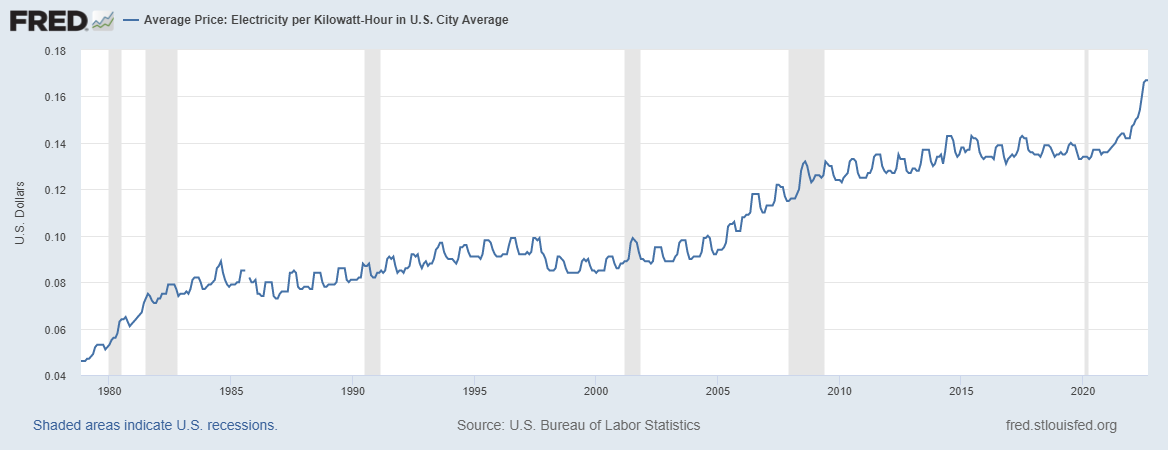

And, as we’ve seen in 2022, we have no control over fuel prices. The price of fossil fuels is tied to geopolitics, supply chains, disasters, and, quite frankly, greed. That’s why electricity prices look like this:

The bottom line: Solar is a good investment

Thanks to free sunshine and the new and improved 30% federal solar tax credit, solar is a good investment with a strong and steady return for most US homeowners.

That’s especially true given the current inflationary environment and risk of recession. Solar panels provide a safe place to protect cash from inflation and plant the seed for long-term energy savings.

Everyone’s potential return on investment is different. Connect with an Energy Advisor to see how much you could save with solar.

Investing in Solar FAQs

Is there a downside to having solar?

Although solar panels are typically a good investment with a strong and steady return, there are some downsides.

First, solar isn’t right for every homeowner. If you have a shaded roof or low electricity rate, you may not see much of a return on investment.

You also can’t take solar panels with you if you move. Although you can typically recoup the cost of the system in the home sale, you’ll have to start fresh if your new home doesn’t already have panels.

Is getting solar panels a good investment?

Solar panels are a good investment for many US households, especially those with ample sunshine and high utility rates. Going solar can lead to hundreds of thousands in energy savings over the 25-year lifespan of a system and can increase your home value.

How long do solar panels take to pay for themselves?

The payback period – or break-even point – of solar panels depends on your utility rate, electricity usage, sun exposure, and incentives. The payback period for solar systems purchased through solar.com ranges from 3 to 15 years with the average around 5-7 years.