Going Solar in New York State: Pros, Cons, and Incentives

At first glance, New York State and rooftop solar don’t exactly feel like a natural pairing.

The Empire State isn’t exactly known for sunshine, but between fast-rising utility rates and some of the country’s best state-level solar incentives, going solar in New York State is a great long-term investment.

Did you know? Congress is moving to eliminate the 30% tax credit for residential solar. Start your solar project today to secure your tax credit eligibility and maximum bill savings for your home.

In this article we’ll cover:

- The pros of going solar in New York

- The cons of going solar in New York

- NY solar incentives

- Frequently asked questions

Pros and cons of solar in NY State

Let’s start with a birds-eye view of the pros and cons of going solar in New York State.

| Pros | Cons |

| Home solar is cheaper than buying grid electricity | New York isn’t especially sunny |

| Tax-free increase in home value | Need cash or access to financing |

| Lower carbon footprint | Panels (usually) stay with home if you move |

| Contribute to a cleaner, more resilient grid | |

| Robust slate of federal and state incentives | |

| 1 to 1 net metering |

The pros of going solar in New York State

Despite receiving less sunlight than much of the country, New York State is one of the leaders in residential solar adoption and ranks sixth for projected growth over the next 5 years.

That’s largely due to the state having some of the highest electricity prices and arguably the best solar incentives. In other words, solar is more affordable than grid electricity in New York State – plain and simple.

Let’s crunch the numbers using an actual quote presented to a solar.com customer in Brooklyn to see how it pencils out.

Related reading: Going Solar in Hudson Valley New York: Incentives, Savings, and Installers

Solar is much cheaper than grid electricity in New York State

The biggest advantage of going solar in New York State is substantial electricity savings over the life of the system.

Yup, solar comes with a big scary price tag, but when you compare apples to apples – the price of electricity per kilowatt hour – solar emerges as the much cheaper option.

Let’s take a look at a real quote for solar and battery presented to a solar.com customer in Brooklyn, NY to see how it stacks up against paying for grid electricity.

| 7.6 kW solar system | Amount |

| Gross price | $36,740 |

| NYSERDA rebate and cash discount | -$7,856 |

| Contract price | $28,884 |

| State and federal solar tax credits | -$13,665 |

| Net cost | $15,219 |

Factoring in the customer’s average sunlight, roof angle, and panel degradation over time, the 7.6 kW system is expected to produce:

- 10,141 kWh of electricity per year

- 233,329 kWh of electricity over 25 years

If you divide the net cost of the project by the lifetime production, the cost per kilowatt-hour of home solar plus battery storage for this customer in Brooklyn comes to 6.5 cents per kWh.

If you add in 11.4 kW of battery storage for $10,000 (after discounts and tax credits), the cost rises to 10.7 cents per kWh.

Now, let’s compare the cost of electricity from home solar to the cost of grid electricity.

Solar vs grid energy prices in New York

| Source of electricity | Cost of electricity (cents/kWh) | Cost per year of 10,141 kWh of electricity |

| Solar.com – solar only | 6.5 | $659 |

| Solar.com – solar + battery storage | 10.7 | $1,085 |

| Grid – New York State average | 21.63* | $2,193 |

*June 2023 per EIA.

When comparing apples-to-apples, solar electricity – even with battery storage – is substantially cheaper than grid electricity in New York State. Going solar also fixes your electricity costs at a low rate – sort of like buying a house to hedge against the constantly rising cost of rent.

From 2017 to 2022, electricity prices statewide increased at an average rate of 3.57% per year. Here’s how the cost of solar versus grid energy in New York compares over 20 years of 1:1 net metering (including the CBC fee).

One way to think about going solar is buying electricity in bulk at a deep discount. Sure, it takes some cash or financing to do it, but the investment more than pays for itself in the long run.

Based on a real binding quote for a solar.com in Brooklyn, a typical solar customer in New York City could save over $45,000 over their 20-year net metering period – almost enough to buy six tall beers at a Yankees game!

| Project type | Break-even point | 20-year savings |

| Solar-only (cash) | Year 6-7 | ~$45,000 |

| Solar-only (20-year loan) | Day 1 | ~$35,000 |

A good chunk of these savings are created by New York State’s solar incentives, which we will cover later in the article. But, for the sake of argument, let’s say you paid the full sticker price of $36,740 for a 7.6 kW solar system. You can still save over $25,000 over 20 years.

Solar increases home value in New York State

In addition to electricity savings, solar and battery storage can increase the value of your home – especially in New York State.

Data analysis by Zillow found that homes with solar panels in New York City sell for 5.4% more than comparable homes without them. The 5.4% premium for solar panels was higher in New York City than any other major metro, and higher than the national average of 4.1%.

Solar panels provided a markup of $23,989 to the median-valued home in 2019. After three years of rapid home price growth, a 5.4% premium for solar panels would amount to $37,800 for a median-priced home in New York City in 2022.

And if you’re worried about solar panels increasing your property value, take a deep breath. In most of New York State there is a 15-year property tax exemption that applies to the value of solar systems. You still have to pay property taxes, but the value of your solar system will not increase your property tax rate unless your local government opts out.

Better yet, New York City has the Solar Electric Generating Systems Tax Abatement Program, which can reduce what you own in property taxes by up to 30% of the project cost. We’ll cover this more in-depth later in the article.

Related reading: 5 Things to Know About Going Solar in Con Edison New York

Home solar can help New York State clean up its energy mix

As of June 2023, more than 50% of New York State’s electricity generation came from natural gas, which emits 12 times more lifecycle emissions per kWh than rooftop solar.

Natural gas is mainly methane, a greenhouse gas with 80 times the warming effect of carbon dioxide. Before it’s even burned, natural gas accounts for 29% of methane emissions and 3% of total greenhouse gas emissions. Once natural gas is burned, it emits carbon dioxide and particulate matter that contribute to climate change and local air pollution.

Less than 7% of New York State’s electricity mix comes from non-hydroelectric renewables like solar and wind. Homeowners can help move the needle away from fossil fuels by installing rooftop solar and battery storage.

Cons of going solar in New York State

The upsides to going solar in New York State are clear:

- Save big money on your electricity bill

- Increase your home value

- Decrease the state’s reliance on fossil fuels

But going solar is a major decision, so let’s weigh the cons as well.

New York gets less sunlight than most states

New York isn’t the sunniest state in America – not by a long shot – and that’s only made worse by shading from buildings in the city and trees upstate.

The Empire State averages fewer than 4.5 hours of peak sun hours per day, with more than six hours in July and less than two hours in December. Less exposure to sunlight essentially increases the cost of going solar. After all, with fewer hours of peak sunlight, you need more solar panels to produce the desired amount of electricity.

For example, based on real solar.com quotes, the sticker price (before incentives) of a 7.6 kW system is $19,700 in Florida compared to $36,740 in New York State.

Fortunately, New York State’s solar incentives and net metering policy make up for the lack of sun and make going solar more than worthwhile.

Related reading: Going Solar on Long Island: Incentives, Savings, and Installation Companies

You (usually) can’t take solar and battery with you

One thing to consider when going solar is that you can’t take the system with you if you move – at least not without voiding your solar warranty.

Although solar and battery storage adds value to your home, there’s no guarantee that you’ll recover the cost of the system in the sale. The longer you own the system, the more you’ll save on electricity costs and the more you’ll recoup on the home sale.

The other thing to consider is extreme weather. Between hurricanes, blizzards, hail, and the occasional tornado, New York gets a pretty wild mix of extreme weather.

In the case of extreme weather events, solar and battery are great backup power sources, but they won’t do much good if you evacuate or your home is destroyed. Solar panels are typically covered by homeowners insurance, but it’s important to check your exact coverage details if you live in an area at risk of hurricane and storm damage.

Cost barriers of solar panels in New York

The biggest hurdle to solar and battery is the sticker price, especially in New York where homeowners need more panels to get the same production as sunnier states.

Even after applying state and federal incentives, a typical solar-only project costs between $10,000 to $20,000, and not everybody has that kind of cash lying around.

Zero-down solar loans can help spread out this cost, which makes going solar more accessible and can shift when energy cost savings kick in. However, solar loans have lending requirements, just like mortgages and auto loans. So, the trick to securing financing is having an eligible credit score and debt-to-income ratio.

See how much you can save by going solar.

Solar incentives in New York State

New York State has perhaps the best solar incentives in the country that can drastically reduce the cost of going solar and increase your return on investment.

NY solar incentives include:

- NY-Sun Megawatt (MW) Block incentive

- NY State Solar Energy System Equipment Tax Credit

- Solar Electric Generating System Tax Abatement

- Home Solar Project Sales Tax Exemption

- Net metering

We’ll cover each solar incentive below, starting with the NY-Sun Megawatt Block incentive.

NY-Sun Megawatt Block Incentive

We’re starting with the NY-Sun Megawatt Block incentive because it’s the first to kick in.

Also known as the NYSERDA incentive, this program reduces the upfront cost of your solar system by directly paying your installer a certain rate per Watt of solar capacity installed.

The incentive rate depends on your region (Con Edison, Long Island, and Upstate) and which phase the Megawatt Block program is in. As of April 2023, the NY solar incentive rates for each region were as follows:

| Region | NY Residential solar incentive rate* | Incentive for 7.6 kW solar system |

| Con Edison | $0.20/W | $1,520 |

| Upstate | $0.20/W | $1,520 |

| Long Island | Closed | None |

*Incentive rates as of October 2023.

Two things you should know about the NYSERDA incentive:

- The maximum incentive for a normal residential solar system is $8,750

- It won’t be around forever

In fact, it began in 2014 at $1/Watt and the rate has gradually decreased as the program has progressed. Both the Con Edison and Upstate regions are in their final blocks, and the Long Island incentive closed in 2016.

The NY-Sun Megawatt Block program is a great incentive, but it’s just a cherry on top of a sundae compared to the New York State and federal solar tax credits.

Federal and New York State solar tax credits

If you’re going solar in New York State, there are two tax credits to be aware of:

- The 25% NY State tax credit

- The 30% federal tax credit – at risk of being eliminated!

This article does not constitute tax advice. Consult a licensed tax professional with questions regarding solar tax credits.

New York State solar tax credit

The NY State Solar Energy System Equipment Tax Credit is a mouthful, but it’s also one of the best state solar tax credits in the country. The tax credit is worth 25% of the installed cost of your system or $5,000 – whichever is less.

The installed cost of your system is the contract price after cash discounts and the NYSERDA incentive are applied.

Here’s how it would look for a real solar.com quote for a 7.6 kW solar system:

| 7.6 kW solar system | Amount |

| Gross price | $36,740 |

| NYSERDA rebate | -$1,520 |

| Cash discount | -$6,336 |

| Installed price | $28,884 |

| NY state solar tax credit | -$5,000 |

| Net Price | $23,885 |

Since 25% of the installed price is more than $5,000, the tax credit is worth $5,000 for this customer.

Three important things to know about the New York State solar tax credit:

- It’s a non-refundable credit, which means it can be used to reduce your tax liability. If you don’t have sufficient tax liability, it can be rolled over for up to five years

- This state tax credit is considered taxable income by the federal government and may need to be claimed on your federal taxes

- It can be used in addition to the 30% federal solar tax credit

Let’s see how these tax credits work together.

Federal solar tax credit

Worth 30% of the installed price of a solar and/or battery system, the Residential Clean Energy Credit was enhanced by the Inflation Reduction Act and is still the largest solar incentive for most homeowners.

Like the New York State tax credit, the federal solar tax credit is a non-refundable tax credit that can be used to reduce your federal tax liability. In other words, it’s not a check that comes in the mail – it simply reduces the amount of federal tax you owe.

If you don’t have sufficient tax liability, the credit can be rolled over until the credit expires in 2034.

Here’s how the federal solar tax credit works alongside the NY state solar tax credit on our 7.6 kW system:

| 7.6 kW solar system | Amount |

| Gross price | $36,740 |

| NYSERDA rebate | -$1,520 |

| Cash discount | -$6,336 |

| Contract price | $28,884 |

| NY State solar tax credit | -$5,000 |

| Federal solar tax credit | -$8,665 |

| Net price | $15,219 |

All tallied up, the New York State solar incentives and the federal solar tax credit reduce the net cost of going solar by more than $15,000 for this solar.com customer.

New York State solar tax exemptions and abatements

NY solar incentives don’t end with tax credits and the NYSERDA incentive. There are also tax exemptions and abatements to further increase your solar savings.

This article does not constitute tax advice. Consult a licensed tax professional with questions regarding solar tax exemption and abatements.

New York State solar sales tax exemption

New York State has a sales tax exemption for residential solar systems. Given the state sales tax rate of 4%, that saves $1,155.36 on a 7.6 kW system with a contract price of $28,884.

It’s important to note that this exemption only applies to state sales tax, and local sales tax may still apply. However, some local jurisdictions – namely New York City – also have sales and use tax exemptions in place.

Property tax exemption for solar systems

New York State Real Property Tax Law 487 provides a 15-year property tax exemption for the value added to your home by solar panels and other renewable energy systems.

To be clear, the exemption only applies to the value of the solar system – it doesn’t mean you can stop paying property taxes altogether.

So if you’re home is worth $400,000 and your solar system adds $35,000 to your property value, you would only pay property taxes on the original $400,000 valuation.

It’s also important to note that many municipalities have opted out of the property tax exemption, so it’s worthwhile to check your local tax code.

NYC real property tax abatement program

Finally, in New York City, there is a real property tax abatement program for grid-connected solar and battery systems, which was recently extended through 2034.

A property tax abatement reduces the amount of property tax you owe over a period of time. For systems placed in service in 2024 and beyond, the New York City solar tax abatement is worth 7.5% of the installed price (after the NYSERDA incentive is applied) over 4 years.

Here’s how that looks on our 7.6 kW system with a contract price of $28,884.

| Year | Amount |

| Year 1 | $2,166.30 |

| Year 2 | $2,166.30 |

| Year 3 | $2,166.30 |

| Year 4 | $2,166.30 |

| Total property tax reduction | $8,665.20 |

The maximum abatement is $62,500 per year and cannot exceed your annual property tax liability.

Net metering in New York State

One of the things that makes going solar in New York State worthwhile is net metering.

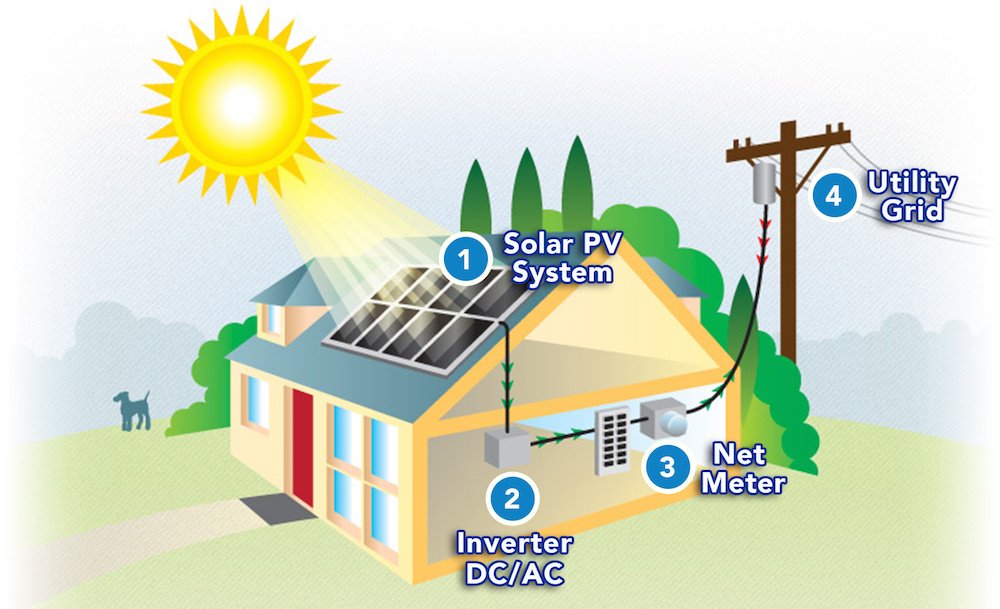

Net metering is a policy that allows you to earn credits for putting your excess solar production back into the grid during the day. These credits can be used to offset the cost of using grid electricity when your solar panels aren’t producing at night or in the winter.

Simply put: Unless you have battery storage, net metering makes residential solar viable even though it’s an intermittent energy source.

However, in many states, including New York, net metering policies are being reshaped to match the rapidly developing solar landscape, which often includes rate increases for solar owners. In fact, New York is in the midst of transitioning its net metering structure now, and currently has two billing options for solar owners.

Phase One plus CBC — This is a transitional version of a standard net metering program in which solar owners receive full retail value for the electricity they export onto the grid. However, it included a “Customer Benefit Contribution” (CBC) charge based on the utility provider and size of the system.

| Utility provider | 2023 CBC rate ($/kW per month) | Charge per month for a 7.6 kW system |

| Central Hudson | $1.18 | $8.97 |

| Con Edison | $1.09 | $8.28 |

| LIPA | $0.59 | $4.48 |

| National Grid | $1.18 | $8.97 |

| NYSEG | $0.70 | $5.32 |

| Orange and Rockland | $1.07 | $8.13 |

| RG&E | $0.84 | $6.38 |

Value of Distributed Energy Resources (VDER) or Value Stack — This new solar billing structure is designed to compensate solar owners based on the value of excess solar electricity when it’s exported onto the grid. Value is based on a number of factors, including wholesale energy rates, environmental benefits, and how much the system reduces grid demand and the need for utility infrastructure upgrades.

VDER is not only more complicated to understand, but it’s also generally less favorable to solar owners. Therefore, it’s worth going solar before the traditional net metering option is phased out entirely (as it has been in California).

The best way to be grandfathered into a favorable net metering policy is to go solar sooner rather than later. Get started here.

Is going solar worth it in New York State?

Between the high cost of grid energy and generous state incentives, going solar is absolutely worth it in New York State.

Based on an actual quote generated on solar.com, a homeowner in Brooklyn could save over $45,000 over 20 years with a 7.6 kW solar system. That’s not to mention the $8,700 property tax abatement, the tax-free increased value to their home, and the environmental benefits of producing clean energy.

Yes, going solar in New York State is worth it, and the best time to start is now.

New York State solar FAQs

What are the NY solar incentives?

Residential solar incentives in New York include the NY-Sun Megawatt Block program, a 25% state tax credit, a 30% federal tax credit, sales and property tax exemptions, a property tax abatement (NYC only), and a favorable net metering policy.

How much do solar panels cost in New York State?

Based on a real binding quote presented to a solar.com customer in Brooklyn, a 7.6 kWh solar system costs $15,219 after applying state, federal, and marketplace incentives.

That breaks down to 6.7 cents per kilowatt-hour for electricity, compared to 24.9 cents per kilowatt-hour for electricity in New York City.

How long do solar panels last in New York City?

Modern solar panels are warrantied to produce at a certain level for 25-30 years and can continue producing electricity for much longer.

Solar panels don’t have an expiration date. Instead, they naturally degrade over time and become less efficient.

Premium solar panels are made to withstand elements like rain, snow, and cold temperatures. In fact, The rain and snow in New York State can actually help keep panels clean and operating efficiently.

Do solar panels add value to your home in New York State?

Yes, solar panels can add to your home value in New York State and, thanks to a property tax exemption, the added value will not increase what you owe in property taxes for 15 years.

According to a study by Zillow, homes with solar panels in New York City sold for 5.4% more on average than comparable homes without solar in 2019. Today, that amounts to $37,800 added on to the median sales price of a home in New York City.