Going Solar in Westchester County: Incentives and Local Installers

Westchester County may not be synonymous with solar panels quite yet, but there may not be a better place in the country for homeowners to consider going solar. With Con Edison, Westchester County homeowners have gotten used to paying a lot for their electricity — and can expect to pay a lot more in 2023.

We’re happy to tell you there is a way to lower your electricity costs. Between state and federal incentives, Westchester County is one of the best places in the US to save money by going solar. We’ll have to dive a little deeper to understand just what to expect when you’re looking to go solar in Westchester County.

Connect with an Energy Advisor to explore your solar options.

Solar Incentives in Westchester County, New York

The Federal Solar Tax Credit

The Federal Investment Tax Credit (ITC) is available to everyone in the country who purchases a solar system. As it stands, the tax credit has no cap and will reduce your system cost by 30%. For instance, if your system costs $20,000, your tax would be worth $6,000, bringing your net system cost to $14,000.

To take the tax credit, you have to have a tax liability greater to or equal to 30% of your system cost. In other words, you can’t claim the full tax credit if you don’t pay at least that much in federal taxes. However, it can be rolled over and claimed in chunks over multiple tax years.

Another caveat to this tax credit is that you must purchase your system, either with a cash purchase or a loan. If you go with a lease or a PPA (Power Purchase Agreement), the installer will be the one taking the tax credit.

The New York State Solar Tax Credit

In addition to the federal tax credit, New York State offers a tax credit of its own. The solar tax credit is worth 25% of the cost of your system with a cap of $5,000. Since you can claim both these tax credits together, there is a potential to have your system cost reduced by 55% if you don’t meet the state cap.

So, if your system cost $20,000, the 25% NY state tax credit would be worth $5,000, effectively bringing your net system cost to $15,000. Now, if your system cost $30,000, you would reach the cap since 25% of $30,000 is $7,500.

| Homebuyer A | Homebuyer B | |

| Gross system cost | $20,000 | $30,000 |

| NY state tax credit (25% with $5,000 cap) | -$5,000 | -$5,000 |

| Federal solar tax credit (30% with no cap) | -$6,000 | -$9,000 |

| Net system cost | $9,000 | $16,000 |

Amazingly, the incentives for buying solar panels in Westchester County don’t end with the tax credits. There is also a rebate that brings down the cost even further.

NYSERDA Solar Rebates

Starting in 2014, NYSERDA (New York State Energy Research and Development Authority) began offering solar rebates to customers in certain utilities and regions across New York. As luck would have it for Westchester residents, the rebates in Con Edison’s coverage area are still active as of February 2023.

The rebate is allocated in sequential segments, called blocks. Every block has a certain amount of installed KWs that can receive the rebate before it is considered full. Once a block is full, the rebate steps down to the next block. Right now, Con Edison is in its 9th and final block, worth 20 cents per Watt of solar capacity installed.

So, for a 10kW system — or 10,000 Watts — the NYSERDA rebate is currently worth $2,000 for Con Edison customers.

It’s worth noting that this rebate is typically applied before claiming the state and federal tax credits, and therefore reduces their value.

| Homebuyer A (5 kW system) | Homebuyer B (7.5 kW system) | |

| Gross system cost | $20,000 | $30,000 |

| NYSERDA Rebate | -$1,000 | -$1,500 |

| Contract price | $19,000 | $28,500 |

| NY state tax credit (25% with $5,000 cap) | -$4,750 | -$5,000 |

| Federal solar tax credit (30% with no cap) | -$5,700 | -$8,550 |

| Net system cost | $8,550 | $14,950 |

Homeowners in Westchester County have access to perhaps the most substantial solar incentives in the entire US. But the motivation to go solar doesn’t end there. This county also faces some of the highest utility electricity prices in the nation, and it’s residents are throwing away money every month they continue to pay for grid electricity.

Solar vs Grid in Westchester County

If the carrot (solar incentives) isn’t motivation enough to go solar, maybe the stick (utility electricity prices) is.

In September 2022, Con Edison — the electricity utility provider in Westchester County — announced a 27% increase in residential electricity prices for November through March. According to News 12 Westchester, “A Westchester County customer using 600 kilowatt hours a month will have an average bill of $203.”

Factoring a basic $27 service charge, that boils down to 29 cents per kilowatt hour — one of the highest electricity rates in the country.

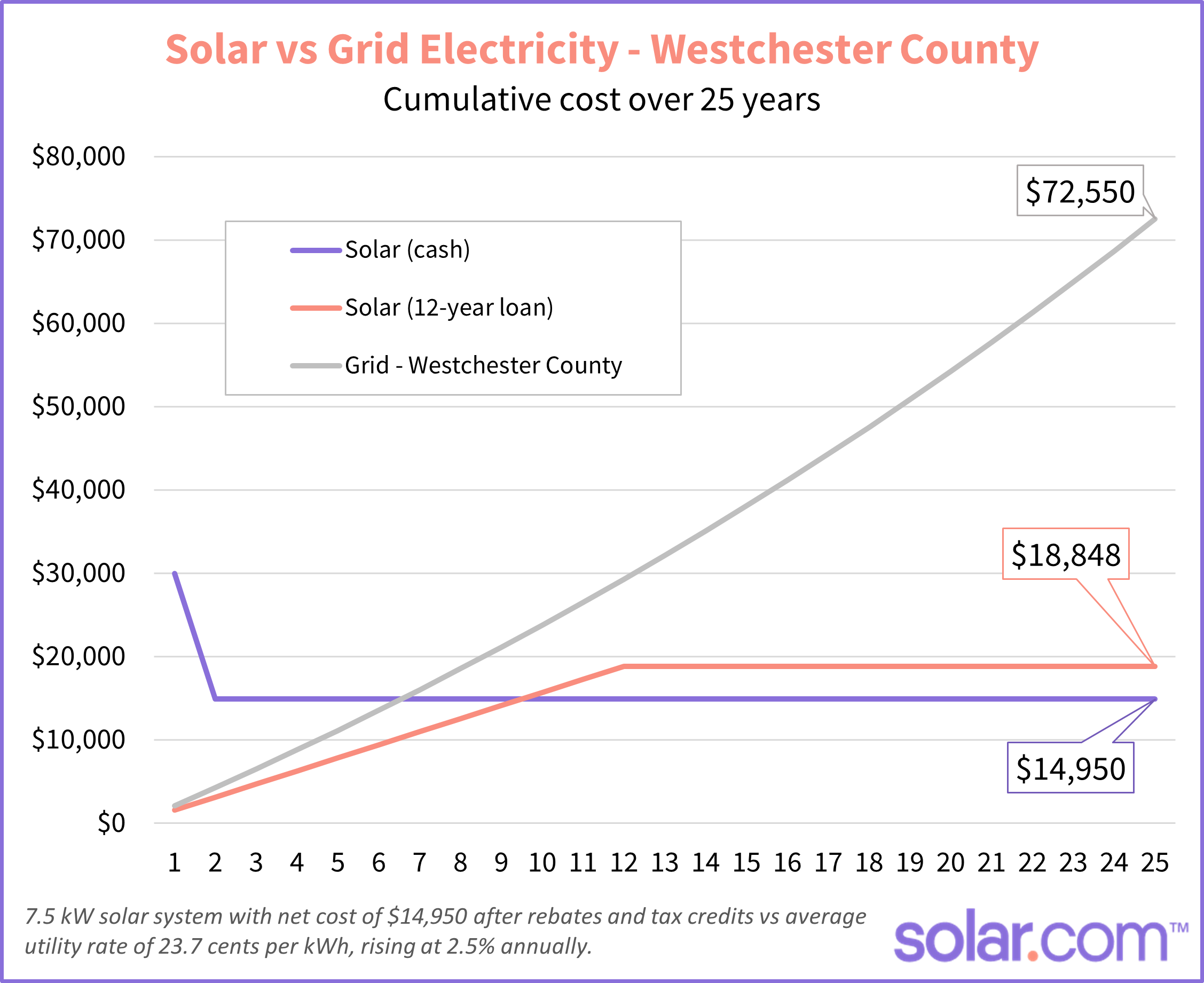

For comparison, going solar effectively reduces your cost per kWh for electricity to around 8 cents per kWh for 25 years. Here’s how that looks for an average Westchester County household using 800 kWh of electricity per month.

| Electricity source | Cost per kWh | Cost per month (800 kWh) |

| 7.5 kW solar system (cash purchase with incentives) | 6.7 cents | $54 |

| 7.5 kW solar system (12-year loan payment) | — | $131 |

| Con Edison (winter rates) | 29 cents | $232 |

Now, let’s say that electricity rates are 29 cents per kWh in November-March and 20 cents per kWh in April-October. That’s an average rate of 23.7 cents per kWh throughout the year.

And here’s the thing about utility rates: They tend to go up over time. Electricity prices typically increase around 2-4% per year, but as we learned in 2022, they can be volatile and unpredictable.

So, let’s see how locking in a low rate for solar compares to paying for grid electricity over the 25-year warrantied life of a solar system.

Thanks to generous incentives and high electricity prices:

- The payback period of going solar in Westchester County is around 6 years

- Lifetime savings can easily top $50,000

- You can see immediate savings over $50 per month by financing your system with a solar loan

The bottom line: Going solar in Westchester County is a no-brainer in terms of energy cost savings. Start a project to see how much you could save.

Finding solar installers in Westchester County

Given the extremely high return on investment for going solar, Westchester County — and much of New York state — is pretty saturated with solar installers all competing for your attention. So how do you find a reputable solar company in Westchester County?

The easiest way is to compare quotes right on solar.com.

In our guided solar process, you team up with an unbiased Energy Advisor to virtually design a solar system and use it to generate dozens of quotes from vetted local installers. Every solar company in our installer network goes through a rigorous vetting process, and fewer than 30% that apply are accepted — we’re that strict.

Using the free solar.com marketplace saves you the time of vetting, calling, and booking consultations from multiple installers just to hear the same sales pitch over and over. Better yet, the competition created by solar.com marketplace leads to lower prices and greater savings for Westchester County homeowners.

It’s time to go solar in Westchester County

Due to ample incentives, sky-high electricity prices, and a strong net metering policies, going solar in Westchester County is a no-brainer. Better yet, comparing multiple quotes from reputable local installers is easy on the solar.com marketplace.

If you are considering solar, the time is now before the NYSERDA rebate runs dry or the net metering policy is weakened (as it has been in California).

Start your project with multiple quotes from local installers.