California Solar Incentives and Rebates: How to Maximize Your Solar Savings

With abundant sunshine and some of the nation’s highest electricity prices, it’s no wonder why over a million California homeowners have gone solar.

Rooftop solar is already a worthwhile investment in California, but a wide-range of federal, state, and local incentives can make the deal even sweeter. In this article, we’ll dig into:

- Solar and battery tax incentives

- Solar and battery rebates

- Cost of solar versus grid electricity

- Is solar worth it in California?

First, let’s go over the pros and cons of solar panels in California to get a sense of why they’re worth considering.

See how much you can save with solar. Start here.

Pros and cons of solar panels in California

| Pros | Cons |

| Ample sun + high electricity prices = massive savings potential | No state tax credits or rebates |

| Increased home value with property tax exclusion | NEM 3.0 not as favorable as previous net metering policies |

| Robust and mature installation market | Robust market also attracts scammers and shady installers |

| Solar + battery = backup power and grid resiliency | Can’t take solar + battery with you if you move |

| Favorable net metering for non-IOU customers | Need cash or access to financing to buy solar |

| SGIP rebates lower the cost of batteries |

California solar and battery incentives

For many California homeowners, going solar is already a slam dunk. However, there are federal, state, and local incentives that can maximize your solar savings.

The incentives fall into two broad categories: tax incentives and rebates. Let’s start by digging into the tax incentives.

California solar and battery tax incentives

The following California solar incentives come in the form of tax credits, exemptions, and exclusions. Consult a licensed tax professional for advice regarding tax incentives.

Federal solar and battery tax credit

The first tax incentive to mention is the 30% federal solar tax credit – also known as the ITC or Residential Clean Energy Credit.

This federal tax credit is worth 30% of the cost of installing solar and battery storage systems with no limit. And, thanks to the Inflation Reduction Act, the ITC will remain at 30% until 2032 and now applies to battery storage that isn’t hooked up to solar.

Property tax exclusion

Studies by Zillow and Berkeley Lab found that solar panels increase home values by up to $4,000 per kW. And Californians know better than anyone else that higher property value means higher property taxes.

But thanks to California’s Active Solar Energy System Exclusion, rooftop solar systems installed before January 1, 2025 won’t be assessed in property valuations, and therefore won’t increase your property tax. According to the California State Board of Equalization, this tax exclusion applies to solar systems “where the energy is used to provide for the collection, storage, or distribution of solar energy.”

It does not apply to solar swimming pool heaters or hot tub heaters.

Property-Assessed Clean Energy (PACE)

Access to financing is often the biggest hurdle to going solar, but the PACE program – known as the Home Energy Renovation Opportunity (HERO) program in California – is one way to go solar with zero money down.

Through the HERO program, your state or local government teams up with a local lender to fund the upfront cost of your solar project. Then you pay the project off through an increase to your property tax bill over an agreed-upon term, typically 5 to 20 years.

The savings come when the increase to your property taxes is lower than the energy savings provided by your solar system.

California solar and battery rebates

California also has solar incentives in the form of rebates, which can help reduce the upfront cost of solar and battery storage projects. We’ve listed a few below, but we strongly encourage you to check for local rebates through your utility, city, or municipality.

Self-Generation Incentive Program (SGIP)

With frequent power outages and Time-of-Use rates, home battery storage is an opportunity for both energy independence and savings.

Through SGIP, eligible Californians can be reimbursed for $150 to $1,000 per kWh of battery storage installed – which, in some cases, covers the entire cost of the project.

The incentive amount depends on your utility, your wildfire risk, and special circumstances like having a life-threatening illness, medical equipment, and an electric pump for well water.

Check out our complete guide to SGIP eligibility here.

Disadvantaged Communities – Single-Family Solar Homes (DAC-SASH)

DAC-SASH is an upfront rebate to reduce the cost of going solar for qualifying low-income households.

To be eligible, you must meet all of the following criteria.

- Receive electrical service from

- Pacific Gas & Electric (PG&E)

- Southern California Edison (SCE)

- San Diego Gas & Electric (SDG&E)

- Own and occupy a single-family home as a primary residence

- Be located in a disadvantaged community identified on this map

- Household income below the CARE or FERA program limits

DAC-SASH is scheduled to run through 2030. Visit GRID Alternatives to check your eligibility.

Local rebates

In addition to state rebate incentives, California also has several local rebates that can further maximize your solar savings.

For example, Rancho Mirage Energy Authority has a Residential Solar Rebate Program that offers a one-time $500 incentive for installing or expanding a residential solar system.

Similarly, Sacramento Municipal Utility District (SMUD) offers a $150 stipend for residential solar system installations.

Cost of going solar in California

While there are a variety of solar incentives in California, most homeowners will only qualify for the federal solar tax credit. Perhaps the biggest factor in solar savings in California is whether your utility offers NEM 2.0 or NEM 3.0 billing for solar owners.

- Under NEM 2.0, compensation for solar exports (the excess electricity you push onto the grid) is the same as the price of the electricity you pull off the grid. So, a solar system sized to produce 100% of your annual electricity consumption can typically offset your electricity bill (except non-bypassable charges)

- Under NEM 3.0, compensation for solar exports is based on its perceived value to the grid at the time it is exported. On average, solar exports are worth 75% less than the retail price of electricity, making for a longer payback period and lower (albeit still worthwhile) lifetime savings.

Currently, only the state’s three largest investor-owned utilities (PG&E, SCE, and SDG&E) have adopted NEM 3.0 solar billing, which means customers of LADWP, SMUD, and other utilities still have access to NEM 2.0. Let’s take a look at the savings potential under each net metering billing policy.

Related reading: Solar Panel Cost Calculator California: 3 Ways to Estimate Your Cost

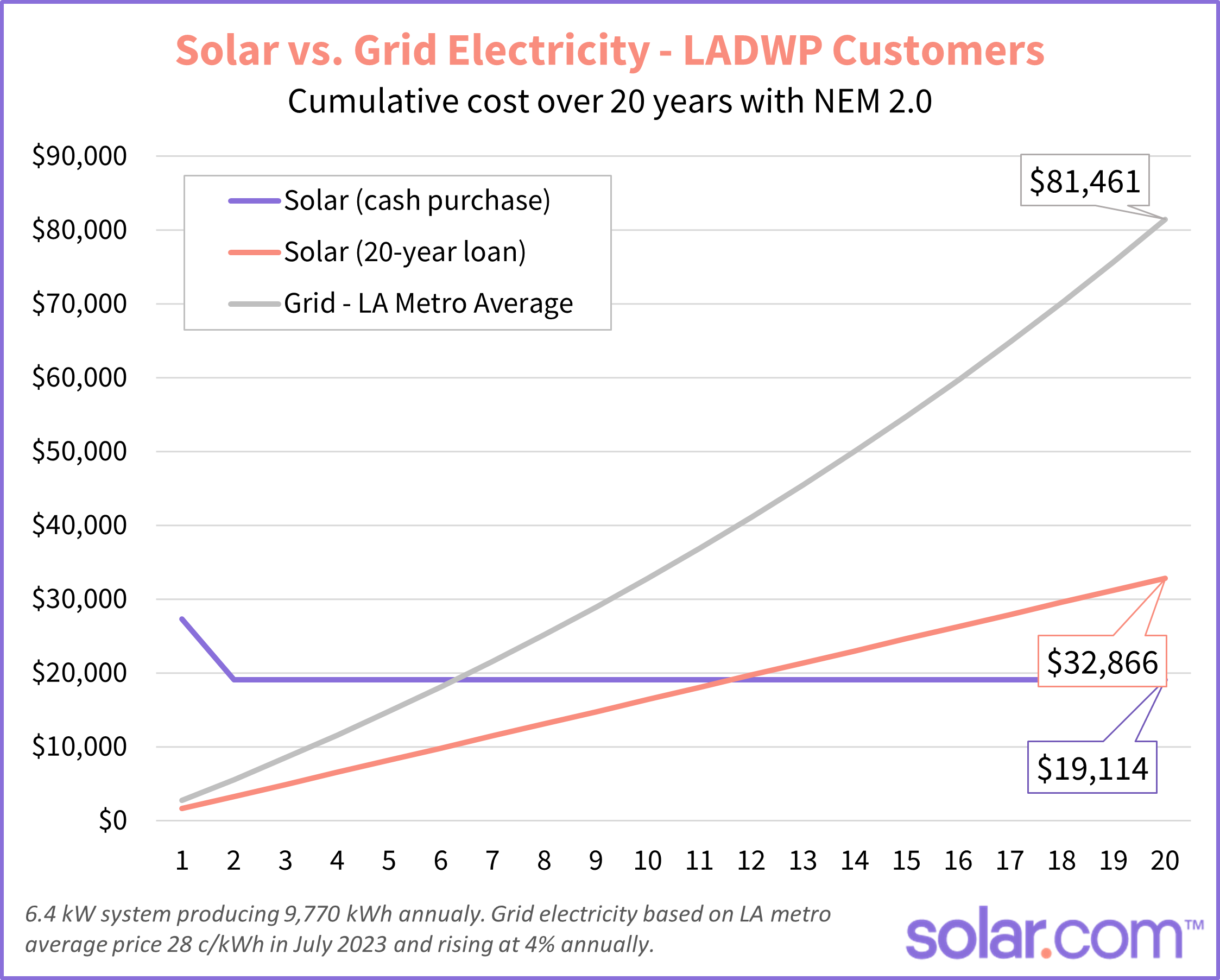

Cost of solar vs grid electricity with 1:1 net metering (NEM 2.0)

The figures below are based on a real quote presented to a solar.com customer in Los Angeles, Cali. for a 6.4 kW solar system under NEM 2.0.

| Item | Amount |

| Contract price (cash purchase) | $27,306 |

| 30% Residential Clean Energy Credit | -$8,192 |

| Net price | $19,114 |

With California’s abundant sunshine, a 6.4 kW solar system can be expected to produce:

- An average of 10,626 kWh of electricity per year

- A total of 245,500 kWh of electricity over 25 years

If you divide the net cost of the project by the lifetime production, the cost per kilowatt-hour of home solar for this Los Angeles-area customer comes to:

- 8 cents per kWh with the 30% solar tax credit

- 11 cents per kWh without the solar tax credit

Now, let’s compare the cost per year of electricity from home solar to the cost of grid electricity:

| Source of electricity | Cost of electricity (cents/kWh) | Cost per year for 10,626 kWh of electricity |

| Solar with tax credit | 8 | $850 |

| Solar without tax credit | 11 | $1,169 |

| Grid – LA metro average* | 28 | $2,975 |

*Average price as of July 2023 per the US Bureau of Labor Statistics.

Even without the 30% federal tax credit, grid electricity is 150% more expensive per year than home solar – and that’s before factoring in the constantly rising cost of grid electricity

According to the Bureau of Labor Statistics, the average cost of grid electricity has increased by over 6% per year since 2017 in the Los Angeles metro area – but let’s use a 4% annual increase to be conservative.

Here’s how the cost of solar versus grid energy in Los Angeles compares over the 20 years:

Under NEM 2.0, Californians enjoy short payback periods of around 6 years and upwards of $60,000 in cumulative savings over 20 years.

Related reading: Should CA Solar Owners Be Worried About Income-Based Electricity Bills?

Cost of solar vs grid electricity under NEM 3.0

Since the compensation for solar electricity is minimal under NEM 3.0 solar billing, the trick to maximizing your solar savings is to avoid exporting solar electricity with the grid as much as possible. The way to store and use your own solar electricity is to pair your solar panels with battery storage.

The chart shows the cumulative cost of three ways of buying and using the same amount of electricity:

- Buying all of it from an investor-owned utility (grey line)

- A solar-only system with around 50% leftover bill (purple line)

- A solar and battery system that offsets nearly 100% of the electricity bill (orange line)

The trick with NEM 3.0 is that even if a solar-only system generates 100% of your average electricity consumption, it will only offset around 50% of your electricity bill. That’s because with a solar-only system you’re essentially selling electricity during the day for 5 cents per kWh and buying it at night for close to 30 cents per kWh.

But with a battery, you can store your cheap solar electricity to avoid buying grid electricity at all. In fact, with new consumption-only batteries, IOU customers are able to get payback periods and lifetime savings in the same ballpark as a solar-only system under NEM 2.0

Is going solar worth it in California?

Whether your goal is energy cost savings, contributing to the clean energy transition, or providing backup power for grid outages, going solar is absolutely worth it in California – even under NEM 3.0 solar billing.

California is notorious for having some of the nation’s highest utility electricity rates and there is plenty of reason to believe they will continue increasing. Home solar is an affordable alternative to buying electricity from a utility provider and a hedge against rising energy costs.

See how much you could save by comparing quotes from our network of trusted installers.

California Solar Incentives FAQ’s

How much do solar panels cost in California?

Based on real binding quotes generated by solar.com, a 6.4 kW solar system (slightly larger than the average for California) has a net cost around $19,000 after claiming the 30% federal tax credit.

That breaks down to around $3 per Watt for the system, and around 6 cents per kWh for the electricity it produces. For comparison, grid electricity rates ranged between 28 cents/kWh in Los Angeles and 31 cents/kWh statewide in July 2023.

How does the California solar tax credit work?

California no longer has a state solar tax credit. However, the federal solar tax credit is worth 30% of the installed cost of a solar and/or battery system. This credit can be used to decrease your federal tax liability and increase your tax refund.

On a $15,000 solar system, the federal solar tax credit can be used to lower your tax liability by $4,500. If you don’t have enough tax liability to use at all it once, the tax credit can be rolled over into future years.

Consult a licensed tax professional for advice regarding applying for the solar tax credit.

Can you get free solar panels in California?

There are a few programs in California that can drastically reduce or completely cover the cost of going solar. These niche programs are reserved for low-income and disadvantaged communities that meet strict eligibility criteria.

The Disadvantaged Communities/Single-Family Solar Homes (DAC-SASH) offers an upfront rebate for low-income homeowners in disadvantaged communities identified here.

California’s Low-Income Weatherization Program provides no-cost solar systems and energy efficiency upgrades for eligible farmworker households and other low-income housing types.