Going Solar in Washington State is a No-Brainer

UPDATE: For our latest article on Washington incentives, please visit here.

Amidst newly announced incentive programs, solar in Washington is hot right now. I know we often write about how attractive solar is, but the buyers market is phenomenal. With many incentives slated to wind down over the next three years, right now is the perfect time to maximize savings from local, state, and federal solar initiatives. Below you will find a comprehensive list of all the solar cost-reduction streams available in Washington:

- Washington Production Incentive

- Federal Solar Investment Tax Credit

- No Sales Tax

- Net Energy Metering

Washington Production Incentive

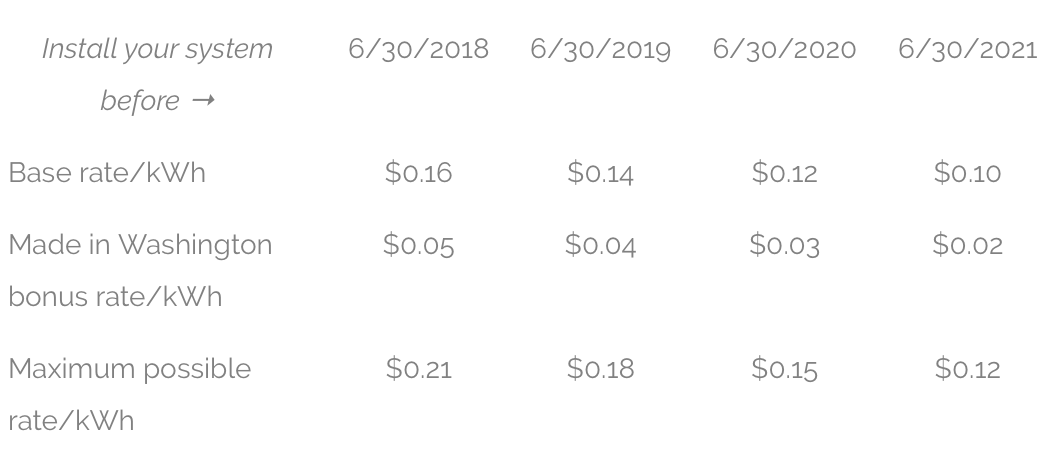

In the interest of fostering solar manufacturing in Washington, special incentives are offered for solar system components made in the state. The Production Incentive is an annual payment based upon the total kilowatt hours (kWh) produced by a solar photovoltaic (PV) system to a maximum payment of $5,000 annually. The incentive amount paid to the producer starts at a base rate of $0.16 per kilowatt-hour (kWh) and is adjusted by multiplying the incentive by the following factors:

- For electricity produced using solar modules manufactured in Washington state: 2.4

- For electricity produced using a solar or wind generator equipped with an inverter manufactured in Washington state: 1.2

- For electricity produced using both solar modules and an inverter manufactured in Washington state: 3.6

Check this video to know more kilo-watt hour (kWh).

The combination of a WA made inverter with out of state solar panels earns up to $.18/ kWh. The combination of WA made panels with out of state inverter earns up to $.36 and when both the inverter and panels are Made in WA, the maximum incentive rate is $.54/ kWh for homes and businesses. Community Solar projects earn at a rate that is double the rate for an individual property owner (home or business owner). The funding comes out of Public Utility Taxes that each utility would otherwise pay to the State. Utilities are charged with reading the meters and tracking the annual payments to customer-generators.

The “Made in Washington” funding is limited in supply so it’s important to act quickly: not only is there a cap of $5,000 on the number of funds a property owner can earn, there is also a limit to how much each utility can redirect out of their taxes they would be paying to the state. Each utility’s annual pool of funds available to pay the Production Incentive is capped at .5% of their taxable sales for the year. The Production Incentive program expires June 30, 2020, and no payments will be made for kWh generated after that date. Contact your utility to find out if and how the caps have affected their implementation of the state incentive program. It will be different for each one. Some utilities simply closed their solar programs and are not allowing more people to join them. Others are reducing the payment to each participant and continuing to keep the doors open for new participants.

Local Incentives:

Chelan County

Chelan County Public Utility District (the PUD) offers the Sustainable Natural Alternative Power (SNAP) program, which encourages customers to connect PV systems to the PUD in exchange for an incentive payment based on the system’s production. The PUD distributes SNAP payments annually, on or around Earth Day. The amount paid per kilowatt-hour (kWh) to SNAP Producers is determined by dividing the total amount contributed by SNAP Purchasers through the utility’s green pricing program, divided by the total electricity generated by all SNAP Producers. The greater the amount contributed by SNAP purchasers, the greater the payout that will be distributed among participating SNAP Producers, up to a maximum of $1.50 per kWh. As a result, payment rates have fluctuated depending on the number of participants. Since solar has become so popular in Washington, SNAP payments henceforth will be sub 50 cents per kWh.

Under the SNAP program, each solar system has a dedicated utility-owned production meter that measures the total AC energy generated by the system. Once renewable energy has been metered, it can either go directly to a utility transformer or connect to the customer’s electrical distribution panel. If the measured power connects to the customer’s distribution panel, the customer receives the additional benefit of net metering. If the output of the inverter is connected directly to the transformer, the customer does not receive any net metering benefit but does receive an additional payment for the wholesale value of the power they generate, at a payment rate of 75% of the Dow Jones Mid-Columbia off-peak wholesale rate.

To view, a comprehensive list of all incentives offered each utility in Washington, click here.

Federal Investment Tax Credit

Like all states, homeowners in Washington can benefit from the federal solar investment tax credit, which accounts for 30% of the gross system cost. However, starting in 2020, the tax credit will gradually reduce for new systems: down to 26% of the total cost in 2020, and 22% of the total cost in 2021. You are eligible for the 30% tax credit so long as solar construction commences on or before December 31, 2019, and the solar panels are in service before 2024. There is currently no tax credit for residential systems established after 2021.

Furthermore, Washington residential solar PV systems are exempt from sales tax, including labor and services related to the installation of the equipment, through June 30th, 2018, so decide soon!

Net Energy Metering

For many PV system owners, net energy metering (NEM) is one of the many ways to decrease the cost of electricity in the long run. Even if you have a robust battery system, when those batteries are at 100% capacity, any additional power generated will be absorbed by the grid. With NEM, net excess energy production is sold back to the grid at the wholesale rate (the rate the utility pays for its energy). Net metering is a great way to capitalize on the production capability of your system, and can even reduce your energy bill to $0.

The three investor-owned electric utilities, Avista Corporation, Pacific Power & Light Corporation, and Puget Sound Energy, have net-metering programs:

-

Avista Corporation’s Schedule 63 – Net Metering Option Schedule, Washington; contact: Mr. Dave Miller, (509) 495-4110.

-

Pacific Power & Light Company’s Schedule 135 – Net Metering Service; contact: Ms. Cathie Allen, (503) 813-5934.

-

Puget Sound Energy’s Schedule 150 – Net Metering Services for Customer-Generator Systems; contact: Mr. Jake Wade, (425) 462-3459.

Solar Recycling Initiative

As an added bonus, there is currently a bill on the table which would require manufacturers of solar panels sold in Washington State to plan and pay for a takeback and recycling stewardship plan for their equipment, or to participate in a national program. It’s fantastic to have a great state like Washington take measures to mitigate the environmental impact of the manufacturing industry.

How Much Would You Save?

If you were to maximize your savings in Washington it would look something like this: The gross cost of the system (equipment, labor, roofing, etc) is reduced 30% thanks to the federal tax credit. Should you choose an inverter and module made in Washington, you could earn upwards of $.54/ kWh until you’ve received a total of $5,000 from the state. On top of that, if you live in Chelan county, you could earn an additional $1.50. kWh. Finally, net metering offers the ability to reduce the actual cost of electricity from the grid, and depending on your consumption habits, could even reduce your electric bill to $0. All in all, it almost seems too good to be true. Nevertheless, the above programs will end within the next few years. Contact us today for a consultation and figure out exactly how much you could save.