Solar and Battery in Florida: Pros, Cons, and Incentives

If you’re thinking about powering your home with solar and battery in Florida, you could do a lot worse in terms of energy savings and preparing yourself for power outages. Like staying on the grid, for example.

Florida is nicknamed the Sunshine State for a reason. The entire state averages at least 4.75 peak sun hours per day, giving solar owners more bang for their buck than most states.

But it’s not just the abundant sun that makes solar worthwhile in Florida. In this article, we’ll cover the pros and cons of going solar in Florida, and explain the handful of solar and battery incentives that can maximize your return on investment.

Punch in your zip code above to see how much you can save by going solar in Florida.

Pros and cons of solar and battery in Florida

| Pros | Cons |

| Lots of sun = cheap solar power | No state rebates or tax credits |

| Backup power for frequent/long last outages | You can’t take solar/battery with you |

| Increased home value | Older population has less time to benefit from savings |

| Clean up Florida’s energy mix | High upfront cost |

| Strong net metering policy |

The pros of solar and battery in Florida

There’s a handful of reasons why Florida ranks third in the US for residential solar installations and has over 40,000 rooftop solar workers.

Let’s jump right in with the obvious one: Florida has the ideal climate for solar production and maximum solar savings.

Lots of sun equals cheap solar power in Florida

The biggest reason it’s worth getting solar panels in Florida is the abundant sun that increases production and maximizes the return on investment of solar.

According to the National Renewable Energy Lab (NREL), the entire state of Florida averages 4.75 or more peak sun hours per day.

In addition to abundant sun, the average temperature in Florida is just over 70 degrees – right in the sweet spot for optimum solar production – and regular rain cleans solar panels to keep them operating efficiently.

In other words, it requires fewer panels and less money to power a home in Florida than it does to power the same home in almost any other state.

Cost of solar and battery vs grid electricity in Florida

Let’s take a look at a real quote for solar and battery presented to a solar.com customer in Florida:

| Item | Amount |

| 7.6 kW solar panel system | $19,700 |

| 13.5 kWh Tesla Powerwall battery storage | $15,000 |

| Gross solar and battery project cost | $34,700 |

| 30% Residential Clean Energy Credit | $10,410 |

| Net project cost | $24,290 |

In Tampa, with an average of 5.67 peak sun hours per day, a 7.6 kW solar system can be expected to produce:

- An average 11,061 kWh of electricity per year over 25 years

- A total of 276,539 kWh of electricity over 25 years

If you divide the net cost of the project by the lifetime production, the cost per kilowatt-hour of home solar plus battery storage for this Florida customer comes to 8.7 cents per kWh. Without battery storage, it breaks down to 5 cents per kWh.

Even if you’re retired and don’t have the tax liability to use the 30% federal solar tax credit, solar and battery is still cheaper than grid electricity in Florida. The cost without the tax credit is 12.5 cents/kWh for solar and battery and 7.1 cents/kWh for solar only.

Now, let’s compare the cost electricity from home solar to the cost of grid electricity in Florida:

| Source of electricity | Cost of electricity (cents/kWh) | Cost per year for 11,061 kWh of electricity |

| Solar.com – solar only | 5 | $553.05 |

| Solar.com – solar + battery storage | 8.7 | $962.31 |

| Grid – Tampa-St. Petersburg-Clearwater* | 15.3 | $1,692.33 |

| Grid – Miami- Fort Lauderdale-West Palm Beach* | 16.2 | $1,791.88 |

| Grid – National average* | 16.7 | $1,847.19 |

Taken over the life of the system, solar electricity – even with battery storage – is substantially cheaper than grid electricity in Florida. Going solar also fixes your electricity costs at a low rate, while the price of grid electricity has increased on average 2.72% per year over the last 20 years.

Here’s how the cost of solar versus grid energy in Florida compares over 25 years:

For solar only, the break even point is between 6 and 8 years, and the total savings over 25 years is between $42,000 and $46,000.

For solar and battery, the break even point is between 11 and 13 years and the total savings over 25 years is between $32,500 and $35,500.

Now let’s see why it’s worthwhile to add battery storage to a solar project in Florida.

Florida has frequent and long lasting power outages

One of the primary benefits of battery storage is to provide backup power when the grid goes down. And Florida’s grid goes down more frequently and for longer periods of time than almost any other state.

According to MRO Electric’s analysis of Energy Information Administration data, between 2015 and 2019, Florida ranked:

- First for average downtime duration (14.6 hours per outage)

- 12 hours caused by major events

- Tied for fourth for the most frequent power outages (2.2 per year)

- 6 outages caused by major events

Major events – hurricanes, cyber attacks, and other anomalies – play a major role in the duration of Florida’s outages. But in the aftermath of Hurricane Ian, we’re learning that pairing solar and battery storage are rising to the occasion.

In Tampa, this Floridian describes his experience of powering his home with solar and battery during the 32-hour outage during and after Hurricane Ian hit in September 2022.

Further south, 200,000 homes in the solar powered community of Babcock Ranch all have full power while Fort Myers is all but devastated just 12 miles away.

Solar and battery can be a money-saver when the power is on, and a lifeline when the power is off. It can also increase the value of your home.

Solar increases home value in Florida

According to a study by Zillow, homes with solar panels sold for 4.1% more on average than comparable homes without solar in 2019.

In Orlando, that figure was 4.6% in 2019, adding nearly $11,000 to the sale price of the home.

It’s likely solar panels add even more to your home value in 2022 given the 20% rise in grid electricity prices since 2019 and ever-increasing interest in renewable energy among homebuyers.

Better yet, Florida has a 100% property tax exemption for solar panels and battery storage, which means even though solar and battery add value to your home, they won’t increase your property tax rate.

So even if you plan on moving before your break-even point, you can enjoy short-term energy savings and can recoup the cost of going solar through the sale of your home.

Home solar can help Florida clean up its energy mix

In 2020, Florida’s energy mix was around 75% natural gas, which is a nasty substance when it comes to greenhouse gas emissions.

Natural gas is mainly methane, a greenhouse gas with 80 times the warming effect of carbon dioxide. Before it’s even burned, natural gas accounts for 29% of methane emissions and 3% of total greenhouse gas emissions.

Once natural gas is burned, it emits carbon dioxide and particulate matter that contribute to climate change and local air pollution.

It’s ironic, then, that Florida is the most vulnerable state to sea level rise and extreme weather caused by climate change, yet it continues to rely on fossil fuels instead of renewable sources like solar to meet its energy needs.

By installing solar and battery, Floridians can help their state transition away from its reliance on fossil fuels in addition to reducing their electricity costs, providing backup power for outages, and increasing their home values.

Cons of going solar in Florida

There is clearly a lot of upside to owning solar and battery storage in Florida. But solar and battery storage are a major investment, so it’s worth considering the entire picture.

No state rebates or tax credits

Several states including California, New York, Massachusetts, and New Jersey offer substantial tax credits and rebates for solar and battery storage that can be used in addition to the 30% federal tax credit.

Florida is not one of these states. Although Florida’s residents and energy grid can benefit from more residential solar and battery – like California did during a record heatwave in September 2022 – the state does not offer any rebates or tax credits.

It does, however, have a solid net-metering policy and a few tax exemptions (which are different than tax credits) that apply to solar and battery. We’ll cover those further down.

You can’t take solar and battery with you

One thing to consider when going solar is that if you move – or evacuate – you can’t take the solar panels and batteries with you.

If you move, solar and battery stay with the old house. Although solar and battery add to your home value, there’s no guarantee that you’ll recoup the cost of the system in the sale. However, the longer you own the system, the more you’ll save and the more you’ll recoup or profit in a home sale.

In the case of extreme weather events, solar and battery are great backup power sources, but they won’t do much good if you evacuate or your home is destroyed. Solar panels are typically covered by homeowners insurance, but it’s important to check your exact coverage details if you live in an area at risk of hurricane and storm damage.

Florida’s older residents have less time to save with solar

To be frank, the older you are, the less time you have to accumulate long-term savings from switching to solar. And with a median age of 42, Florida has the fifth oldest population of any US state or territory.

Another issue is that Florida’s many retirees may not have the tax liability to apply the full 30% federal solar tax credit. Consult a licensed tax professional for advice regarding the solar tax credit.

However, solar isn’t always about long-term savings. By using a solar loan instead of paying in cash, you can save money immediately by replacing your electricity bill with a lower monthly payment on your solar panels.

And if you are older, perhaps you’re thinking about your legacy and what you’ll leave behind for your family and future generations. Solar and battery can add value to your estate and contribute to the clean energy transition required to mitigate climate change.

Upfront cost of solar

The biggest hurdle to solar and battery is the upfront cost. Even after the 30% tax credit is applied, a typical solar-only project costs between $10,000 to $20,000, and not everybody has that kind of cash laying around.

However, solar loans can help spread out this cost, which makes going solar more accessible. The trick is to find that balance of down payment and monthly payments that achieve your savings goals.

Solar and battery incentives in Florida

While the state of Florida doesn’t offer rebates or tax credits for solar and battery, it does have some solar-friendly policies.

Net metering in Florida

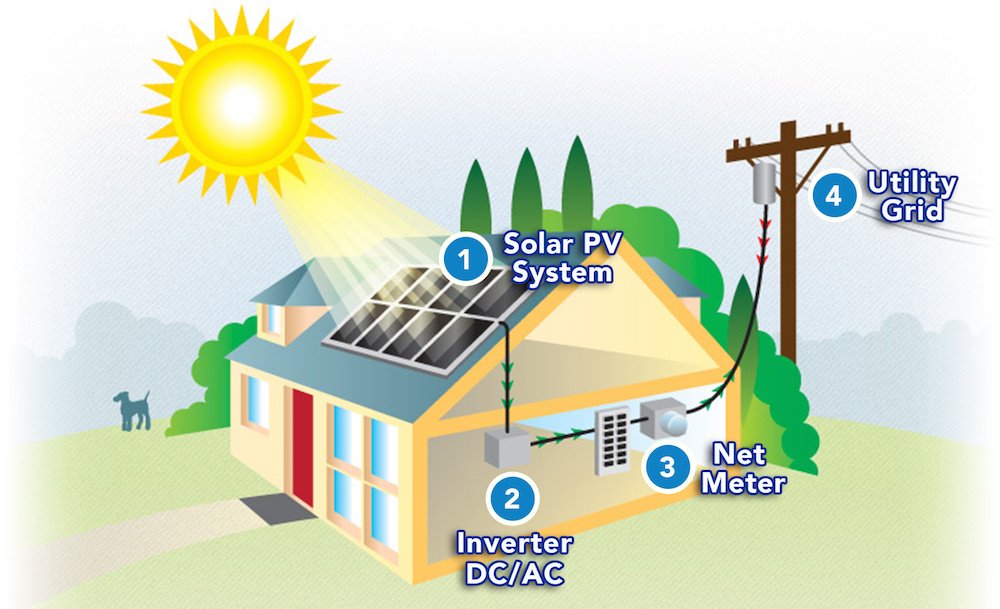

Net energy metering (NEM) – widely known as net metering – is a policy that allows solar owners to earn credit for putting excess solar production onto the grid that can be used offset the cost of the electricity pulled off the grid when panels aren’t producing.

How does net metering work in Florida?

Florida has a very strong net metering policy and most utilities pay a full retail rate for solar energy. That means for every kWh of solar energy you put on the grid fully offsets a kWh of electricity you pull off the grid.

Through net metering, solar owners essentially replace their electricity bill with payments on their solar system. Once the system is paid off, you’re paying for neither grid nor solar electricity and saving thousands of dollars per year.

Net metering was instituted statewide in 2008 and has had a tremendous impact on solar adoption. In April 2022, Florida Governor Ron DeSantis vetoed a bill that would have phased out Florida’s net metering incentives, citing the “steep increases in the price of gas and groceries, as well as escalating bills.”

Long story short: Net metering is here to stay in Florida and can be used to save tens of thousands of dollars on energy costs.

Florida solar tax exemptions

Although Florida doesn’t offer a state solar tax credit, it does have two tax exemptions that can maximize savings from home solar.

First, there is a sales tax exemption for solar energy systems in Florida that applies to:

- Solar collectors (panels)

- Pumps and controls

- Photovoltaic power conditioning equipment

- Energy storage units (solar batteries)

- Accessories integral to a qualifying system

For example, the sales tax rate in Miami is 7% (6% for the state of Florida and 1% for the county). On the $34,700 solar and battery quote we used above, that amounts to $2,429 in sales tax that customer doesn’t pay.

Then, there’s the property tax exemption we covered earlier in the article. To recap, solar and battery can increase the value of your home, but in Florida your property taxes won’t increase as a result of the value added by solar and battery.

This article does not consitute tax advice. Consult a licensed tax professional with questions regarding solar tax exemptions.

30% federal solar and battery tax credit

While this isn’t unique to Florida, homeowners in all states may qualify for the federal Residential Clean Energy Credit worth 30% of the cost of solar and battery expenditures.

In August 2022, the passage of the Inflation Reduction Act increased this tax credit from 26% to 30%, where it will stay until 2032.

Beginning in 2023, battery storage that’s not connected to solar will qualify for the 30% tax credit, as long as it’s above 3 kWh in capacity.

Is it worth going solar in Florida?

If you’re a fan of cheap electricity, increased home value, and a cleaner energy mix then it’s totally worth going solar in Florida. And if you pair your solar with battery storage, you’ll have backup power for Florida’s frequent and long-lasting power outages.

Thanks to abundant sun and a strong net metering policy, Florida is an ideal place to power your home with solar panels.

Of course, everybody’s energy goals are different and going solar is a major decision. Start by seeing how much you could save with our solar calculator.

Florida solar FAQs

Are solar panels worth it in Florida?

Solar panels are absolutely worth it in Florida. Ample sunshine, sales and property tax exemptions, a strong net metering policy, and frequent power outages make solar and battery storage a worthwhile investment in Florida.

Based on a real quote from solar.com, a 7.6 kWh solar system can pay for itself in 6-8 years. That leaves 17+ years of zero electricity costs and a cumulative savings around $45,000.

How much do solar panels cost in Florida?

Based on a real quote from solar.com, a 7.6 kWh solar system costs around $19,700, or $13,790 after the 30% federal tax credit is applied.

That breaks down to 5 cents per kilowatt-hour for electricity, which is much lower than the 16.7 cents per kilowatt-hour the average American pays for grid electricity.

How long do solar panels last in Florida?

Most solar panels are warrantied to last 25-30 years, but can continue producing electricity for much longer.

Exactly how long solar panels last depends on a variety of factors. But with abundant sun, mild temperatures, and regular rain, Florida has very favorable conditions for solar panels and long-term savings.

Do solar panels add value to your home in Florida?

Yes, solar panels can add to your home value in Florida and Floridians don’t pay property tax on the value added by solar and/or battery storage.

According to a study by Zillow, homes with solar panels sold for 4.1% more on average than comparable homes without solar in 2019. In Orlando, that figure was 4.6% in 2019, adding nearly $11,000 to the median home sales price.