New Jersey Solar Incentives in 2025

If fast-rising electricity prices weren’t motivation enough, New Jersey has a handful of solar incentives that can help homeowners maximize the energy cost savings of...

Read More

Massachusetts Solar Rebates & Incentives 2025

Sticker shock is often the biggest barrier to installing a home solar system and enjoying the energy cost savings that come with it. However, Massachusetts...

Read More

Massachusetts SMART Solar Program: 2025 Overview

Update: Due to rising utility rates, the SMART incentive for solar-only systems is $0/kWh in all MA territories. However, there is still value in the...

Read More

New Jersey Electricity Bills Set to Rise 20% in 2025 – Here’s...

New Jersey homeowners will soon see a significant increase in their electricity bills. Starting June 1, 2025, residential customers of major utilities—including PSE&G, JCP&L, Atlantic...

Read More

Going Solar on Long Island: Incentives, Savings, and Installation Companies

Long Island is known for bagels, beaches, and Billy Joel – but few people know that it’s also one of the best places in the...

Read More

Duke Energy PowerPair: Up to $9,000 for Home Solar + Battery in...

Duke Energy customers in North Carolina will soon have access to rebates worth up to $9,000 for home solar and battery systems. In May 2024,...

Read More

California Proposes Beefed-Up Solar and Battery Rebates for Low-Income Households

Low-income households in California may soon have access to one of the best solar and battery incentives in the country and an opportunity to drastically...

Read More

NYC Embraces Residential Solar Power in 2024 with Groundbreaking Policies

With residential solar incentives eroding across the country, New York City is one of the few places in the US getting more solar-friendly in 2024...

Read More

NYC Solar Property Tax Abatement Extended Through 2035. Here's How It Works.

With the stroke of a pen by Governor Hochul, the New York City Property Tax Abatement has been extended through 2035 and expanded to offer...

Read More

Going Solar in New York State: Pros, Cons, and Incentives

At first glance, New York State and rooftop solar don’t exactly feel like a natural pairing. The Empire State isn’t exactly known for sunshine, but...

Read More

What is NEM 3.0 and How Will it Impact California Solar Owners?

Updates regarding legal action seeking to overturn NEM 3.0: On May 4, 2023, three environmental groups filed a lawsuit seeking to overturn NEM 3.0 on...

Read More

Arizona's Net Billing Battle: What You Need to Know

Key takeaways: Arizona adopted a net billing program in 2017 to compensate solar owners for their excess production In October 2023, the Arizona Corporation Commission...

Read More

What Is the Austin Energy Solar Rebate and How Does It Work?

The benefits of home solar extend beyond the system owners. Rooftop solar provides clean energy with zero additional land use, and can be stored in...

Read More

The Benefits of Solar Panels in Fairfield County, Connecticut

Southwest Connecticut isn’t the sunniest corner of the world. But with some of the highest grid electricity prices in the nation, solar panels can go...

Read More

Are Solar Panels Worth It in Newark, New Jersey?

Newark isn’t the sunniest place in the US by a long shot, yet it consistently ranks in the top 20 cities for Watts of solar...

Read More

Newark: A Top 20 Solar City — You Got a Problem With...

In 2016, solar.com launched a series of profiles on the hottest solar states in the US, taking a look at why these cities have been...

Read More

Maryland's Battery Storage Tax Credit Explained

In 2018, Maryland became the first state in the country to offer an income tax credit for energy storage systems, putting the benefits of solar...

Read More

What Solar and Battery Incentives Does Maryland Offer in 2024?

With a healthy offering of solar incentives, Maryland is an underrated state for saving money with home solar panels. But with a combination of tax...

Read More

Connecticut Solar Incentives: Are Solar Panels Worth It in Connecticut?

Connecticut isn’t the sunniest state, but between solar incentives and high electricity prices, there’s plenty to gain by powering your home with solar panels. In...

Read More

New Jersey SuSI Program: Get Paid For Your Solar Production

What’s better than laying around and soaking up some sun? Getting paid to lay around and soak up some sun. While that’s a pipedream for...

Read More

5 Reasons to Go Solar in Massachusetts

Massachusetts is blessed with rich history, leading educational institutions, and successful sports franchises. And, thanks to local incentives and high electricity prices, Massachusetts is also...

Read More

Going Solar in Hudson Valley New York: Incentives, Savings, and Installers

New York’s Hudson Valley is known for its rich history and natural beauty, but it may not jump out as the best place for solar...

Read More

The Cost of Solar Panels Versus Grid Electricity in San Diego

With ample sunshine and some of the country’s highest grid electricity prices, San Diego is perhaps the best city in America for rooftop solar. In...

Read More

California Solar Incentives and Rebates: How to Maximize Your Solar Savings

With abundant sunshine and some of the nation’s highest electricity prices, it’s no wonder why over a million California homeowners have gone solar. Rooftop solar...

Read More

Solar and Battery in Florida: Pros, Cons, and Incentives

If you’re thinking about powering your home with solar and battery in Florida, you could do a lot worse in terms of energy savings and...

Read More

California Senator Wants to Require Solar Installations on All New Roofs

Scott Wiener, a recently elected California State Senator, is on a mission to make the state the first in the country to mandate solar installation...

Read More

Going Solar in Westchester County: Incentives and Local Installers

Westchester County may not be synonymous with solar panels quite yet, but there may not be a better place in the country for homeowners to...

Read More

The Top 4 Home Solar Policy Developments of 2017

The North Carolina Clean Energy Technology Center just released its comprehensive The 50 States of Solar: Q1 2017 Quarterly Report. It provides a detailed...

Read More

Wisconsin Solar Incentives and Benefits

On the surface, solar energy and Wisconsin may seem to be an odd couple, but they’re actually a near-perfect match. Wisconsin has shown and still...

Read More

Minnesota's Solar Incentives and Benefits Are Better Than Ever

Minnesota has historically relied on unstable fossil fuels for electricity. However, as concerns over localized pollution and climate change have risen in the land of...

Read More

It's Time To Go Solar in Washington

If you are a homeowner anywhere in Washington state, you are sitting on an untapped goldmine of opportunity. You’ll be happy to hear that Washington...

Read More

It's Time to Consider Going Solar in Rhode Island

The future looks bright for going solar in Rhode Island. The State’s Renewable Energy Fund (REF) is incentivizing solar energy investments throughout the State through...

Read More

5 Things to Know About Going Solar in Con Edison New York

So, you’re a Con Edison customer in New York looking into home solar. Good news: You’re located in one of the best areas for solar...

Read More

The California Solar Mandate: Everything You Need to Know

Many states are paving the way towards a cleaner, emissions-free, and sustainable future. They are actively addressing climate change and innovating new solutions to fit...

Read More

Solar Renewable Energy Certificates (SRECs) in New Jersey

Updated: As of August 2021, Solar Renewable Energy Certificates (SRECs) are distributed through New Jersey’s Successor Solar Incentive (SuSI) Program and are known as SREC-II’s....

Read More

What is California's Solar Bill of Rights? Here's Everything You Need to...

California state leaders keep proving again and again that the Golden State is the best state for solar and clean energy innovation. First, state regulators required...

Read More

2018 Midterm Election Results: Renewable Energy Wins and Losses

There was so much to follow in the 2018 midterms. Overall, we’d consider the election results in a step in the right direction towards a...

Read More

BREAKING: California Governor Signs SB100 for 100% Renewable Power by 2045

California legislators are making strides in fulfilling their commitment to electricity generated from zero-carbon sources. The new deadline? 2045. After Governor Brown’s signature today, Senator...

Read More

Mayor Garcetti and LADWP Launch New Attic Insulation Incentive

There’s no question that Los Angeles is heating up. Increasingly frequent heat waves, wildfires, and power outages throughout the greater Los Angeles area have put excess...

Read More

How Net Metering Policies Work in Florida

Net energy metering (NEM) is a system that has been in place for over a decade across multiple states in the US and has provided...

Read More

Solar Policy Update - The Latest Home Solar Laws in Florida

Solar has been getting a lot of attention in the past couple of years in Florida, and there is a reason why. Not only has...

Read More

2018 Solar Incentives, Rebates, and Pricing in Florida

With the nickname “The Sunshine State,” you would think that Florida would be one of the best states in the country for going solar....

Read More

California SGIP Home Battery Incentive Tiers Fill and Rebates Drop

California was a dark place (sometimes) in 2000 and 2001. The sunny state was experiencing power blackouts due to demand overload on the grid....

Read More

Solar Tariffs Update 2018: Protecting American Solar Jobs Act

You probably heard about the solar tariffs when they made headlines earlier this year. There’s a new update worth mentioning. The Protecting American Solar...

Read More

California Will Require Solar for New Homes

California just took a major step forward in their renewable energy effort by becoming the first state in the US to require new homes and...

Read More

What is Net Energy Metering for Solar?

Net energy metering (NEM) is a system that allows solar panel owners to store their solar energy in an existing electrical grid. Through NEM, a...

Read More

Con Edison’s Megawatt Block Incentive is Lowering Soon

Since 2014, Con Edison has given its customers in New York access to NY-Sun’s Megawatt Block Incentive, which gives solar panel owners a rebate based...

Read More

The Three Steps to Going Solar in San Francisco

If you live in San Francisco, you’ve no doubt seen the blossoming solar network around you. The process of switching to solar energy might seem...

Read More

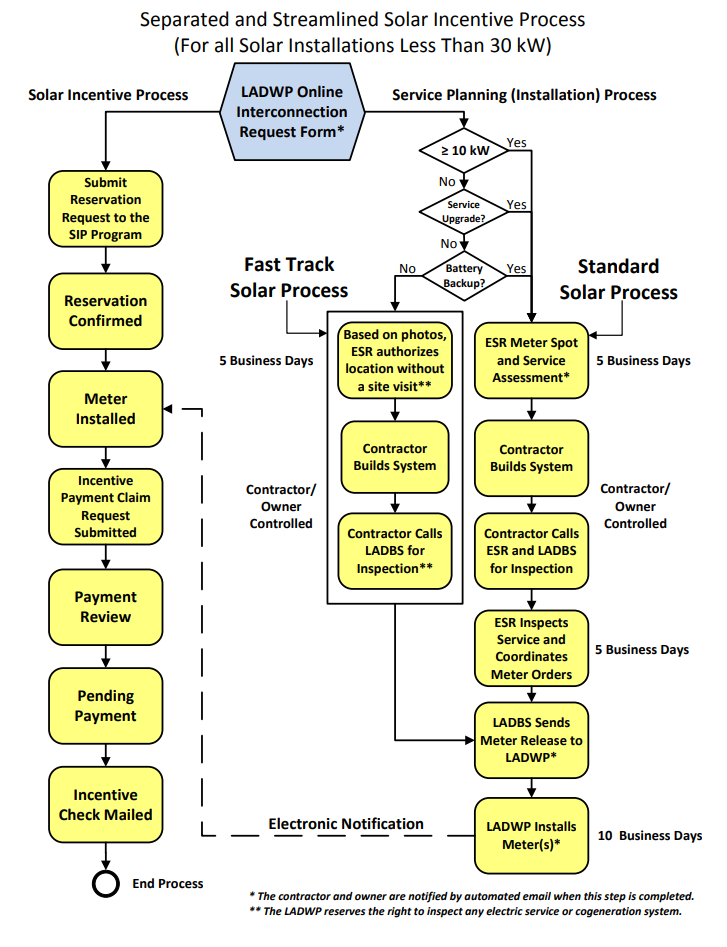

First Steps to Go Solar with LADWP

LADWP wants to encourage Angelenos to choose clean energy. Solar energy contributes to a healthier city and supports the burgeoning local solar industry. If you...

Read More

Free Home Energy Improvements from Los Angeles DWP

The Los Angeles Department of Water and Power will work with eligible customers to upgrade their home electricity and water efficiency for free. Does it...

Read More

New York's Ambitious Renewable Energy Goals

As the federal government has shied away from confronting climate change, the responsibility is starting to fall on the individual states and their own climate...

Read More

Home Solar Rebates in California - 2017 Update

Solar rebates save. They take the edge off the initial investment of going solar, which leads to even more savings on energy costs. In fact,...

Read More

Save Big by Going Solar in Washington State

Washington State recently announced major changes to their solar incentive programs that will go into effect this October. While some incentives have been discontinued, new...

Read More

Going Solar in Washington State is a No-Brainer

UPDATE: For our latest article on Washington incentives, please visit here. Amidst newly announced incentive programs, solar in Washington is hot right now. I know...

Read More

3 New York Solar Incentives At Risk of Running Out in 2024

What New York lacks in sun, it more than makes up for with incentives that reduce the cost — and increase the savings — of...

Read More

It's Time to Consider Going Solar in Washington D.C.

DC has become one of the most attractive areas to go solar. Here’s why: Washington DC has experienced a sustained SREC (Solar Renewable Energy Credit)...

Read More

LA County's New, Cheaper Energy Option for SoCal Edison Customers

Southern California Edison (SCE) ratepayers in Los Angeles County soon will have a different method of getting electricity — from a new government-executed energy...

Read More

Oregon Solar Incentives and Benefits

Are you a homeowner in Oregon who is considering making the move to solar? If you answered yes to this question making the switch to...

Read More

The Nuts and Bolts of California's Self Generation Incentive Program

California is taking a bold step toward solar energy self-consumption. On May 1st, California will accept applications for a limited time rebate program that rewards...

Read More

Solar Rebates in California: Full Breakdown

When thinking about solar, it is important to know that the price of solar has been decreasing year after year, making the idea of...

Read More

Time of Use Rate Impact on Residential Electricity Costs: A Southern California...

Southern California Edison (SCE), one of California’s three biggest investor-owned utilities, has created optional Time of Use rate schedules for residential customers. The new schedules...

Read More

San Jose: #5 Best Solar City in the US

This month, Solar.com is launching a series of profiles on the hottest solar cities in the US. We’ll take a look at why these...

Read More

Four Shots at a Solar Revival in Nevada

There’s no sugarcoating what happened in Nevada late last year. State regulators slashed rates for supplying solar energy to the grid, rates that homeowners expect...

Read More

Party for Solar Incentives

The industry association for solar companies is looking for a new CEO. Here at Solar.com, we’ve got a little advice for the next commander in...

Read More

California Net Metering 2.0 Update

This afternoon, the California Public Utilities Commission (CPUC) released an updated proposed decision on Net Energy Metering (NEM) 2.0. Here are the key takeaways from...

Read More