In the last year, nearly two-thirds of solar.com customers paired their solar panels with a home battery energy storage system (aka BESS). Why? Because home battery storage has something to offer everyone—from backup power to bill savings to self-reliance.

With this in mind, there is no single “best” battery. There are different solutions to meet the varying requirements and needs of homeowners across the country.

In this article, we’ll explore some of the best home battery storage products on the market today and what to look for in a battery storage system. To find a solution that best meets your needs, consult a solar.com Energy Advisor to review custom designs, proposals, and savings estimates.

Jump to a topic:

- What can home battery storage do for me?

- Best solar batteries of 2026

- Solar battery features

- How to choose the best battery for your needs

- Battery pricing in 2026

- Frequently asked questions

What Can Home Battery Storage Do For Me?

While primarily known for providing backup power during grid outages, home battery storage can also improve the economic and environmental benefits of home solar. To find the best battery for your home, start with a goal. What problem are you trying to solve? There are three main use cases for adding a battery storage system to your home.

Time-of-Use Shifting

Sometimes called solar arbitrage or load shifting, Time-of-Use shifting allows you to capture the excess power your solar array generates relative to what your home is consuming. It then banks this power and discharges it in the late afternoon or early evening when utility rates are typically higher and your solar array isn’t producing as much.

This cost-saving strategy also works well in areas where the net metering or buy-back rate is less than your purchase rate, and is especially true in California under NEM 3.0.

Self-Consumption

Some areas and utilities don’t actually allow solar generators to send power back to the grid. Or, if they do, they provide no value for it. In this instance, battery storage acts like a giant sponge to soak up your excess generation and discharge it in your home later to avoid buying power from your utility provider.

Many homeowners also enjoy the independence and environmental benefits of storing and using their own electricity, instead of swapping their solar electricity for dirty kilowatt-hours from the grid.

Resilience

With power outages from natural disasters such as hurricanes, earthquakes, fires, and ice storms occurring with greater frequency, almost every area of the US experiences periodic grid outages. And, unless you have a specifically configured system called “sunlight backup,” your solar array will shut down if there’s a grid outage (this is to code for the safety of line workers working to re-establish power). Because of this, many homeowners choose to add a battery to provide an element of resiliency to their project so they can keep food at safe temperatures, have some lights at night, and be able to keep their phones charged.

Need to dial in your home energy goals? Connect with a solar.com Energy Advisor to explore your home’s potential for savings and self-reliance.

Best Solar Batteries of 2026

Evaluating the best home battery storage system goes beyond published specifications. The solar.com team also considers pricing, the bankability of the manufacturer, and the controlling software, as the best battery hardware is useless without operating control software to tell it what to do. And, as discussed above, different battery use cases will dictate what capacity (size) and capabilities you’ll want to look for when selecting a home battery storage system.

Quick tip: If you’re unfamiliar with some of the technical terms, we left a handy guide below!

It’s also important to note that some utility providers offer generous rebates for homeowners to install a home battery system that’s on their approved list, and not every battery qualifies for every program.

Because there’s no perfect battery for every solution, here are the battery storage systems that solar.com Energy Advisors find work well with homeowners who invest in solar and battery.

Tesla Powerwall 3

From a hardware and software perspective, the Tesla Powerwall 3 is an outstanding product. Building on the successful prior generations of Powerwalls, Tesla continues to pack a lot of value in a high-feature set, high-capacity product. Because the Powerwall 3 has an integrated inverter built in, if you install a Powerwall 3 with your solar array, you can eliminate the need for a standalone solar inverter.

Tesla Powerwall 3 tech specs

| Feature | Measurement |

| Usable capacity | 13.5 kWh |

| Peak power | 185 LRA (75% higher than Powerwall 2) |

| Continuous power | 11.5 kW |

| Warranty | Up to 10 years |

| Round-trip efficiency | 90% |

| Depth of discharge | 100% |

Things to consider about the Powerwall 3

Since its debut, the Powerwall 3 has been in high demand and, in some instances, has been difficult to source. In early 2026, these supply chain issues appear to be resolved.

Enphase IQ 5P

The leading inverter company, not surprisingly, offers a fantastic home battery storage solution in the Enphase IQ Battery 5P. This smaller capacity battery comes in at a lower price point than larger capacity competitors, and can often get the job done in Time-of-Use shifting applications for bill savings. And, the Enphase app provides powerful insights in a user-friendly format.

Enphase IQ 5P tech specs

| Feature | Measurement |

| Usable capacity | 5 kWh |

| Peak power (3 seconds) | 7.68 kW |

| Continuous power (with solar) | 3.84 kW |

| Warranty | Up to 15 years |

| Round-trip efficiency | 90% |

| Depth of discharge | 98% |

Things to consider about the Enphase 5P

The downside is, of course, lower capacity means less availability for power if the grid goes down. But, if you live in an area with a relatively stable grid that isn’t prone to long-duration outages, the 5P might just get the job done. And, if you like the Enphase ecosystem but the 5P is too small? Enphase offers a 10C battery, which offers higher capacity.

Franklin aPower2

Franklin is a relatively new entrant to the home battery storage space but has quickly cemented its position as offering a sleek all-in-one package that’s simple to install and provides “whole home” backup. What makes Franklin’s aPower2 a great option for resiliency applications is that it can be integrated with almost every solar inverter (great if you already have solar and want to add battery storage), AC power generator, or the grid itself.

The aPower2 is a 15kWh capacity battery that offers 10kW of continuous output, which means you can power just about anything as long as you have enough charge in the battery. The aPower2 is controlled by the aGate, which runs your charge and discharge algorithms, and feeds information to Franklin’s well-designed app.

Franklin aPower2 tech specs

| Feature | Measurement |

| Usable capacity | 15 kWh |

| Peak power | 15 kW (10 seconds) |

| Continuous power | 10 kW |

| Warranty | Up to 15 years |

| Round-trip efficiency | 89% |

| Depth of discharge | 100% |

Things to consider about the Franklin aPower2

Quoted prices are typically at the high end of the spectrum, which makes the solution from Franklin a premium choice. And while it does offer a premium user experience and feature set, the extra cost might not be warranted in all applications. Franklin is also a relatively new company, and so we have to flag whether they can survive long-term to continue to operate the app and provide warranty support. While there are no known financial issues today (they’re privately held), the home battery storage space is notoriously challenging.

Solar Battery Features

Frankly, there is a lot to consider when choosing a solar battery. The industry jargon doesn’t help, and neither does the fact that most battery features are things we don’t think about on a daily basis.

So, in this section, we’ll give a brief summary of some common battery terms and what they mean.

AC vs DC-coupled

It’s important to understand the difference between Alternating Current (AC) and Direct Current (DC) batteries because DC batteries, while more efficient, can be challenging to add to an existing solar system.

This is due to differences in which type of power is generated, stored, and used in each system, shown in the table below.

| System | Type of current |

| Solar panels | Produce DC power |

| Batteries | Store DC power |

| Home (lights, AC, fridge) | Use AC power |

| Utility grid | Distributes AC power |

Existing solar systems typically have solar inverters, which change the DC power produced by panels to AC power that can be consumed in your home or exported onto the grid. But if you want to store that AC power in a battery, it needs to be inverted again to DC power. Each time the power is inverted, a little bit is lost during the inversion process (hence the lower efficiency of AC-coupled systems).

In a DC-coupled system, the DC power produced by the panels can be directly stored in the battery and inverted only once to be used in your home or exported to the grid.

Round-Trip Efficiency

Related to AC vs DC coupling, round-trip efficiency is a measure of how much of the original power put into the power can be retrieved later on.

As we mentioned above, a small amount of power is lost each time it is inverted from AC to DC, or likewise. So, for AC-coupled systems with multiple inversions, efficiency is typically around 85-90%, while DC-coupled systems with fewer inversions can boast up to 97.5%.

If you plan to use your battery on a daily basis to charge an EV or avoid peak time-of-use rates, small differences in efficiency can really add up.

Types of Solar Batteries

The next thing to consider is the composition of the battery. Every battery on our list is either lithium-ion or lithium iron phosphate (LFP). While similar, the differences are noteworthy. LFP batteries typically have longer lifespans and increased thermal stability (aka less heat and fire risk). They also do not use nickel or cobalt, which can be toxic and dangerous to mine.

Learn more about the different types of home battery storage here.

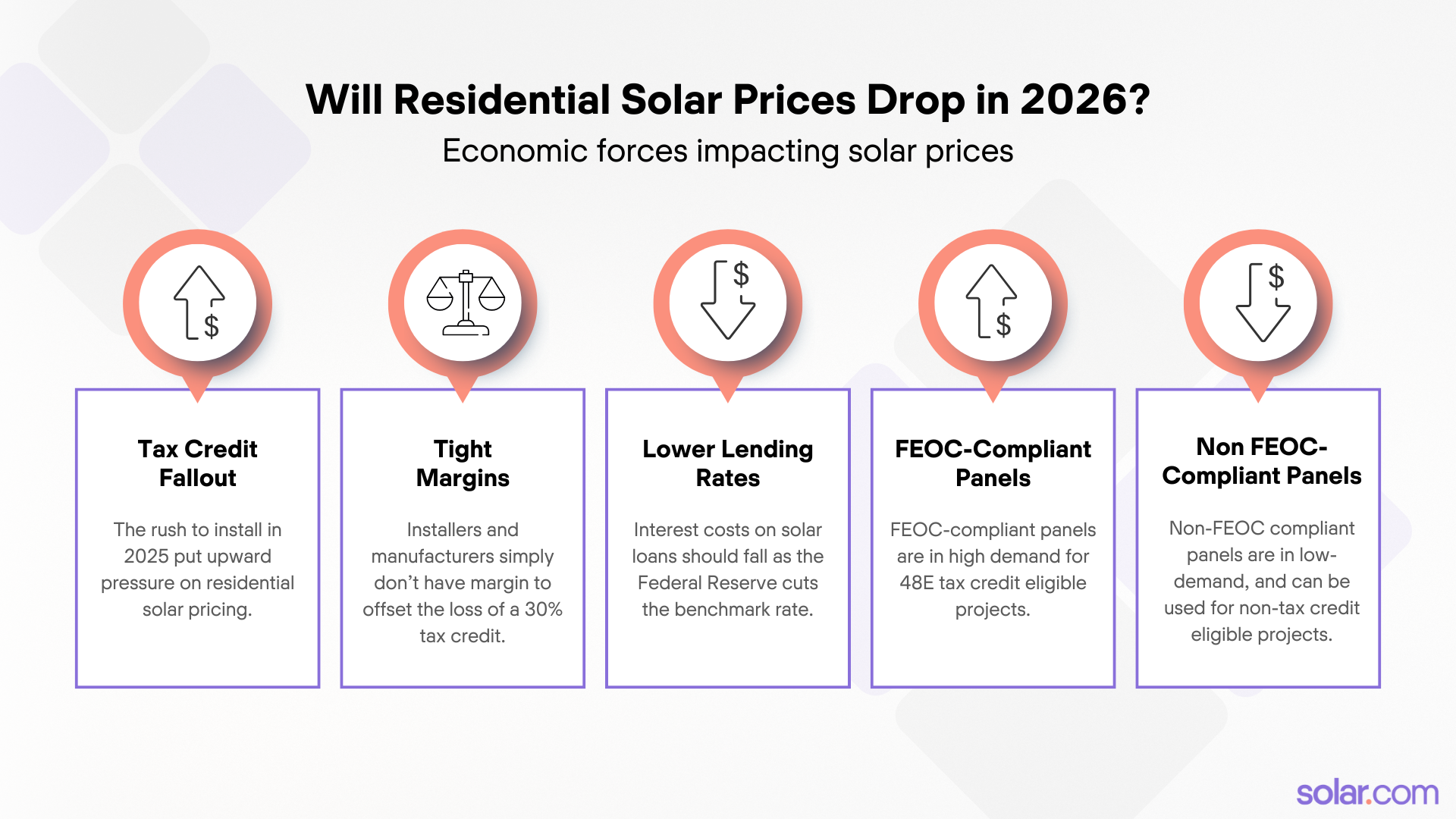

Batteries can also be categorized as backup versus consumption-only.

Traditionally, the main feature of solar batteries was to provide backup power for grid outages. However, as net metering policies are weakened and removed, there is a growing demand for batteries that allow homeowners to save money by storing and using their own solar production without providing backup power – known as consumption-only or non-backup batteries.

Why would anyone want this? Well, the components, programming, and labor that go into providing backup capabilities are expensive, and removing these things can reduce the cost of a battery by 20-30%.

So, consumption-only batteries enable all of the bill savings of a traditional backup battery at around 75% of the upfront cost – which can be well worth it for homeowners who aren’t concerned with grid outages.

Peak and continuous power

Most batteries feature two numbers that represent their capacity to provide power.

Peak power is the measure of the battery’s ability to handle surges of power, like when an air conditioner turns on. This is a short burst of energy that can typically only be sustained for 10 seconds or so.

Continuous power is a measure of how much output the battery can sustain over long periods of time. This figure is especially important if you plan on using a battery for backup power during grid outages.

Usable Capacity

Usable capacity is a figure that represents how much power you can draw from your battery at one time. This is different from the nameplate capacity, which represents the total amount of power a battery can store.

The key difference is that draining a battery all the way down to 0% can damage the system and reduce its lifespan. It’s typically recommended to leave at least 10% of the nameplate capacity in the battery at all times to prevent damage, hence the term “usable capacity.”

Depth of Discharge (DoD)

Depth of Discharge is the manufacturer’s recommendation for how much power you can pull from the battery at one time relative to its total capacity. This figure ranges from 84% to 100%. Some manufacturers say “go ahead and empty the tank,” while others say it is best to keep a minimum charge of 16%.

Battery Warranties

Like solar panels – and everything else – batteries naturally degrade over time. Battery warranties guarantee a certain level of performance over a stated time frame.

For example, every battery on our list has a warranty guaranteeing that it will have 70% of its original usable capacity available after 10-15 years or a certain level of usage (measured in throughput capacity or cycles), whichever comes first.

How to Choose the Right Solar Battery for You

As we’ve shown above, not all solar batteries are created equal, and the best battery is the one that serves your needs. So, it’s important to begin your search with some goals, beginning with your energy needs.

Assessing Your Energy Needs

In 2026, there are several reasons to want battery storage for your solar system. These include:

- Backing up essential systems for outages (lights, refrigeration, Wi-Fi, medical devices)

- Backing up your entire home (air conditioning, EV charging, heat)

- Load shifting to reduce your energy bill

- Reducing your carbon footprint as much as possible

- Adopting new and pioneering technologies

Your energy goal(s) will play a big part in dictating the best solar battery for you. For example, if your primary goal is bill savings, then you will likely be shopping for smaller batteries than if your goal is to back up your entire home.

Comparing Battery Specifications

Once you’ve used your energy goals to narrow down a few brands and models, take a deeper dive into the specifications. If you’re comparing backup batteries, pay attention to usable capacity and continuous power. If you’re comparing self-consumption batteries that will charge and discharge every day, focus on efficiency.

Evaluating Battery Warranties

Finally, if you’re having trouble deciding between two battery models that check all your boxes, use the warranty offerings as a decision-maker. While the goal is to never have to use your warranty, it can be worth the peace of mind to have a more robust guarantee on your side.

What is the estimated cost of solar battery systems in 2026?

Solar battery cost in 2026 can range from $1,000 to $2,000 per kilowatt-hour (kWh) of storage capacity, before incentives are applied. So, for a 10 kWh battery (considered average size), prices can range from $10,000 to $20,000 fully installed.

Battery storage pricing can vary quite a bit based on the brand, model, and its capabilities. One major battery pricing factor is whether the battery is installed at the same time as solar, or on its own. Installing solar and battery together cuts down on the soft costs (permitting, inspection, labor, etc.) that make up a significant portion of installation costs.

What are the installation costs associated with solar battery systems?

Installation costs typically make up 5-10% of the overall battery project costs. This includes specialized labor for mounting the battery, installing subcomponents (control box, inverter, sub-panel), and configuring the system to receive and distribute power.

Recent advancements in battery technology have helped bring these costs down. For instance, battery systems with a “meter collar” or “backup switch” cost far less to install because there are fewer components to configure, which cuts down on labor and material costs. The same is true for “consumption-only” batteries that enhance the economics of rooftop solar, but do not provide backup power during grid outages.

Conclusion

Let’s face it: Choosing a solar battery can be daunting. However, by starting with your energy goals and focusing on two or three batteries that check your boxes, it can be much easier to identify a storage system that meets your needs.

Solar.com’s best solar batteries of 2026 are a great place to start. If you’re ready to compare prices, connect with an Energy Advisor to see exactly how much solar batteries cost through installers in your area.

Solar Battery FAQs

Which batteries are best for solar systems?

Solar.com’s top choices for best solar system batteries in 2026 include the Tesla Powerwall 3, Enphase IQ 5P, and the Franklin aPower2. However, it’s worth noting that the best battery for you depends on your energy goals, price range, and whether you already have solar panels or not.

Which is the best solar battery company?

Some of the best solar battery companies in 2026 include Tesla, Enphase, and Franklin. These companies all have a track record of producing quality products and offer some of the most robust warranties on the market.

Which solar batteries last the longest?

Since solar batteries are a relatively new technology, we are still waiting to see which batteries last the longest. In 2026, you’ll see battery makers offer up to 15-year warranties, but it’s worth paying attention to how many cycles or power output are tied to those warranty lengths.

What’s the difference between lithium-ion and lead-acid batteries?

Lithium-ion batteries are lighter, more efficient, and last longer than lead-acid batteries, making them ideal for solar and home energy storage. Lead-acid batteries cost less upfront but have shorter lifespans, lower efficiency, and require more maintenance. Overall, lithium-ion offers better performance and long-term value, while lead-acid suits lower-cost, short-term applications.