Trump’s One Big Beautiful Bill is Now Law: How it Impacts Solar

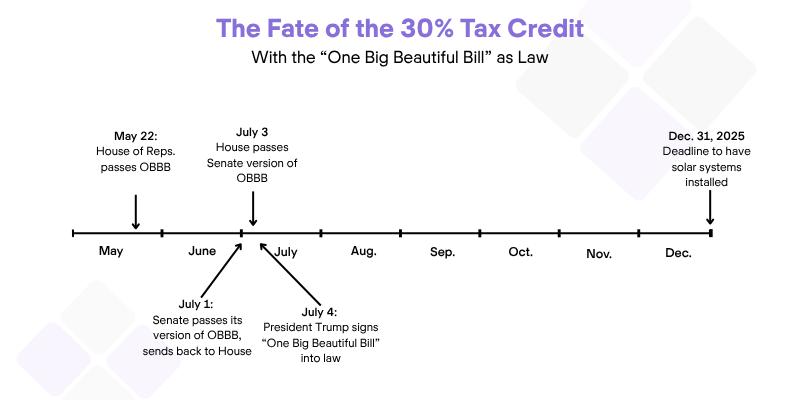

On July 4th, Donald Trump signed his megabill—called the “One Big Beautiful Bill” or OBBB for short—into law. The OBBB solar provisions and implications are vast. With the preface that solar.com is not providing legal or tax advice, here’s what you need to know about this Megabill’s direct and indirect impacts on residential solar.

Solar.com’s One Big Beautiful Bill Resource Center:

- FAQs about the OBBB

- Homeowner guide to going solar in the OBBB rush

- What homeowners need to know about leasing solar post-OBBB

- Archive: tracking the OB3 through the House and Senate

Big Beautiful Bill Summary: What Does it Mean for Solar?

The headline change to solar from the OBBB is that the 30% solar tax credits will be ending soon. However, there are important distinctions between the different types of tax credits and their phase-out schedules.

The 30% Consumer Solar Tax Credit (25D)

The consumer claimed tax credit under Section 25D is going away at the end of 2025. These credits are claimed by consumers who own their own solar array (and/or battery storage system), either by paying cash or financing it through a loan. The language in the bill specifically states that “expenditures made” after December 31, 2025 are not eligible to be claimed on individuals on their federal tax returns.

The current understanding (confirmed by the IRS on August 21) is that the system must be fully installed by the end of 2025 to qualify for this credit before it’s gone—signing a contract or placing a deposit is likely insufficient to meet the “expenditures made” threshold. Our team is seeking legal guidance to clarify this point, but for now, it’s safest to assume installation must be complete by December 31 to qualify.

Practically, this means that homeowners interested in going solar and owning their array should start their project as soon as possible and carefully vet whether their selected contractor can complete the project before the end of the year. The typical “contract to installation” cycle is around 3 months. But in some parts of the country, permitting can take significantly longer and installation times can push 6 months from contract signing—which means it might already be too late, in some areas, to go solar and claim the tax credit.

Many sales originators and installation companies have been reporting record homeowner demand for solar as the OBBB worked its way through the House and Senate. This increased demand will also strain installers’ ability to complete projects by the end of the year.

Solar Tax Credits for Leases, PPAs, and Businesses (48E)

The business tax credit for solar, claimed under Section 48E ends at the end of 2027, but with an important distinction. Homeowners who want to go solar and access the tax credit but aren’t able to have their project completed by the end of 2025 still have an opportunity to enter into a Third-Party Ownership (TPO) arrangement. TPO solar is typically in a lease or Power Purchase Agreement structure where a business owns the solar array and sells the power back to the homeowner, either at a fixed rate (lease) or on a per kWh basis (PPA).

Since the solar array is owned by a third party, they claim the tax credits under section 48E, which stays open until the end of 2027. The value of the tax credit (and depreciation), which is claimed by the TPO, reduces the cost of the lease or PPA. So while the 25D tax credit can’t be claimed by homeowners directly after 2025, entering into a TPO structure still allows homeowners to benefit from the 48E tax credit.

Review solar.com’s consumer guide to leases with the One Big Beautiful Bill as law.

The 48E “loophole” for residential solar

Since tax credits for Third-Party Owned residential solar are claimed under the same section of the tax code as very large solar projects, they benefit from the same tax treatment. The OBBB contemplates that the “mega” projects take years to develop and construct, so ending the tax credits clean at the end of 2027 would likely strand billions of dollars of investment and would have serious negative impacts on the electric grid. Interconnection queues in the US are filled with far more solar than any other type of generation technology, and society needs that power.

The loophole allows for projects that Commence Construction prior to one year after the bill is signed (July 4, 2026) up to four years to place the project in service to claim the tax credit. This is known as a safe harbor rule, and largely applies to utility and commercial-scale projects that can take years to complete.

There are a few ways for companies to demonstrate they’ve Commenced Construction prior to the end of 2027, and residential solar companies will likely utilize these strategies to continue to offer tax credit advantaged leases and PPAs post 2027. Why does this matter? Investing in solar is a significant commitment, and having confidence the manufacturers and installers involved in your project are around to support the installation is important. This extra runway will help create a glide path for parts of the industry to evolve into a post-tax credit economic model.

On July 8, President Trump issued an Executive Order directing agencies to deliver a report regarding safe harboring rules within 45 days, specifically relating to how the Treasury defines “commence construction.” Until that report is delivered, there will be some uncertainty around the “commence construction” milestone, and which projects will qualify for extra time to be placed in service. Given the faster construction cycle for residential leases, this Executive Order likely won’t have much effect on homeowners.

Energy Storage Tax Credit Retention

Energy Storage Systems (ESS) or batteries retained their tax credits under 48E (third-party owned) through 2033 before a phase-out occurs. This is the same tax credit phase-out schedule for nuclear, geothermal, and hydro. However, these projects must comply with FEOC rules (see below).

The preservation of ESS tax credits under 48E helps protect homeowners who invest in solar today but may face utility rate changes in the future that devalue solar exported back to the grid. Having the option to install a battery through a lease arrangement at a later time will help preserve the value of solar. (Note – it’s always better, and more cost-efficient, to install both solar and ESS at the same time, when possible).

Manufacturing Tax Credits (45X)

The US has seen a renaissance in US manufacturing since the IRA was passed, with factories capable of producing over 50 GW of annual solar panel production either brought online or under construction. These factories created billions of dollars in economic investment and created, collectively, tens of thousands of jobs. The OBBB acknowledged these facts and preserved the 45X solar tax credits through 2032.

However, a lot of factories were placed in the US by Chinese-owned or controlled companies, and those factories will likely lose access to the 45X credits under FEOC restrictions.

While this has lower relevance to homeowners than the consumer-facing tax credits, it’s important to consider whether the company and factory supplying the technology to an individual’s project will be able to support warranty claims for the life of the system.

Restriction of Tax Credits that Benefit Foreign Entities of Concern (FEOC)

One of the major changes to energy tax credits under the OBBB compared to the IRA is the restrictions on Foreign Entities of Concern from benefiting directly or indirectly from US taxpayer support. The FEOC rules are complex and voluminous, impacting both the supply and demand parts of the value chain. Simply put, an FEOC country is a “Foreign Entity of Concern” and, for practical application in the solar industry, effectively references Chinese companies.

For homeowners rushing a project in during 2025 to claim the consumer tax credit under 25D, there is no direct implication to FEOC rules for projects. However, homeowners should be considerate of whether factories and companies will stay in the US market after the restrictions take effect. Simply having a US entity operating a US factory is insufficient in the long-term, as it also considers whether the company has FEOC debt or equity above certain ratios, FEOC nationals as Executive members, rely on intellectual property from FEOC companies, whether its principle place of business is in a FEOC country, or other metrics defined by the law.

Even non-FEOC companies face FEOC restrictions under “material assistance” rules, which phase in starting in 2026 and examine the percentage of FEOC subcomponents in a project relative to non-FEOC components.

The good news is that businesses monetizing the tax credits under Section 48E will run the audits and take the risks on claiming tax credits under the complex FEOC restrictions.

Solar Thermal Tax Credits

Tax credits to support solar thermal applications (hot water) are ending for both consumer (25D) and business (48E) claims.

Energy Efficiency Tax Credits

Section 45L or consumer tax credits for energy efficiency projects end at the end of 2025 under the OBBB. Homeowners with older or less efficient homes may want to consider making efficiency upgrades prior to the end of the year.

EV Tax Credits Ending

New and used tax credits for purchasing an electric vehicle end on September 30, 2025 in an accelerated phase-out of the tax credits to encourage consumers and businesses to adopt electric vehicles.

A Final Note

The solar.com editorial team has gone to great lengths to provide accurate information in simple-to-understand language. See something we missed or find an error? Please CONTACT us at newsroom@solar.com. If you’re doing research on the OBBB and found this article helpful, please link back to this article to help others find it.

And finally, we believe informed homeowners make smarter solar decisions. The biggest compliment you can make is by getting no-obligation binding quotes for your home solar projects via solar.com. We never sell or remarket your information. You’ll be assigned a dedicated Energy Advisor to help you navigate the process with the same care and trust we hope we’ve earned through producing content like this.