Solar Pricing in 2026: Are Costs Going Up or Down?

With the start of 2026, there are a few substantial changes to the residential solar industry, mainly driven by the passage of Trump’s “One Big Beautiful Bill,” that homeowners need to be aware of:

- The ending of the consumer-claimed 30% federal solar tax credit.

- New rules relating to minimizing the use of components from Chinese components for corporate-owned projects, which can still qualify for the 48E tax credit for a limited time (this is relevant for leases, PPAs, and prepaid products).

With tectonic shifts in energy policy, one of the big questions both homeowners and industry professionals are wondering is what will happen to solar installation pricing as we enter 2026?

Learn more about the “One Big Beautiful Bill” and “Third-Party Owned” solar products that remain eligible for a federal tax credit in 2026.

One Big Beautiful Bill articles:

- Trump’s One Big Beautiful Bill is Now Law: How it Impacts Solar

- FAQs About Solar and Trump’s One Big Beautiful Bill

TPO Solar articles:

- Prepaid Solar Leases & PPAs: A New Path to Owning Solar

- Leasing Solar Panels: The Complete 2026 Guide

- Solar PPA: The Simple Guide to Power Purchase Agreements in 2026

Will Solar Prices Go Down in 2026?

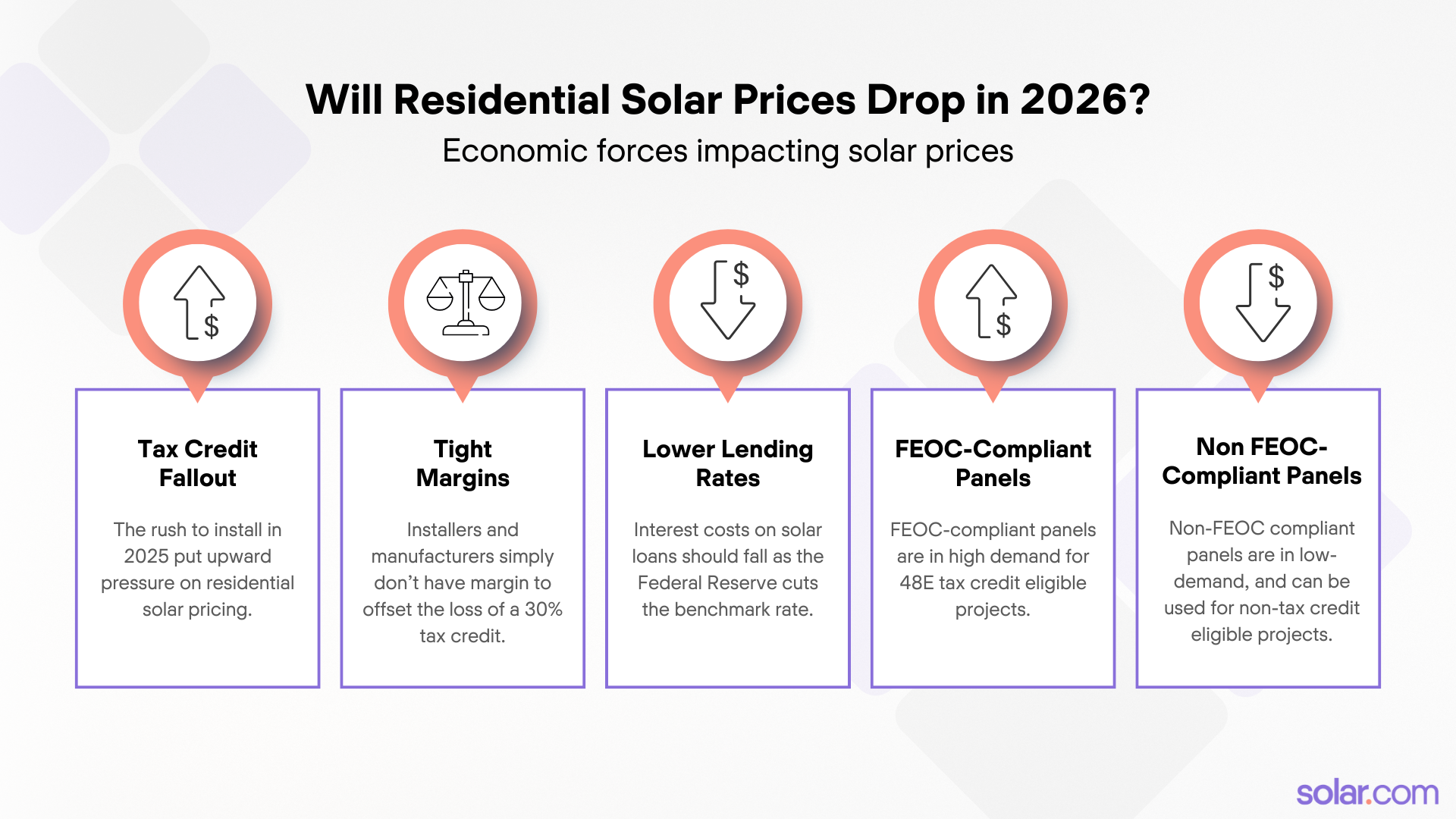

Residential solar prices face a mixture of economic headwinds and tailwinds in 2026. While we don’t expect a dramatic drop in pricing, there are opportunities to lower costs and increase homeowners’ savings.

Starting point for 2026

After the passage of the One Big Beautiful Bill (OBBB), demand for solar exceeded the available supply of installation capacity, which drove prices up. While there’s not a comprehensive database of installation price movement in the second half of 2025, the quoted prices on solar.com increased by roughly $0.15/Watt after the OBBB signing for comparable system sizes compared to the first half of the year. This was a modest increase relative to the overall cost of the installed system of roughly 5% (for projects including a battery).

Can’t installers and manufacturers just cut their costs?

With the expiration of the 25D consumer solar tax credit, many were wondering if the cost to install solar would magically drop by 30% to offset the elimination of the tax credit. The assumption being that manufacturers, installers, and banks would all tighten their belts to continue offering consistent value post tax credit. After all, when benchmarking against solar costs in other countries like Australia and the EU, US installation costs have room to move.

But this assumption fails to understand the unit economics of residential solar in the US, a notoriously difficult sector.

The unfortunate reality is that there is not a 30% margin anywhere, and so a reduction in install price to offset the lost tax credit simply can’t be offered on a sustainable basis. Companies that attempt it will lose tremendous amounts of money and will likely end up in insolvency before the end of 2026.

Lower financing rates favor solar savings

There is hope for cost reductions in 2026. One of the largest drivers of solar economics in the US is the cost of a loan to pay for the project. Solar.com’s analysis is that for every 1% point reduction in interest rate is equivalent to roughly $0.15/Watt cost reduction. And with the Federal Reserve lowering rates, we can expect long-term loans—including solar loans—will see rates drop in lock-step.

Supply chain matters in 2026

On the component side, you’re starting to see a tale of two cities. On one hand, there is robust demand for solar products on the corporate tax credit side of the industry—especially for products that are free and clear of “FEOC” risk and have domestic content attributions. Pricing for these components is going up almost monthly due to a supply & demand imbalance, which will likely persist through, at least, the first half of 2026.

But there is a lot of capacity that doesn’t meet FEOC compliance that can be sold into projects that otherwise don’t qualify for a federal tax credit. Herein lies the potential for cost savings—but it won’t make up the 30% loss of tax credit value. And there are substantial tariffs on solar panels imported from other countries, including two new pending cases on imports from Indonesia, Laos, and India, as well as a universal “232” tariff on polysilicon imports.

Is 2026 a Good Time to Go Solar?

Homeowners who are considering going solar might feel they missed the window of opportunity to capture the tax credit. But 2026 still offers a good time to consider going solar.

The tax credit for PPAs, leases, and prepaid products is rapidly closing and, with the risk of new tariffs on solar panels and other barriers, locking in a solar project today can still help ensure your project achieves maximum savings. There are also still some state rebates, which can help offset costs.

And one of the biggest artifacts of Trump’s One Big Beautiful Bill is that a lot of planned new generation capacity will never see the light of day. This will create a further “spark spread” between the supply of electricity and the demand. This will inevitably drive up the cost to rent power from the utility. Locking in savings today with solar will be better than waiting two or three years for savings that may never materialize.

Plus, going solar is quantified to add value to your home. And this value may increase in a post-tax credit environment.