Is Solar Worth It in New Jersey in 2026?

The Quick Answer: Yes. New Jersey remains one of the top solar markets in the U.S. for 2026, driven by utility rates that spiked 17-20% across the state last year and friendly local solar policies.

While the direct federal tax credit for homeowners who purchase solar is no longer available, New Jersey residents still have access to an incredibly valuable state-based solar incentive and favorable net metering. In 2026, many homeowners are meeting their savings goals through Third-Party Owned (TPO) solar options that are still eligible for a business-claimed federal tax credit.

The strategies to maximize your savings potential have shifted in 2026, but solar remains the most effective hedge against the Garden State’s rising energy costs.

Jump ahead:

- The 2026 Shift: Navigating Tax Credit Changes

- New Jersey Economic Snapshot

- Choosing Your Path: Three Ways to Save in NJ

- Common Solar Questions for 2026

- The Verdict: Is New Jersey Solar Worth It?

The 2026 Shift: Navigating Tax Credit Changes

The key change in 2026 is the termination of the consumer-claimed federal solar tax credit. Unlike past years, homeowners who directly purchase solar and/or battery can no longer claim a 30% tax credit on their federal tax return.

Fortunately, when it comes to going solar, New Jerseyans have it better than most.

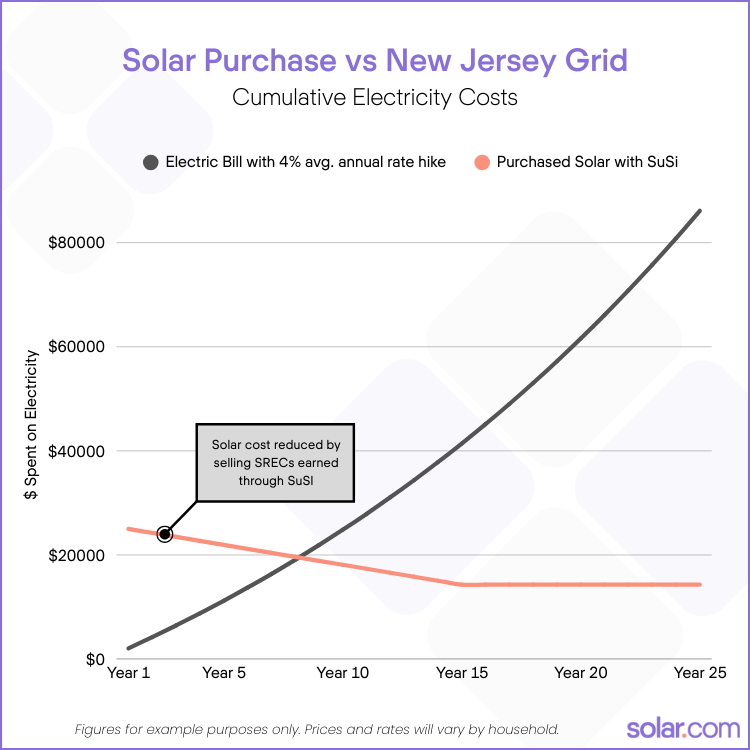

- Get Paid for Your Solar Power: New Jersey’s Successor Solar Incentive Program (SuSI) is perhaps the best state-based solar incentive in the U.S. If you own solar, you can earn and sell Solar Renewable Energy Certificates (SREC-II) for every 1,000 kilowatt-hours your system produces. At the current value of $85 each, that’s worth more than $1,100 per year for an average 10 kW solar system in NJ.

- Easy Solar Offset: Most utilities in New Jersey still offer 1-to-1 net metering, meaning the excess solar power you share with the grid directly offsets the cost of using grid electricity at night. This makes it easy to offset your electricity bills—even in the winter.

- The “NJ Bonus”: Unlike many other states, New Jersey still offers a 100% Sales Tax Exemption and a Property Tax Exemption, meaning you don’t pay tax on the equipment. Solar adds value to your home, but the assessed value doesn’t increase your property taxes.

- The TPO Opportunity: By choosing a Third-Party Owned (TPO) plan—such as a lease, power purchase agreement (PPA), or Prepaid Solar—a provider claims the Section 48E Commercial Credit and passes its value to you in the form of lower upfront or monthly payments.

New Jersey Economic Snapshot: Statewide Rate Hikes

New Jersey utility bills have skyrocketed in recent years due to grid upgrades and regional supply shortages.

-

Recent Spikes: In 2025, a regional “capacity auction” led to electricity rate increases of 17% to 20% at four major NJ utilities.

-

Current Rates: Average New Jersey residential rates now hover around 22 to 23 cents per kWh, well above the national average.

-

The “Worth It” Threshold: For most NJ households, solar becomes a “Day 1” win if your average monthly electric bill is $120 or higher.

Recent Electricity Rate Increases in New Jersey

| Utility Provider | Notable Rate Increase |

| Public Service Electric & Gas (PSEG) | 17.2% increase in June 2025 |

| Jersey Central Power & Light (JCPL) | 20.2% increase in June 2025 |

| Rockland Electric (RECO) | 18.2% increase in June 2025 |

| Atlantic City Electric (ACE) | 17.2% increase in June 2025 |

Choosing Your Path: Three Ways to Save in NJ in 2026

Whether you prefer the simplicity of a lease or the long-term gains of ownership, New Jersey has a viable path for every savings goal.

Direct Ownership (cash or loan purchase)

This is the more familiar path to solar. Buy the system outright, claim the incentives yourself, and take on the monitoring and maintenance responsibilities.

-

Why it’s worth it: While there’s no longer a federal tax credit for this, you keep 100% of the SuSI payments. In New Jersey, you earn an “SREC-II” for every 1,000 kWh your system produces, which can be sold for approximately $85 each for 15 years.

-

Best for: Homeowners who want to invest in maximum long-term savings and add value to their home.

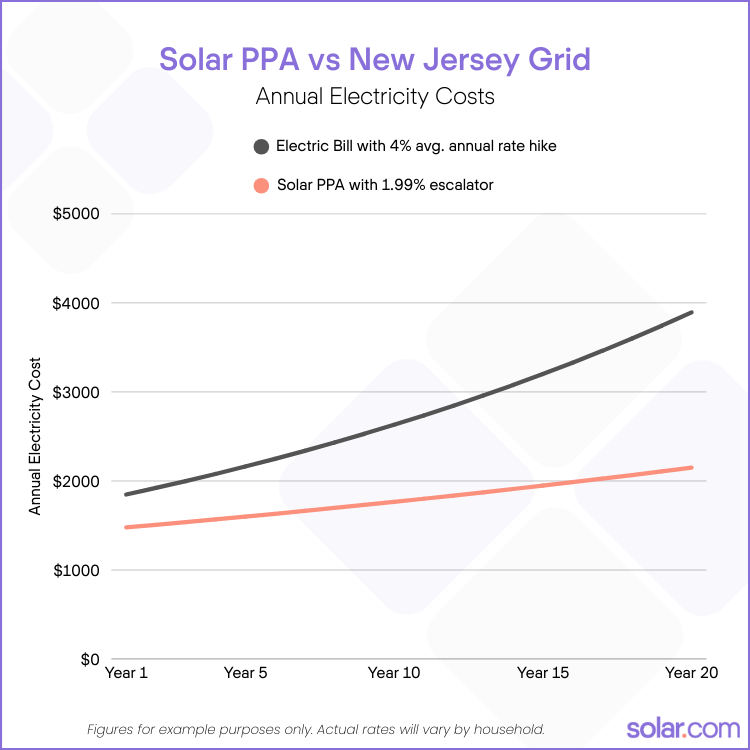

Standard Lease or Power Purchase Agreement (PPA)

In a standard lease or PPA, a third-party owns, maintains, and claims incentives for the solar system installed on your property. In a lease, you make consistent monthly payments to “rent” the system, whereas in a PPA you make variable monthly payments based on the system’s power production.

-

Why it’s worth it: Leases and PPAs are regaining popularity in 2026 because they still qualify for a federal tax credit (claimed by the provider). You typically pay $0 upfront and essentially trade your high utility bill for lower, predictable solar payments.

-

Best for: Homeowners who want immediate savings with zero maintenance or upfront costs.

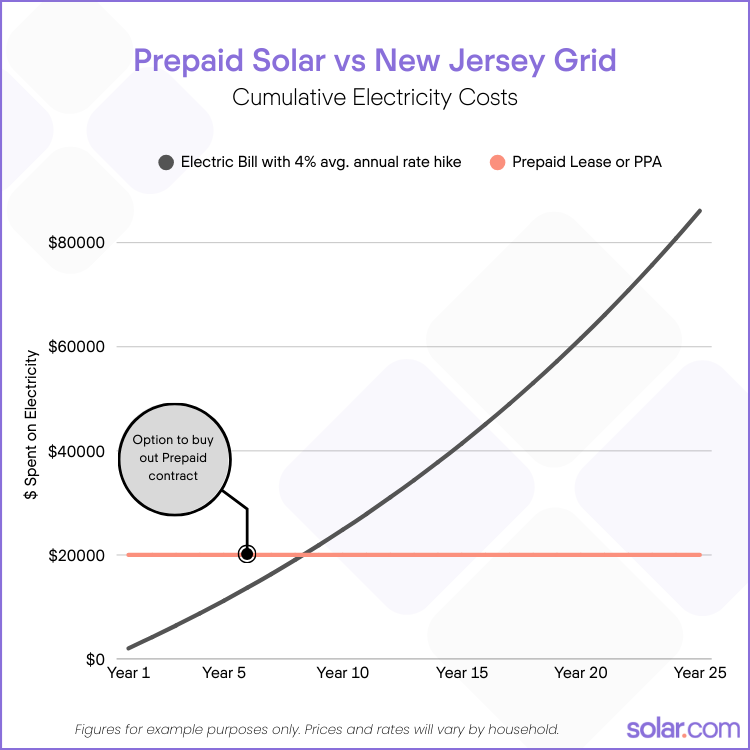

Prepaid Leases and PPAs

Prepaid Solar Products are emerging options that allow homeowners to pay for a solar lease or PPA upfront (or finance an upfront amount) and enjoy third-party monitoring and maintenance. At Year 6, there is typically an option to buy out the system at little to no cost or continue operating under third-party ownership.

-

Why it’s worth it: You pay for 25 years of power upfront at a discounted rate. Because it is third-party owned, the provider claims incentives—including a federal tax credit—and can reduce the lower upfront cost accordingly.

-

Best for: Homeowners who want minimal monthly electricity costs and the peace of mind of third-party monitoring and maintenance while the system is new and most likely to present issues.

New Jersey Solar FAQs: Common Questions for 2026

Did I miss the federal solar tax credit?

For direct solar and battery purchases, yes. However, a federal tax credit is still available for Third-Party Owned (TPO) solar and battery systems installed before January 1, 2028. This credit is claimed by the third-party owner, and its value can be applied to lower the upfront cost or monthly payments of a lease, PPA, or Prepaid Solar financing agreement.

What is “SuSI” or SREC-II?

The Successor Solar Incentive (SuSI) is New Jersey’s way of paying you for contributing to the state’s clean energy goals. For every 1,000 kilowatt-hours (kWh) your system generates, you receive a certificate worth $85. For a typical 10 kW system, this can result in $1,100 in annual cash on top of your bill savings, and the SuSI program allows you to earn and sell these certificates for up to 15 years.

Is NJ a good state for solar in the winter?

Yes. While summer is the peak, New Jersey’s Net Metering laws allow you to “store” the excess energy you produce in July and August as credits on your bill, which you can then use offset the cost of grid power used in your home through the winter.

The Verdict: Is New Jersey Solar Worth It?

If you are tired of watching your electricity bill climb every year, solar is absolutely worth it in New Jersey in 2026—and there are several ways to achieve your savings goals.

Thanks to solar-friendly state policies, direct solar ownership is still a great path to energy cost savings in the Garden State. If you’re looking for immediate savings without ownership responsibilities, Third-Party Ownership options such as leases, PPAs, and Prepaid Solar can tap into state and federal incentives to lower your solar costs.

What’s your best path to energy cost savings? Team up with a solar.com Energy Advisor to review proposals tailored for your home and energy goals.