Many New Yorkers are bracing for even higher electricity bills in 2026, as utility regulators consider a 23.6% total bill increase request for New York State Electric & Gas (NYSEG) residential customers.

If approved, the new rates would add over $33 to the average customer’s monthly electricity bill.

At-A-Glance: 2026 NYSEG Rate Impact

This table breaks down the requested changes currently under review by the New York State Public Service Commission (PSC).

| Metric | Details |

| Utility Company | New York State Electric & Gas (NYSEG) |

| Requested Total Revenue Increase | $464.4 million |

| Average Monthly Bill Impact (residential) | $33.12 |

| Projected Start Date | May 1, 2026 |

| Status | Pending PSC Approval (As of February 2026) |

Why are NYSEG rates going up?

According to the official rate case filing, NYSEG is requesting a massive $464.4 million increase in annual electric revenues. This request represents a 35% jump in base delivery revenues compared to what the PSC previously approved.

The utility identifies several “Primary Rate Drivers” behind this request:

- Major Storm Allowance: $189.7 million to handle extreme weather costs.

- Capital Investments: $189.0 million for aging infrastructure and grid upgrades.

- Labor & Benefits: $55.6 million for workforce costs.

- Vegetation Management: $32.4 million for tree trimming to prevent outages.

How Will That Impact Your Bill?

For a typical residential customer using 600 kWh per month, this hike adds $33.12 to a typical bill — not including charges for natural gas service. While that is a hit to the monthly budget, the long-term cost of inaction is even higher.

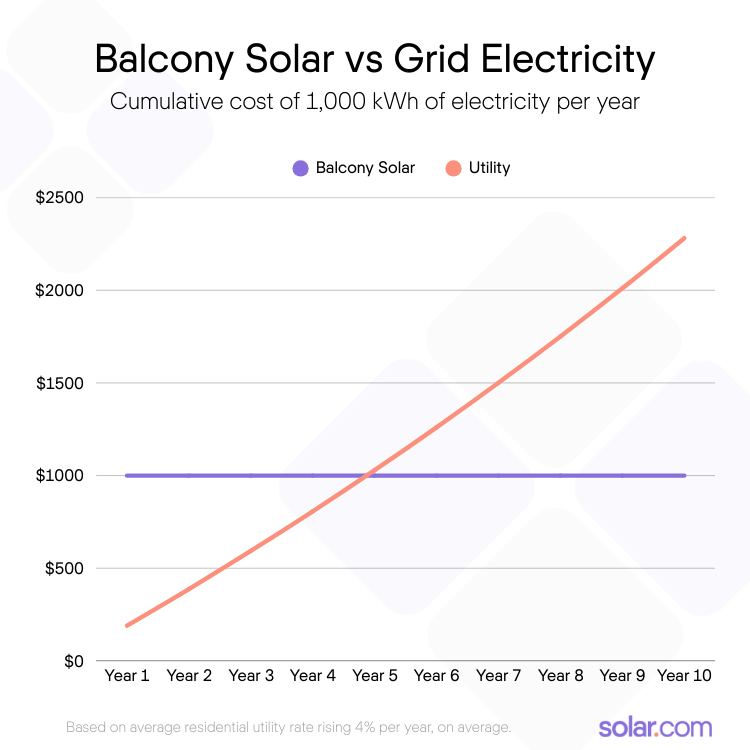

If this rate is approved for the “Rate Year” starting in May 2026, the average household will pay an additional $397.44 per year for electricity service. Over the next decade—assuming no further increases—that is nearly $4,000 in extra costs paid to the utility for the exact same amount of electricity you use today.

How to Offset the NYSEG Rate Hike

As delivery charges skyrocket by nearly 35%, the most effective way to protect your home is to reduce your reliance on the grid. Solar energy allows New York homeowners to replace some or all of their electric bill with a low, flat cost for solar.

- High Impact Savings: Because NYSEG’s increase is heavily weighted toward “delivery revenues,” every kilowatt-hour you produce on your roof is a kilowatt-hour you don’t have to pay these new, higher fees on.

- Lock in Predictable Rates: By installing solar before the May 2026 effective date, you can effectively bypass the 23.6% total bill jump and lock in lower, more predictable electricity costs.

In addition to new solar financing models that benefit from a federal tax credit, New Yorkers can lower their solar costs by claiming a 25% State Income Tax credit, worth up to $5,000.

Get a custom proposal on solar.com and explore your savings potential with an expert Energy Advisor.