See how much solar panels cost in your area

Please enter a valid zip code.

Zero Upfront Cost

Best Price Guaranteed

![]()

![]()

Solar Learning Center > Solar Financing > Buy Solar Panels

Buy Solar Panels

How to Buy Solar Panels

Buying solar panels is something homeowners do once, maybe twice, in a lifetime. As such, the process can be a little intimidating and it can be tough to know where to begin.

So, in this article we’ll break down the basics of buying solar panels for your home. We’ll cover:

- How to buy solar panels

- Leasing vs buying solar panels

- Where to buy solar panels

- Buying a house with solar panels

- The best solar panels to buy

Let’s jump right by exploring the two main ways to buy solar panels.

Compare multiple solar quotes from local installers.

How to buy solar panels: Cash vs loan

If you plan to buy solar panels, one of the first things to consider is whether you’ll purchase them with cash or finance them with a loan.

While a cash purchase leads to greater lifetime savings, financing with a solar loan can lead to more immediate savings. Typically, about half of solar.com customers chose to pay cash and the other half chose to finance with a solar loan.

| Cash advantages | Loan advantages |

| Greater lifetime savings | More immediate savings |

| No interest payments | Zero down payment |

| Not subject to loan approval qualifications | Steady, predictable electricity costs |

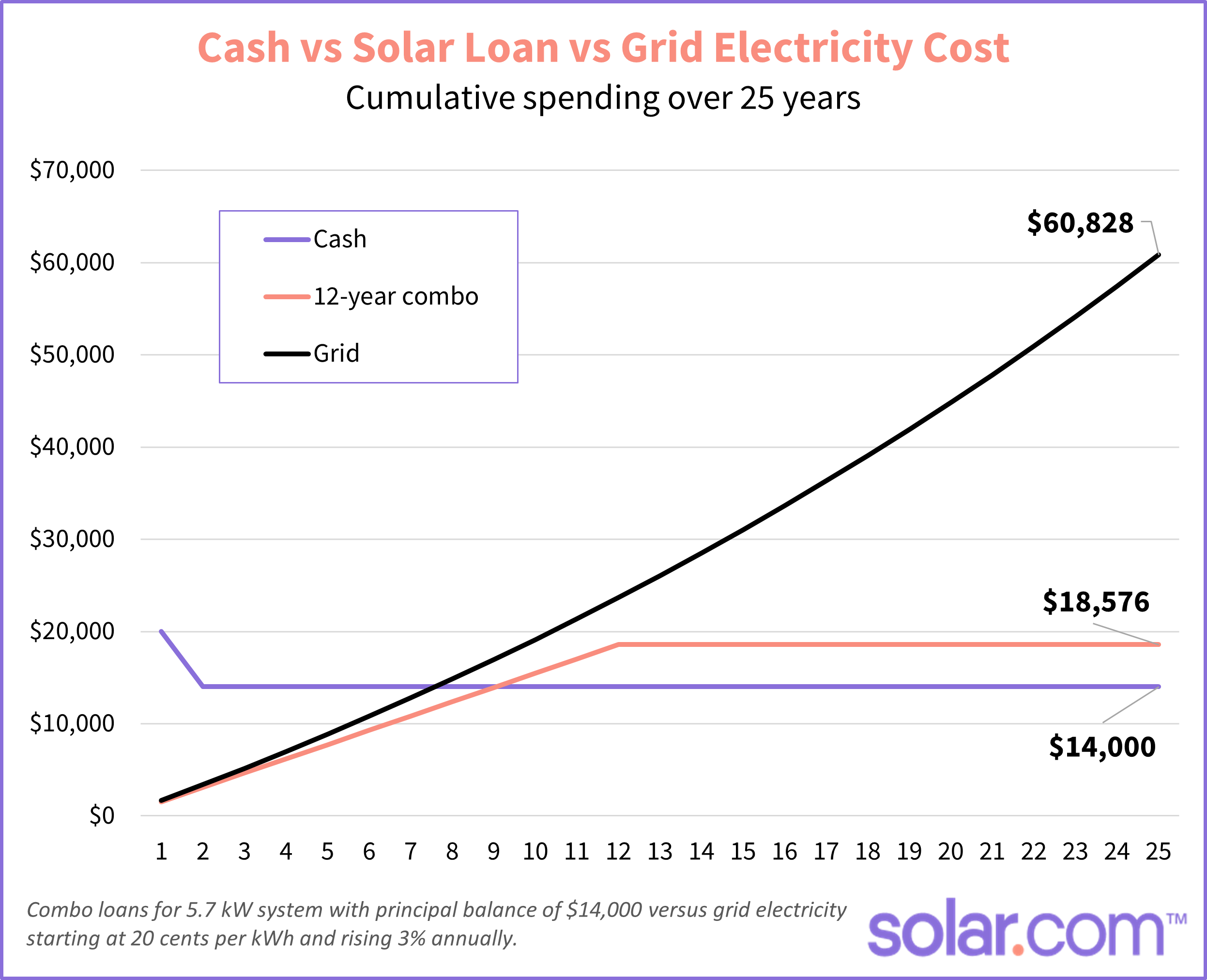

In the example below:

- Paying cash (purple line) leads to ~$4,500 in additional energy cost savings, but it takes around 7 years to break even

- The 12-year solar loan (pink line) offers immediate monthly savings, but includes ~$4,500 in interest payments

How you choose to buy solar panels depends on your financial situation and your savings goals.

Buying solar panels with cash

Paying cash is the simplest way to buy solar panels and offers the greatest return on investment. Cash purchases are typically made in 3-4 installments.

For example:

- Down payment/deposit – An initial deposit upon signing a contract in order to lock in an installation date

- Due upon delivery of materials – A second installment around 50% of the remaining balance is due when equipment is delivered and/or installation begins

- Due upon final inspection – The remaining balance is due once your system is installed and passes city building inspection

Of course, the exact payment schedule varies by installation company, but now you have a basic idea of what to expect.

While cash provides the greatest long term cost savings, there is typically a 6-10 year payback period before you recoup your upfront investment. Given that solar panels are warrantied for 25 years (and last much longer) that leaves plenty of time to accumulate savings.

Buying solar panels with a loan

Let’s face it, not everybody has $20,000 to $30,000 in cash laying around – but that doesn’t mean you can’t buy solar panels.

Solar loans offer a steady monthly payment that can front-load your solar savings. For example, if your average electricity bill is $125 a month and your solar loan payment is $100 a month, you’re saving $25 a month ($300 per year) right off the bat.

The great thing about solar loans is that they are incredibly versatile. There are two types of loans – combo and reamortizing – and loan terms range from 8 to 20 years. In addition, most solar loans do not require a down payment, although you can make one to lower your monthly payments.

So, by mixing and matching the type of loan, the term, and your down payment, you have a lot of control over your monthly electricity costs.

As a rule of thumb:

- Longer loan term equals lower monthly payments but more money spent on interest

- Shorter loan term equals higher monthly payments and less money spent on interest

A majority of solar.com customers that finance their solar system choose a 12-year loan as it provides a balance of low monthly payments and substantial lifetime savings.

Where to get a solar loan

There are a few ways to find a lender for your solar loan.

- Find one yourself (Google, use your primary bank, call around)

- Use the lender your solar installer recommends

- Team up with a solar.com Energy Advisor to shop for loan options

Keep in mind, not all lending institutions have the combo and reamortizing loans designed specifically for financing solar systems. So, having an Energy Advisor on your side to shop for loans can be a huge help.

Solar loan qualifications

Like a mortgage or a car loan, you’ll need certain qualifications to be approved for a solar loan.

Loan qualifications vary by lender, but typically you’ll need:

- A FICO credit score above 650

- A debt-to-income (DTI) ratio below 50%

- The primary borrower on the loan must have their name on the title of the home getting solar panels

It’s worth checking to see if you meet these qualifications before going too deep in the solar process. If you need a little boost, adding a co-borrower with a strong credit score and DTI can help you qualify.

Leasing vs Buying Solar Panels

Now that we know the basics of buying solar panels, let’s explore the advantages of buying versus leasing your solar system.

The major difference is who owns the system.

- If you buy solar panels – either with cash or a loan – you own them

- If you lease solar panels, someone else owns them

In previous decades, solar leases were more common because buying solar panels was too expensive for most homeowners. However, between the plummeting cost of solar panels and the federal solar tax credit, buying a solar system is much more affordable and accessible.

| Advantages of buying solar panels | Advantages of leasing solar panels |

| Greater energy cost savings | No maintenance |

| Increases home value | |

| You claim tax credits and other incentives | |

| Easier to transfer in home sale |

Leases are often advertised as “free solar panels” or “zero-down solar.” First of all, there is no such thing as free solar panels. Second, you can just as easily purchase solar panels with a zero-down solar loan.

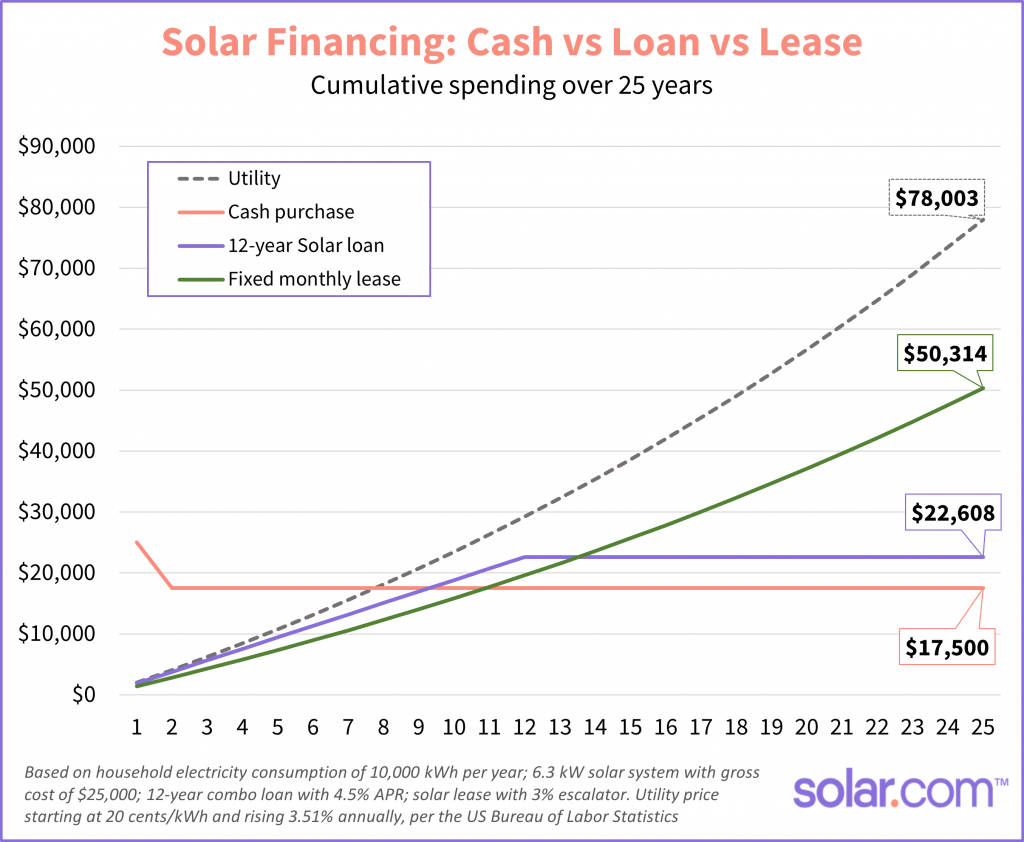

Like a solar loan, solar leases offer a flat monthly payment to replace your utility electricity bill. However, the major difference is that solar loan payments stay consistent over time, while lease payments increase each year.

Solar leases typically have an escalator that increases your monthly payment by around 3% each year. Over 20 to 25 years, the monthly payments end up being much greater than loan payments, and can even outpace the rate of energy inflation.

The graph below shows how a lease (green line) may be the most attractive option up front, but ends up having the highest overall cost with none of the benefits of owning the system.

The bottom line: Solar leases had their heyday, but today they are considered a last resort for going solar as the savings and benefits of ownership are far greater.

Where to buy solar panels

In most cases, residential solar panels are bought through an installation company, just like kitchen cabinets are typically ordered through a contractor.

In 2023, there were over 800 different models of solar panels available through solar.com’s network of installers. By easily comparing quotes from local installers, homeowners have access to a tremendous variety of solar panels, inverters, and batteries.

While it is possible for homeowners to buy solar panels themselves, either used or directly from the manufacturer, there are a few reasons buy them through an installer.

- Solar installers have relationships with manufacturers that allow them to get better pricing than homeowners

- Unlike used panels, new solar panels come with 25-year warranties that are crucial to protecting your investment

- Installers have reliable shipping methods and will deal with shipping and handling issues if they arise

Design a custom solar system and compare quotes online.

Buying a house with solar panels

The back way into buying solar panels is buying a house that already has solar panels installed.

According to Zillow, homes with solar panels – and other energy efficient features – sell faster and for more money than comparable homes without.

And why wouldn’t solar panels be an attractive feature? You’re essentially buying a house with incredibly low electricity costs and saving money on energy the day you sign the deed.

There are a few things to consider when buying a house with solar panels:

- Is the system owned or leased? If the home has a leased system, are you prepared to take over the lease payments, or would you rather have the owner pay off the lease and remove the system?

- Is the roof in good condition? One of the drawbacks of rooftop solar is that the system needs to be removed in order to re-roof the house, which costs money. If the roof seems old, it may be worth negotiating over.

- Will the system cover your electricity needs? If you will use substantially more electricity than the previous owner (say, by charging an EV at home), then the existing system won’t cover 100% of your consumption. That shouldn’t be a deal-breaker, but it’s worth considering.

- Will the warranties transfer over? In most cases, the performance and product warranties will transfer in a home sale and continue protecting the system. However, it’s worth establishing that during the sale.

Buying a house with solar panels is getting more common and routine, and is an excellent back door method of buying solar panels.

Related reading: Do Solar Panels Increase Home Value?

Best solar panels to buy

There are thousands of residential solar panel models that range in size, efficiency, power output, price, and warranty coverage. The best solar panels to buy depends on your budget, priorities, and energy goals.

Most homeowners look for a balance of efficiency, affordability, and warranty coverage. Based on thousands of sales over a 12-month period, REC was the most popular brand of solar panel, followed by Q Cells, Panasonic, SEG Solar, Canadian Solar, and Solaria.

Some things to consider when you’re choosing a solar panel model:

- The size of your roof. If you have a limited roof space, you may need panels with higher efficiency and power output

- Manufacturer warranties. Most panels have 25- to 30-year performance warranties that guarantee a certain level of output over time

- Black vs blue. Monocrystalline panels tend to be black in color while polycrystalline panels tend to be blue in color

- Where it’s made. With incentives from the Inflation Reduction Act, more solar panels are being manufactured in the US

If you’re looking for the very best solar panels to buy, here are some of the top performers for each characteristic.

| Category | Panel(s) | Measurement |

| Lowest degradation | SunPower X-Series, Panasonic EverVolt, REC Alpha | No more than 0.25% per year |

| Most efficient | SunPower A-series | Up to 22.8% |

| Longest performance warranty | Aptos Solar DNA Split Cell Series, Hyundai RG Series, Canadian Solar (various models) | 30 years |

| Locally made | Silfab mono series, Q Cells Peak Duo series, Mission Solar PERC series, Solaria Power XT series | Manufactured in the USA |

Picking the best solar panel is kind of like picking a car – everybody has a different idea of what makes the best product. The best panel is the one that helps you achieve your energy goals.

The bottom line

Between incentives, zero-down financing, and plummeting prices, the cost of going solar is nowhere near the barrier it once was. In fact, just figuring out how to buy solar panels is often a bigger hurdle than actually buying them.

Solar.com simplifies the process of buying solar panels by pairing you with an expert Energy Advisor to guide you every step of the way. Better yet, studies by the US Department of Energy have proven that homeowners save money by comparison shopping on solar.com.

Compare multiple quotes and see how much you can save by going solar today.

Related Articles

Is It Better to Lease Or Buy Solar Panels?

Home solar is a means to long-term energy savings for a vast majority of US homeowners, but exactly how much you save depends on whether...

Buying Solar Panels vs. Leasing Solar Panels

Buying solar panels is your best bet in today’s energy market. We will discuss the pros and cons in this article, but first, we must...

5 Common Ways to Finance Solar and Storage Systems

Acquiring solar panels and a solar storage system for your home, and transferring to solar power can be expensive – it can add up to...

All You Need To Know About Solar Home PACE Financing

As the cost of solar goes down year by year, more people are finding that a home solar panel system may be the right decision...

Is Bitcoin Mining Sucking the Energy Market Dry?

Bitcoin has crossed a threshold. The value of a single bitcoin peaked at $20,000 in December 2017, putting dollar signs in tech-savvy eyes around...

SolarCoin, an Energy Cyptocoin with a Bright Future

Everyone can admit that 2017 was a wild year for cryptocurrencies. Sure, Bitcoin popularity skyrocketed, but so did many altcoins as well, such as Litecoin,...

Mass Solar Connect Extended to November 30th

Mass Solar Connect, a program with the objective of helping South Coast residents use renewable solar energy to power their households, has extended its deadline...

What to Expect from a Solar Contract

You’ve decided to go solar. Now it’s time to start thinking about how you’re going to pay the solar bill. Like buying a car, you...

The Future of Solar Energy Under The Trump Administration

The recent election of President Trump has affected every sector of the economy, from agriculture to energy. While some would argue that most of the...

Solar Leases vs. Solar Loans vs. Solar PPAs

So, you’ve decided to go solar – fantastic! The easy part is done. But do you know how you’re going to pay for it? Here’s...

See how much solar panels cost in your area.

Please enter a valid zip code.

Please enter a valid zip code.

Zero Upfront Cost. Best Price Guaranteed.