Trump and the Fate of the 30% Solar Tax Credit

As President Trump continues his second term, the future of America’s solar incentives has taken a definitive turn. On July 4, 2025, the One Big Beautiful Bill (OBBB) was signed into law, officially ending the 25D federal solar tax credit for homeowners on December 31, 2025.

Fortunately, homeowners haven’t lost access to federal solar tax credits altogether. The business-claimed 48E tax credit for residential solar leases, PPAs, and prepaid solar products remains in effect through the end of 2027.

In this article, we’ll explore what these tectonic policy shifts mean for homeowners, installers, and the future of clean energy.

This content is for informational purposes only and does not constitute legal or tax advice.

Jump to a section:

- What is the solar tax credit? 25D and 48E explained

- Is the solar tax credit going away?

- Is 2026 a good time to go solar?

- Is the entire Inflation Reduction Act at risk?

- How did this happen? The Big Beautiful Bill and the Solar Tax Credit

Starting in 2026, Third-Party Owned (TPO) solar products are the only way for homeowners to access a federal tax credit. Explore these options in our TPO Resource Center:

- Leasing Solar Panels: The Complete Guide

- The Simple Guide to Power Purchase Agreements (PPAs) in 2026

- Prepaid Solar Leases & PPAs: A New Path to Owning Solar

What is the 30% tax credit for solar? 25D and 48E Explained

The solar tax credit allows solar system owners to receive a federal tax credit worth up to 30% of the eligible cost basis of a solar and/or battery storage installation. For instance, a project with an eligible cost basis of $30,000 would entitle the owner to receive a $9,000 tax credit in the year the project was placed in service (fully installed, as confirmed by the IRS on August 21 ). In most cases, it is the highest-value residential solar incentive and has been available nationwide for two decades.

There are actually two federal tax credits that apply to residential solar and battery systems. The key differences are who gets to claim them and when they expire, now that the One Big Beautiful Bill is law.

| Tax Credit | Applies To | Claimed By | Ends |

| 25D | Homeowner-owned solar systems (cash and loan purchases) | Homeowner | Dec 31, 2025 |

| 48E | Third-Party Owned residential systems (leases and PPAs) | Third-party system owner | Dec 31, 2027 |

How do solar tax credits vary by state?

While they last, the federal solar tax credits (25D and 48E) apply in the same fashion in every state. Some states, namely New York and Massachusetts, offer state-level tax credits that can be claimed in addition to federal credits. There are also rebates and incentives offered through states, municipalities, and utilities that can further lower the net cost of going solar. We’ve compiled a list of solar incentives by state to help homeowners maximize their return on investment in solar.

With the federal tax credits being phased out, it’s possible that states will fill the gap with tax credits, rebates, and other incentives to encourage rooftop solar adoption and combat rising grid electricity prices.

How does the solar tax credit affect the resale value of homes?

Study after study—including this 2025 analysis by solar.com—has shown that solar panels increase home value. The added value varies by location and other factors, and is not directly impacted by the solar tax credit. However, by claiming the tax credit, you get a 30% discount on a home upgrade that improves your home value, and benefit from the full property value of the system when you sell your house. Additionally, many states have property tax exemptions for the value solar adds to your home.

Federal Solar Tax Credit Income Limit

There is no income limit for claiming the 25D solar tax credit. There is also no upper limit on the value of the tax credit—as long as you have the federal tax liability to claim it against. If the tax credit amount exceeds your tax liability, the unused portion can be carried into future tax years. Consult a licensed tax advisor for advice regarding your personal tax situation.

Is the solar tax credit refundable?

No. As a nonrefundable credit, the solar tax credit can only be used to reduce your federal tax liability, and, in turn, reduce the amount of tax you owe or increase your refund. It is NOT a check that automatically comes in the mail. Check out our guide for how to claim the solar tax credit using Form 5695.

Brief history of the solar tax credit

The solar panel tax credit actually originated during the oil crisis in 1978. It was then brought back in 2005 and, with some tweaks and changes, has persisted ever since. It’s often referred to as the “Solar Investment Tax Credit” or ITC for short.

The Inflation Reduction Act of 2022 extended the tax credit at a 30% rate through 2032, after which it would have declined by 4% per year through 2034. The solar tax credit has been a relatively durable piece of policy and has survived both Republican and Democratic administrations, recessions, wars, and other policy uncertainty. Trump himself extended the solar tax credit at the end of his first term (the COVID year).

Is The Solar Tax Credit Going Away in 2025?

Yes—with Trump’s One Big Beautiful Bill as law, the 25D solar tax credit expiration is set for midnight on December 31, 2025. Residential solar systems installed by this deadline still qualify for a 30% federal tax credit, and there is no retroactive component in this law that strips the tax credit from homeowners who have already claimed it lawfully.

In 2026 and after, there will be no residential tax credit for homeowners to claim for their investment. However, homeowners can still benefit from the 48E solar tax credit for Third-Party Ownership (TPO) arrangements installed before the end of 2027. In TPO arrangements, such as leases and Power Purchase Agreements (PPAs), the leasing company claims the tax credit and the homeowner benefits from lower payments for their system.

Early versions of the One Big Beautiful Bill closed off the 48E tax credit for residential solar and battery systems, but the Senate removed this language for the final version that became law.

See 20-year solar industry veteran Brian Lynch and Solar.com lead writer Sam Wigness discuss the threat to residential solar tax credits and what the near and long-term future looks like for the solar industry.

Why is the federal government ending residential solar tax credits?

During the campaign, President Trump and Republican elected officials called for the “repeal of the Green New Deal,” a name Trump uses to refer to the Inflation Reduction Act (IRA). The IRA was the Biden administration’s cornerstone policy and was a broad bill that included several pieces of favorable policy for the solar industry and, most importantly, extended the solar panel tax credit through 2034.

During Trump’s first week in office, he published an Executive Order that directed the Federal Government to suspend spending funds under the “Green New Deal.” This Executive Order was broadly worded and ultimately legally unenforceable, and it was rescinded a week later. However, it caused many people to question whether the IRA, and the solar tax credit, would be dealt an untimely fate.

Even as President, Trump himself can not cancel an existing law. He can, however, work with his legislative bodies in the House and Senate to repeal the law or pass a superseding law that alters the IRA—which is exactly what he did with the One Big Beautiful Bill and the solar credit phase-out.

Is 2026 a Good Time to Go Solar?

Yes – even without a solar tax credit for homeowners to access directly, installing solar in 2026 can still provide bill savings in the short and long term. In areas with strong local incentives (especially New York, New Jersey, and Illinois), buying solar panels with cash or loan can be an attractive hedge against rising electricity rates.

Without local incentives for ownership, many homeowners will see greater Day 1 savings from leases and PPAs than they will from buying solar with a loan. Perhaps the most attractive option for 2026 is prepaid leases and PPAs, which can benefit from the 48E tax credit and offer a path to owning the system after 6 years.

Let a solar.com Energy Advisor develop a proposal for your unique home and savings goals. Get started today with a short questionnaire.

Will projects built in 2025 qualify for the residential solar tax credit?

Yes. Based on the bill signed into law on July 4, projects installed in 2025 will qualify for the 30% solar tax credit. There is no language in the OBBB that retroactively strips the tax credit from homeowners who claim it lawfully.

It would be politically very difficult and would cause substantial economic havoc for the Trump Administration to retroactively rescind a tax credit that’s part of established law. Any attempt to do this would undoubtedly face substantial legal challenges.

The tax credit industry is much larger than the homeowner tax credit, and it’s been sized at hundreds of billions of dollars under the IRA, helping support hundreds of thousands of jobs directly and indirectly. A retroactive repeal would shake the foundation of investor confidence, not just in solar but just about everything that’s tied to policy.

Is the rest of the Inflation Reduction Act (IRA) at Risk?

Yes. Republicans made drastic cuts to the IRA through the budget reconciliation process as a way to pay for the Tax Cuts and Jobs Act (TCJA) extension. In May 2025, the House Ways and Means Committee introduced a measure that would weaken or remove several parts of the IRA—primarily incentives for wind and solar energy. That measure was passed by the full House on May 22 and sent to the Senate.

After some back and forth, the Senate kept the termination of the 25D solar tax credit at midnight on December 31, 2025. Residential systems will need to be installed by then to qualify for a 30% tax credit before it’s gone. In a minor win, the Senate also removed language that blocked access to the 48E tax credit for residential leases and PPAs. Trump signed this version into law on July 4, and residential leases and PPAs will have access to the 48E tax credit through the end of 2027.

The Big Beautiful Bill and Solar Tax Credit: How it Happened

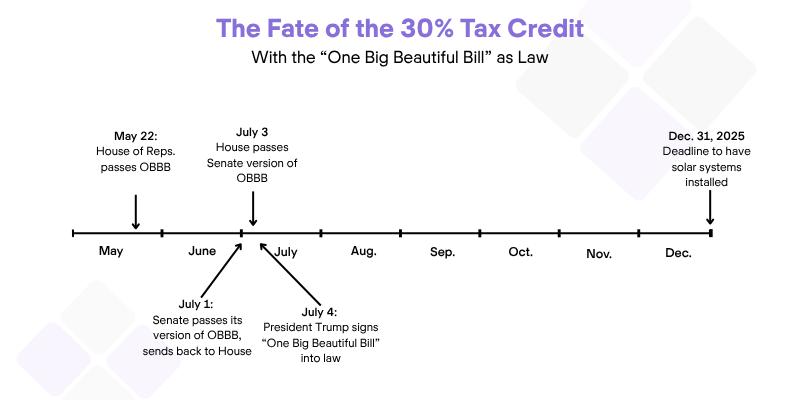

We meticulously tracked the One Big Beautiful Bill through Congress to understand its impact on solar tax credits. Here’s a timeline of how this law was formed.

July 4 Update: President Trump signed the “One Big Beautiful Bill” (OBBB) into law, cementing an early termination of the 30% solar tax credit claimed by homeowners at the end of 2025. To claim this credit before it’s gone, homeowners need to have their systems installed by December 31, 2025.

July 3 Update: The “One Big Beautiful Bill” has been passed by both Chambers of Congress and is headed to President Trump’s desk to be signed into law. This bill includes an early termination of the 30% solar tax credit claimed by homeowners (25D). Homeowners will need to have their systems installed by December 31, 2025 to qualify for this credit before it’s gone.

Here’s is how this law impacts residential solar:

- The 30% solar tax credit claimed by homeowners (25D) would be terminated at midnight on December 31, 2025. Homeowners who have their systems installed before the end of the year can still claim this credit against their federal tax liability.

- The 30% solar tax credit for leases and PPAs (48E) would be available through the end of 2027. In a lease or PPA arrangement, the installation company claims this tax credit and passes the savings to the homeowner through lower lease payments or a buy-out agreement.

- Home battery storage would qualify for the 48E tax credit through 2032. This credit will be available for retrofits (adding battery storage to existing solar) and standalone systems (installing battery without solar) through lease agreements.

July 1 Update: The Senate voted on and passed its version of the “One Big Beautiful Bill.” The Senate text now heads back to the House of Representatives. If the House makes further changes, the bill goes back to the Senate (and so forth) until both Chambers agree on a final version and send it to the President’s desk for final signature. We will continue updating this article as new udpates are released.

June 30 update: The Senate updated its bill text over the weekend and included several key changes to the residential solar tax credits. Click here for a more substantial breakdown of these updates, or read the bullet points below for how this affects residential solar.

- 30% Consumer Solar Tax Credit (25d): In the latest Senate draft, the deadline to install residential systems eligible for the 30% tax credit claimed by homeowners is back to December 31, 2025. After this date, the 25D tax credit is terminated, and homeowners will no longer have a solar tax credit to claim directly.

- 30% Solar Tax Credit for Residential Leases and PPAs (48E): The latest Senate draft allows residential installation companies to claim 30% tax credit for residential solar leases and PPAs. Access to the 48E tax credit was explicitly excluded in previous House and Senate drafts, but is now back on the table for several more years. It’s important to note that the 48E credit is claimed by the installation company, and the savings are passed on to homeowners through lower lease payments.

- Foreign Entity of Concern (FEOC) Restrictions The Senate tightened restrictions on using components from FEOC-controlled or influenced companies and created a new excise tax for projects that use these components beginning in 2028. For residential solar, this introduces new risks to using components from Chinese-owned or controlled companies.

These are likely the final updates to energy policy in the “One Bill Beautiful Bill” before it is signed into law (likely before July 4).

June 26 update: We were expecting to see updated bill text from the Senate this week, but it keeps being pushed back. As of writing this, it still seems likely we’ll see a new version of the “One Big Beautiful Bill” prior to the July 4th recess. While the renewable energy provisions are important to all of us, they’re on the margins of the bill’s debate.

The industry has used this time to advocate for a phase-down of the tax credits to allow the market a more natural evolution to a post-subsidy environment, and this message seems to be resonating. We’re hearing that tax credits for residential solar are “in play” in discussions and some of the technical issues in the prior drafts are being addressed. Whether this stays into signed law and what exactly these changes will be are unknown.

What We’re Watching:

- Will the Consumer tax credit (25D) receive a gradual phase-out similar to the Corporate tax credits? Or will they end 180 days after the Bill passes, as is the current language? And if the 25D is preserved, will it have “FEOC” provisions associated with it, similar to the 48E tax credits?

- Will Residential leases once again qualify for the tax credit as part of the phase down? They were explicitly excluded in the House bill and the previously released Senate draft.

- Will the phase-out continue on the previously proposed Senate draft of 16% in 2026 and 6% in 2027?

- Will the domestic content bonus stay on the drawdown or be maintained at 10% for systems that qualify (commercially owned only)?

What Seems Likely

2025 is still the best time to go solar, and systems that are placed in service this calendar year will be eligible. There is no proposal from either the House or the Senate for a retroactive repeal of the tax credit.

FEOC restrictions will remain, and they are intensive. FEOC restrictions would disallow companies under Chinese control or influence from benefiting from US taxpayer assistance, and components that receive “material assistance” from Chinese companies have an escalating ramp or requirements in the Senate draft. Note that using components from Chinese companies would potentially disallow the entire project from realizing the tax credits.

June 16 update: The Senate Finance Committee released its text for the “One Big Beautiful Bill” with proposed changes to phasing out the 30% residential solar tax credit. Instead of ending on December 31, 2025, the Senate is proposing to end the 25D solar tax credit 180 days after the bill is signed into law. Assuming the One Big Beautiful Bill is signed into law sometime in July, we’re this to be in January 2026. Residential solar systems will need to be installed by this deadline to qualify for a 30% tax credit.

May 22 update: The House of Representatives passed the budget reconciliation bill, including the measure to terminate the 30% residential solar tax credit at the end of 2025. The “big, beautiful” budget bill will head to the Senate, where a final vote is expected before the August recess, and possibly before July 4. If passed as currently written, residential solar and battery systems placed in service by December 31, 2025 will still qualify for the Residential Clean Energy Credit.

May 13 update: The House Ways and Means Committee is proposing an end to the residential solar tax credit as part of the reconciliation process. If passed, systems placed in service (i.e., installed and inspected) by December 31, 2025 will still qualify for a 30% tax credit.