NYC Solar Property Tax Abatement Extended Through 2035. Here’s How It Works.

With the stroke of a pen by Governor Hochul, the New York City Property Tax Abatement has been extended through 2035 and expanded to offer a maximum incentive value of 30% of eligible solar and battery expenditures.

This property tax abatement is one of several solar incentives that make New York City a great market for residential solar and a rare example of a solar incentive increasing over time.

Previously, the abatement reduced the property tax burden of solar owners by up to 20% of the price paid for the system (aka “eligible expenditures”). Beginning in 2024, it is now worth up to 30% of eligible solar and battery expenditures up to $250,000.

In this article, we’ll explore how the abatement works, who is eligible, and how to claim it.

This article does not constitute tax advice. Always consult a licensed tax professional regarding questions about solar tax abatements, exemptions, and credits.

What is the NYC Solar Property Tax Abatement?

Run by the NYC Department of Buildings, the NYC solar property tax abatement allows homeowners to reduce their property tax liability by 7.5% of the cost of their solar and/or battery installation each year for four consecutive years.

Several studies have shown that solar systems increase home value. While increased home value is great when it’s time to sell, it can also increase how much you pay in property tax. The NYC solar property tax abatement reduces this tax burden as a means of incentivizing home solar and battery storage.

Related reading: NYC Embraces Residential Solar Power in 2024 with Groundbreaking Policies

Abatements vs exemptions

Over 30 states — including New York (outside of NYC) — have property tax exemptions for the home value added by solar systems. Basically, an exemption works by ignoring the additional value added by the solar system. So, if you’re home was worth $400,000 before going solar and $430,000 after going solar, you would still pay property tax based on the original $400,000 valuation.

- Abatement: A reduction in property taxes over a certain period of time

- Exemption: A reduction in the taxable value of the property

That’s sort of a mouthful, so let’s break the NYC abatement down step by step.

How does the NYC Solar Property Tax Abatement work?

First of all, the abatement is based on the price you paid for the solar system — including equipment, labor, and soft costs (design, permitting fees, etc). It does not apply to financing costs or interest paid on a solar loan. The maximum abatement is $62,500 per year or your annual property tax liability (whichever is less).

So, let’s say you purchase a 5 kW solar system for $20,000. Your abatement would be worth $1,500 per year, and you can claim it for four consecutive years for a total incentive of $6,000.

However, most New Yorkers are Con Edison customers and are therefore eligible for the NY-Sun Megawatt Block rebate through NYSERDA, which reduces the upfront cost of going solar. In the Con Edison region, this rebate is currently worth 20 cents per watt of solar capacity installed.

Let’s see how that plays out with our 5 kW system with a gross price of $20,000.

| After 2024 (30% abatement) | Before 2024 (20% abatement) | |

| Gross price of solar system (5 kW system) | $20,000 | $20,000 |

| NYSERDA rebate (20 cents/W) | -$1,000 | -$1,000 |

| Price paid for solar system | $19,000 | $19,000 |

| Year 1 tax abatement (7.5% of price paid) | $1,425 | $950 |

| Year 2 tax abatement (7.5% of price paid) | $1,425 | $950 |

| Year 3 tax abatement (7.5% of price paid) | $1,425 | $950 |

| Year 4 tax abatement (7.5% of price paid) | $1,425 | $950 |

| Total abatement incentive | $5,700 | $3,800 |

As you can see, the property tax abatement applies to the cost of the system after the NYSERDA rebate is applied.

The NYC solar property tax abatement can also be combined with federal and state tax credits. However, claiming these credits does not change the price paid for the system and therefore does not affect the value of the property tax abatement.

Combining the NYC solar tax abatement with rebates and tax credits

Just for fun, let’s see how much combining all of solar incentives available in New York City reduces the cost of a 5 kW system with a gross price of $20,000.

| Gross price of solar system (5 kW) | $20,000 |

| NYSERDA rebate (20 cents/Watt) | -$1,000 |

| Price paid for solar system | $19,000 |

| Federal tax credit (30%) | -$5,700 |

| State tax credit (25%) | -$4,750 |

| NYC property tax abatement | -$5,700 |

| Net cost of solar system | $2,850 |

For those keeping score at home, combining these incentives reduces the cost of going solar by more than 75%.

The video below provides a full breakdown of solar incentives in New York state.

See how much you can save by going solar in New York.

Who is eligible for the NYC Solar Property Tax Abatement?

The NYC solar property tax abatement is available to “property owners that install solar electric-generating systems (photovoltaic solar panels) on their buildings,” according to NYC buildings.

The abatement is only available to property owners in New York City. For systems “placed in service” before January 1, 2024, the abatement is worth 20%. For systems placed in service between January 1, 2024 and January 1, 2035, the abatement is worth up to 30%. Placed in service refers to the date you received permission to turn on (PTO) or the sign-off date on your electric permit — whichever is later.

As we mentioned above, New York State also has a solar property tax exemption. This exemption cannot be combined with the NYC solar property tax abatement.

How to claim the NYC Solar Property Tax Abatement

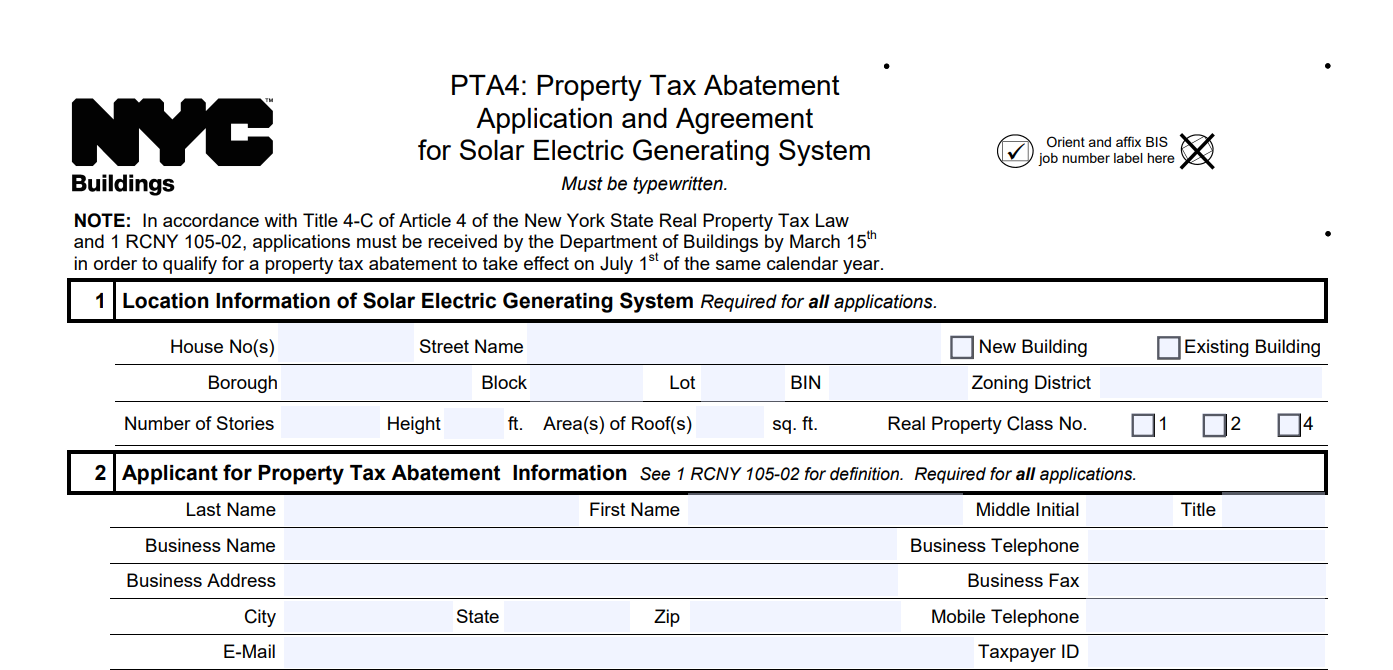

You and your project manager will need to complete the PTA4: Property Tax Abatement Application and Agreement for Solar Electric Generating System in order to claim this incentive, part of which is pictured below.

Screenshot of Application PTA4 for claiming the tax abatement

To be honest, this form takes some planning and cooperation to fill out. For example, it requires the signature of a “registered design professional.” These instructions from NYC Buildings may be of some help, but it’s best to mention this to your solar installer early in the process.

If you submit a complete and accurate PTA4 by March 15, the abatement will kick in on the July 1 tax bill of the same year. If you miss the March 15 deadline, the abatement will take effect on July 1 of the following year.

The bottom line

The NYC solar property tax abatement is one of many incentives that make New York City one of the best places for solar savings. The abatement reduces the amount of property tax you pay by 7.5% of the cost of your solar system each year for four consecutive years.

In September 2023, the signing of Senate Bill S6640B extended this incentive through 2034 and increased the incentive amount from 20% to 30%.

Compare solar prices from local solar installers.